Fannie Mae raised its origination forecast by $300 billion following Fed rate cut actions in response to coronavirus impact

Fannie Mae in March increased its mortgage origination forecast by $300 billion for 2020 — almost all of that due to refinancings from the decline in rates because of the coronavirus.

But the spread of COVID-19 will almost certainly put a halt to U.S. economic growth, even as the lower interest rate environment is likely to continue to support housing and fuel a surge in refinance activity, said Fannie Mae Chief Economist Doug Duncan.

“The recent shocks to the global economy are unprecedented and have introduced immense uncertainty into our economic forecast,” Duncan said in a press release. “While we are still projecting modest growth in the coming months, the impact of the coronavirus threatens the longest expansion in U.S. history.”

“The rapid international spread of the coronavirus and Saudi Arabia’s decision to dramatically increase oil production — and the resulting impacts on financial market volatility and consumer behavior — led us to revise downward our second-quarter growth forecast to near-zero and our full-year 2020 forecast to 1.8% from last month’s 2.2%,” according to Duncan.

“However, those forecasts are subject to significant uncertainty, depending on the extent and duration of the coronavirus outbreak, its impact on consumer and business behavior, and government policy response.”

The 10-year Treasury remained consistently below 1% in March, breaching that level briefly in mid-March to a high of 1.185% for the month on March 18.

“We expect the Federal Open Market Committee to cut the federal funds rate by an additional 50 basis points at its next meeting, adding to its 50-basis-point cut from earlier this month,” Duncan added.

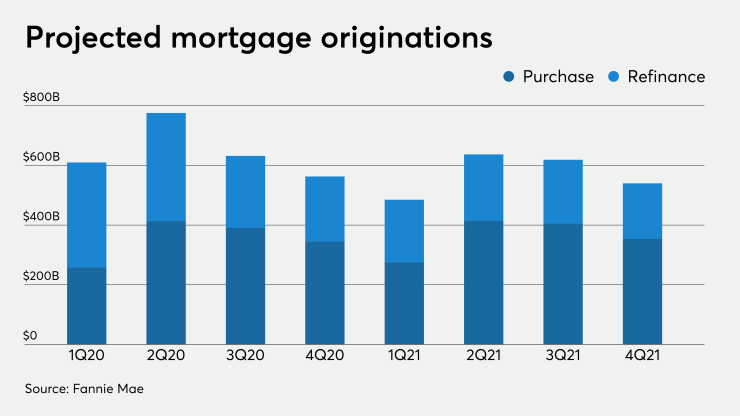

Fannie Mae’s latest origination forecast calls for $2.58 trillion in mortgage production this year; a month ago, when the virus first started making headlines in this country, the projection was for $2.32 trillion.

The refinance forecast went to $1.17 trillion from $895 billion, while purchase volume is expected to reach $1.41 trillion compared with $1.39 trillion in February’s projection.

Increased expectations for refis will carry into 2021. The new forecast for that year of $2.28 trillion (compared with the prior $2 trillion) was driven by a $263 billion hike in refinance originations expected to be $832 billion.

The Mortgage Bankers Association has raised its 2020 forecast to $2.51 trillion, with $1.23 trillion of that derived from refinance production.