Cross River Bank in Teaneck, N.J., believes it will be a stronger partner for fintech after buying a San Francisco startup.

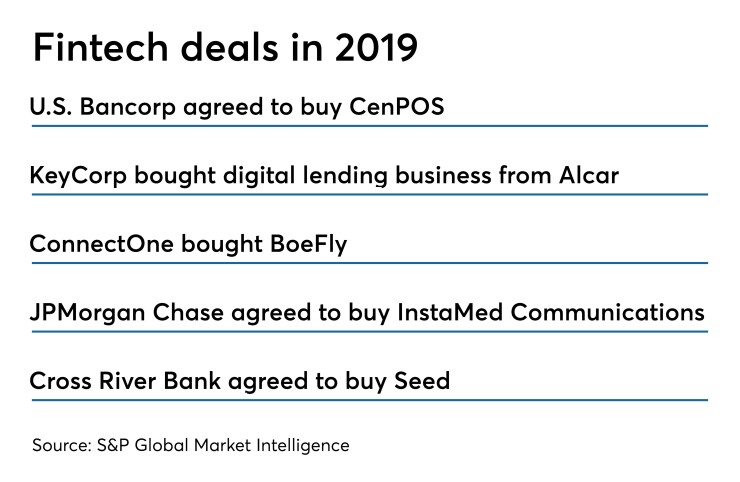

The $1.5 billion-asset bank agreed on Monday to buy Seed for an undisclosed amount. The 5-year-old fintech offers a mobile account for small businesses, complete with bill payment, remote deposit and an attached debit card.

Seed's most attractive offering, particularly for Cross River, is its ability to let small businesses

“The technology is very compelling,” Cross River Chairman and CEO Gilles Gade said in an interview. “From a cultural standpoint and from a synergistic and strategic standpoint, it just made sense for us to join forces."

Community bankers attending American Banker's Digital Banking conference said that the

The need for more efficient onboarding is being driven by clients who have become more comfortable conducting business online and a push by bigger banks to offer digital experiences, said Tiffani Montez, a senior analyst at Aite Group. She said that banks that offer online account opening are eager to "optimize" the experience, while others are straining to get in the game.

"It's an issue across the community banking and credit union industries," Montez said.

The Seed team, including founders Brian Merritt and Ryan Hildebrand, will join Cross River, where they will continue to manage Seed and help the bank develop new technology in areas such as operations, IT and anti-money-laundering compliance.

Cross River's initial priority involves taking the next few months to fully integrate Seed.

Seed also provides Cross River with its first West Coast operations, though the bank plans to open additional offices in San Francisco and Portland, Ore.

“We want to continue increasing the team," Gade said. "The idea is that there's a pool of talent we never tapped into on the West Coast. San Francisco and Portland … are two areas we’re going to explore for further potential hires, particularly on the development side.”

It is unclear what the deal will mean for The Bancorp, which has been Seed's banking partner.

A call to The Bancorp wasn't immediately returned.

Cross River has no plans to open branches, Gade added.

The acquisition is the first major strategic initiative for Cross River since it raised $100 million in December, including a $75 million investment from KKR.

A KKR spokesman wasn't immediately available for comment.

Since its creation in 2008, Cross River has grown rapidly by aggressively partnering with fintech. It’s the bank behind Rock Holdings' Rocket Loans unit and the retail microlender Affirm. The bank recently provided a $70 million warehouse facility to Idea Financial, an online small-business lender.

Its fintech strategy has bolstered Cross River's financial results. It had assets of only $265 million five years ago.

Cross River’s return on assets stood at 1.99% on March 31, surpassing the 1.35% industry average. Its 15.89% return on equity is much higher than the 11.93% industry average.

While Seed is the first fintech firm Cross River has bought, Gade said he believes the bank could pursue more such deals.

“The experience was very pleasant and conclusive," he said. "We hope to be able to repeat it in the future.”