Analysts from Barclays Capital on Jan. 2 weighed in on the effects of updated valuations for residential mortgage-backed securities (RMBS) and commercial mortgage backed securities (CMBS) held by U.S. insurers.

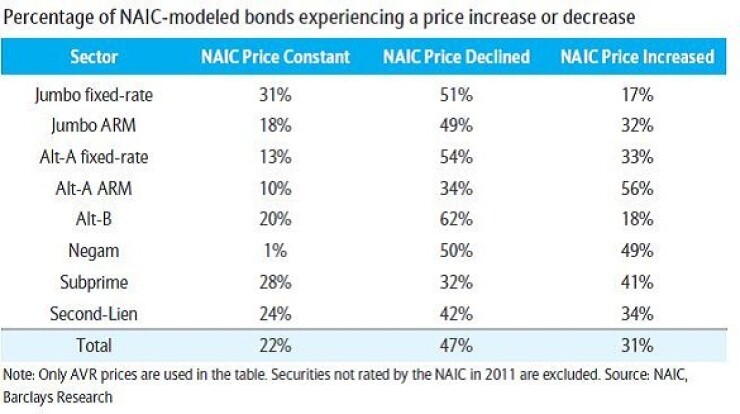

They expect the new approach will have a moderately-positive-to –moderately-negative impact on non-agency RMBS, depending on the security type. (See chart below article) Within the CMBS class, Barclays expects that higher quality paper will benefit, while riskier classes will get hit.

The new valuations are put out by the National Association of Insurance Commissioners (NAIC). Insurers use them to calculate the amount of capital they need to set aside for certain investments.

Barclays said the new capital requirements factor in a higher likelihood of grimmer macroeconomic scenarios. This effect though was partly offset by the increase in real estate prices this year in both the commercial and residential sectors.

In the RMBS realm, even with the more conservative valuations, the analysts said the changes would be moderately positive for tranches that are subprime, alt-A ARM, and negam — all classes that saw healthy price rises last year.

But Barclays said that insurers will likely see their capital requirements rise for other kinds of private label residential mortgage-backeds, including jumbo fixed-rate, alt-A fixed rate, alt-B and second lien securitizations.

In the CMBS class, higher caliber bonds are expected to benefit from price increases last year. As for the more “cuspy” bonds: “Trading at steep discounts, [they] had their NAIC prices fall from last year because of the increased weight given to stressful scenarios,” the analysts said.

Below see chart summarizing the percentage of bonds of each RMBS type that have the same price, get a boost, or are discounted under the new valuations.