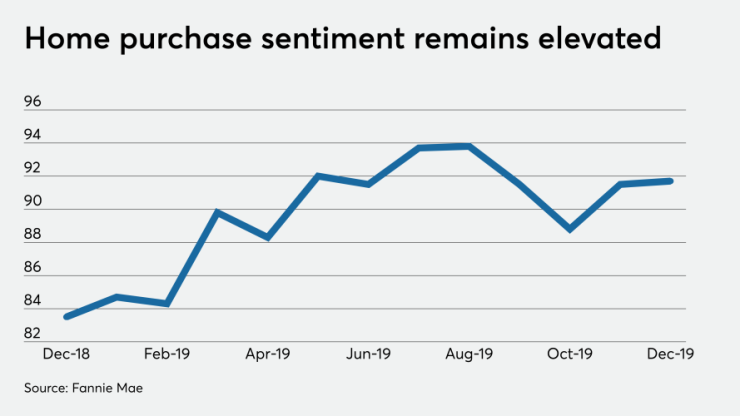

Consumer perception of the housing market ticked up slightly in December, as potential buyers remain bullish about making a home purchase in 2020, a Fannie Mae report said.

The Home Purchase Sentiment Index for December rose to 91.7, up 0.2 points from November and 8.2 points from December 2018. In fact, the year-ago HPSI was the low point for 2018.

That turned around by midyear 2019, with August setting a record high for the HPSI of 93.8.

"The continued strength in the HPSI attests to the intention among consumers to purchase homes. This is consistent with the Fannie Mae forecast for 2020," Doug Duncan, Fannie Mae senior vice president and chief economist, said in a press release. "The HPSI hit and remained near an all-time high in 2019, driven by the 16-percentage point year-over-year increase in the share of consumers believing it is a good time to buy. The HPSI's strength supports our prediction of a healthy housing market in 2020, as well as consumers' appetite and ability to absorb the expected increase in entry-level inventory."

While the majority of those surveyed still said now is good time to buy a home, the percentage fell to 59% from 61% in November. On the other hand, those who disagreed with that statement increased to 32% from 27%, meaning the net share (the difference between the two sentiments) fell to 27% from 32%. A year ago, the net share was 11%.

Meanwhile, 65% of respondents felt now is a good time to sell, down from 66% in November. At the same time, those who considered it a bad time sell fell to 22% from 26%. That resulted in an increase in the net share to 43% from 40% in November. The net share in December 2018 was 36%.

Exactly half of the respondents expected home prices to rise over the next year, while just 10% expected them to drop, resulting in a net share of 40%. That increased from 34% in November and 31% in December 2018.

When it came to mortgage rates, consumers remained firmly in the view they were more likely to stay flat or rise than fall. Only 7% of respondents said rates would decrease in the next 12 months, compared with 11% in December.

Stay the same got the largest response at 46% (compared with 42% in November), while 39% said they were more likely to rise, which was unchanged from last month.

The survey was taken between Dec. 1 and Dec. 19, before the shift in investor sentiment that affected the bond markets, driven by the death of Iranian General Qasem Soleimani in a U.S. airstrike.