-

The government-sponsored enterprise’s seller/servicer guide is now integrated into the online portal. Freddie also improved the readability of loan-level reporting it provides, and has further changes in the works.

September 15 -

Only 18% of refinance borrowers returned to the same lender in the second quarter, the second lowest rate since 2005.

September 14 -

Though overall forbearance share is down, the number of extensions is rising as coronavirus hardship filings surpass the 90-day mark that delineates the end of traditional forbearance plans.

August 7 -

Issuers approved for the program will receive written authority to use "digital collateral" for a limited number of securitizations.

July 20 -

The court struck down a 2015 update to the Telephone Consumer Protection Act, which permitted robocalls to cellphones for government-related debt collection.

July 6 -

The language most frequently spoken by LEP consumers is Spanish, followed by Chinese, Vietnamese, Korean and Tagalog. The Federal Housing Finance Agency's online clearinghouse translates CARES Act forbearance information into these languages.

June 17 -

The other parts of the Day 1 Certainty program regarding income and asset verifications remain in effect.

May 6 -

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

March 12 -

Terry Wakefield, a technology consultant who helped launch Fannie Mae's mortgage-backed securities business and form Prudential Home Mortgage, has died. He was 70.

March 11 -

In a recent interview, Plaza Home Mortgage CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

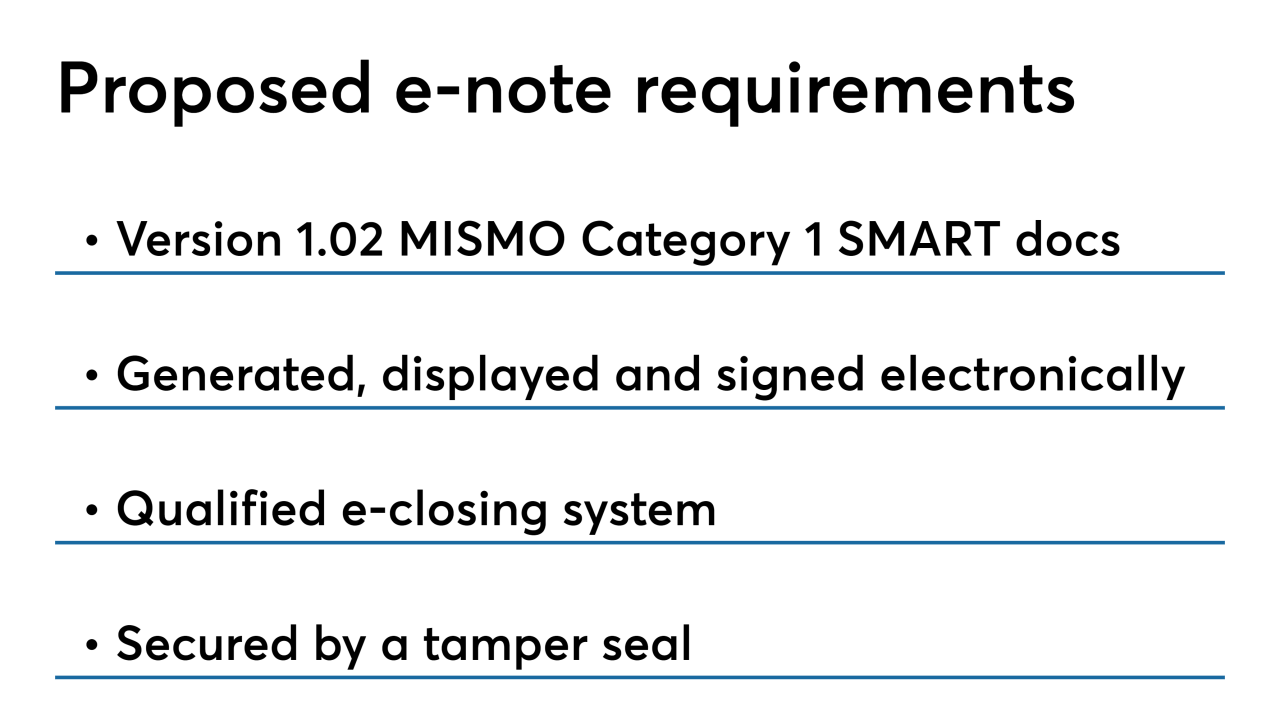

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

Freddie Mac is postponing the date it will make using its Servicing Gateway platform mandatory, and adding new requirements related to chargeoffs and interactions with document custodians.

October 11 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

Freddie Mac is increasing the number of companies offering merged reports from the credit bureaus through integrations with its Loan Product Advisor automated underwriting system.

September 30 -

The mortgage industry has put more emphasis on organizing data in a digital manner and presenting it in an easily digestible format.

September 18 -

Freddie Mac is automating a manual form submission process used to correct post-settlement and real estate owned data, and adding policy changes aimed at accommodating electronic signatures on loss mitigation documents.

August 20 -

Investors can now exchange certain existing Freddie Mac bonds for to-be-announced uniform mortgage-backed securities in preparation for the full launch of UMBS next month.

May 8 -

A security lapse left millions of mortgage records exposed online without proper data protections, according to security researchers.

January 23 -

LoanDepot's CEO Anthony Hsieh delivered a bracing message to mortgage lenders on Monday — strong new competitors are coming into this market, so they need to expand their offerings.

September 17 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23