-

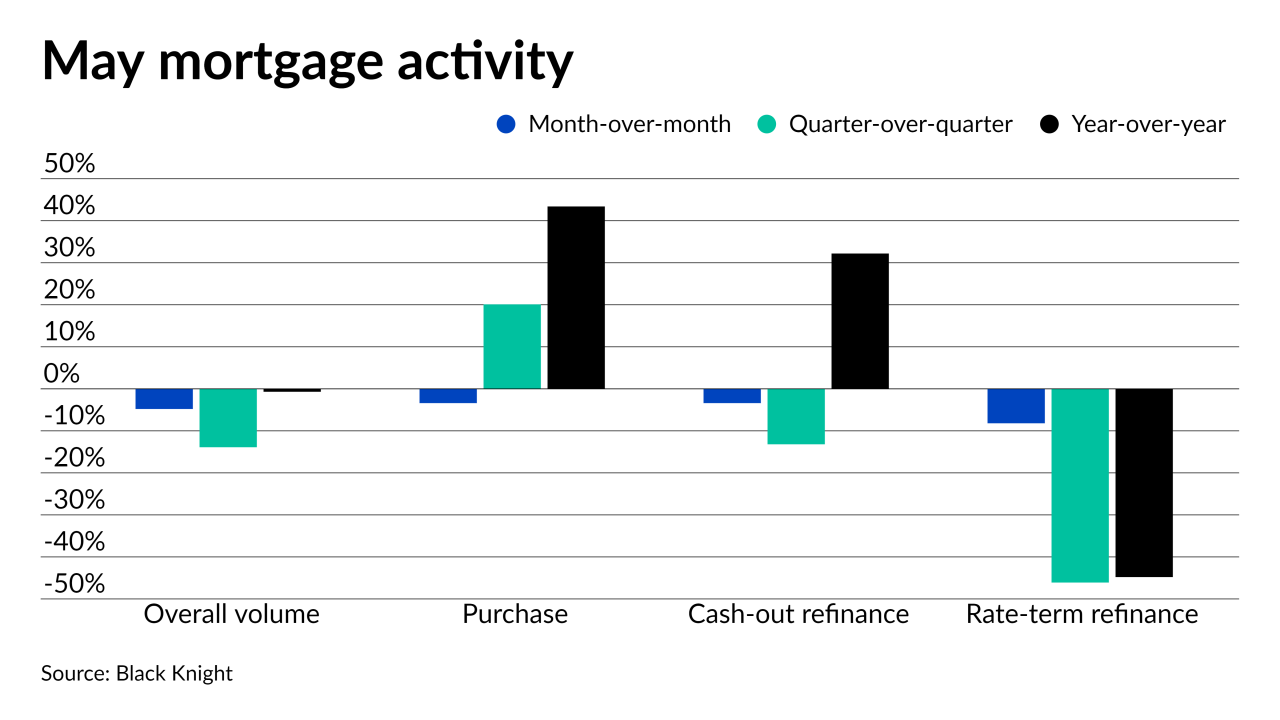

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

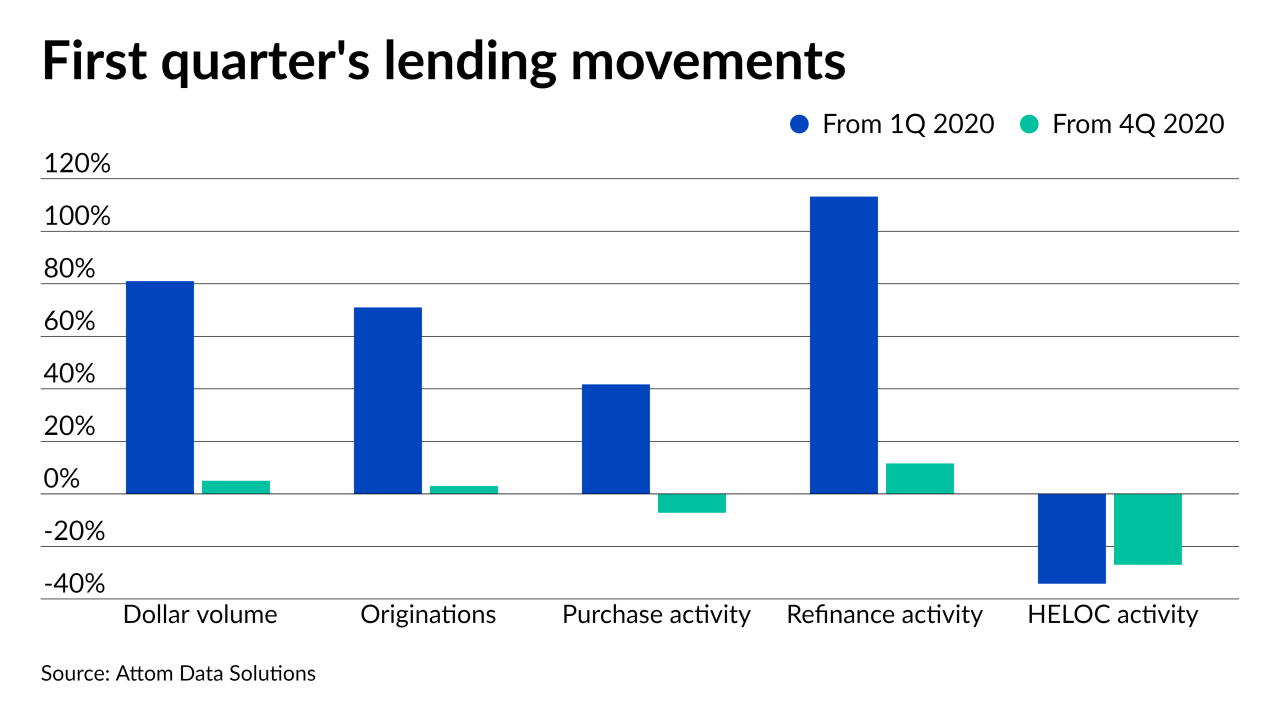

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19 -

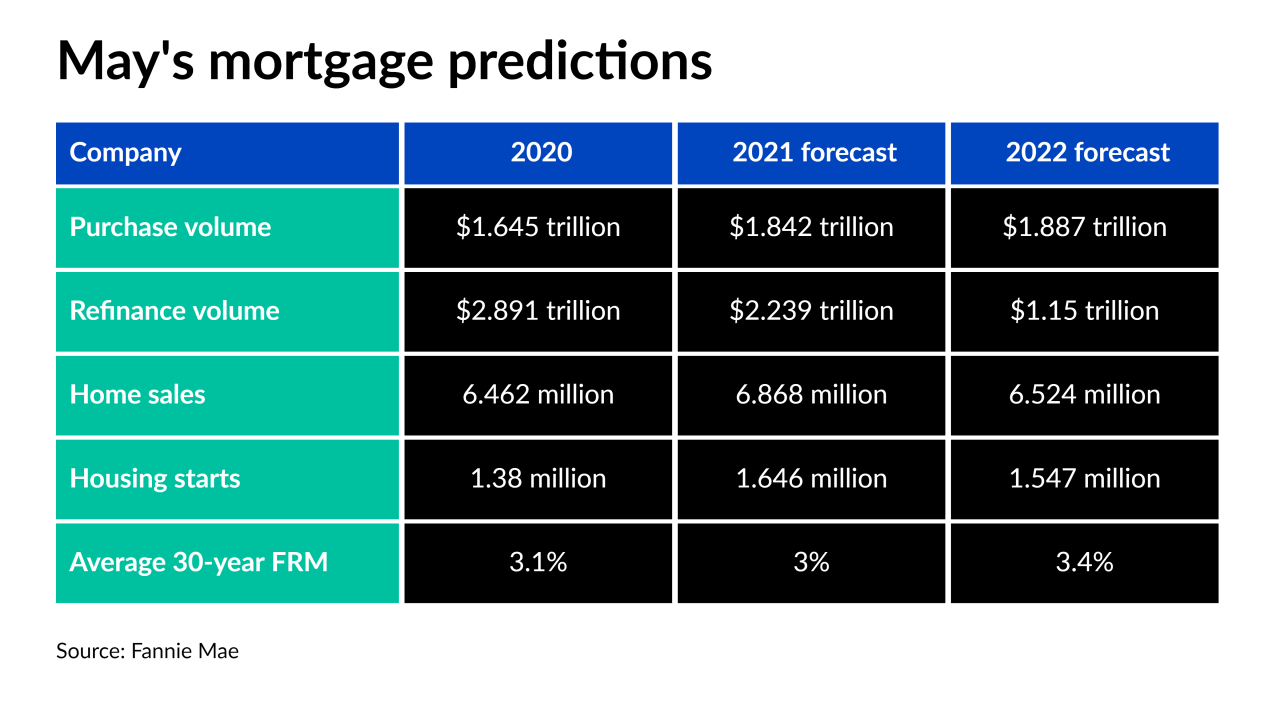

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

With little transitional disruption, the bigger players on the non-agency side could gain a hefty share of non-owner-occupied mortgage volume as a result of Fannie Mae and Freddie Mac’s caps on such purchases, a KBRA analysis finds.

May 17 -

It’s getting easier to close bigger loans for higher-priced properties, but credit is expanding slower for first-time buyers.

May 11 -

The Consumer Financial Protection Bureau has moved ahead with an earlier proposal to postpone the full adoption of the qualified-mortgage ability-to-repay rule, citing a need to maximize borrowers' credit access.

April 28 -

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

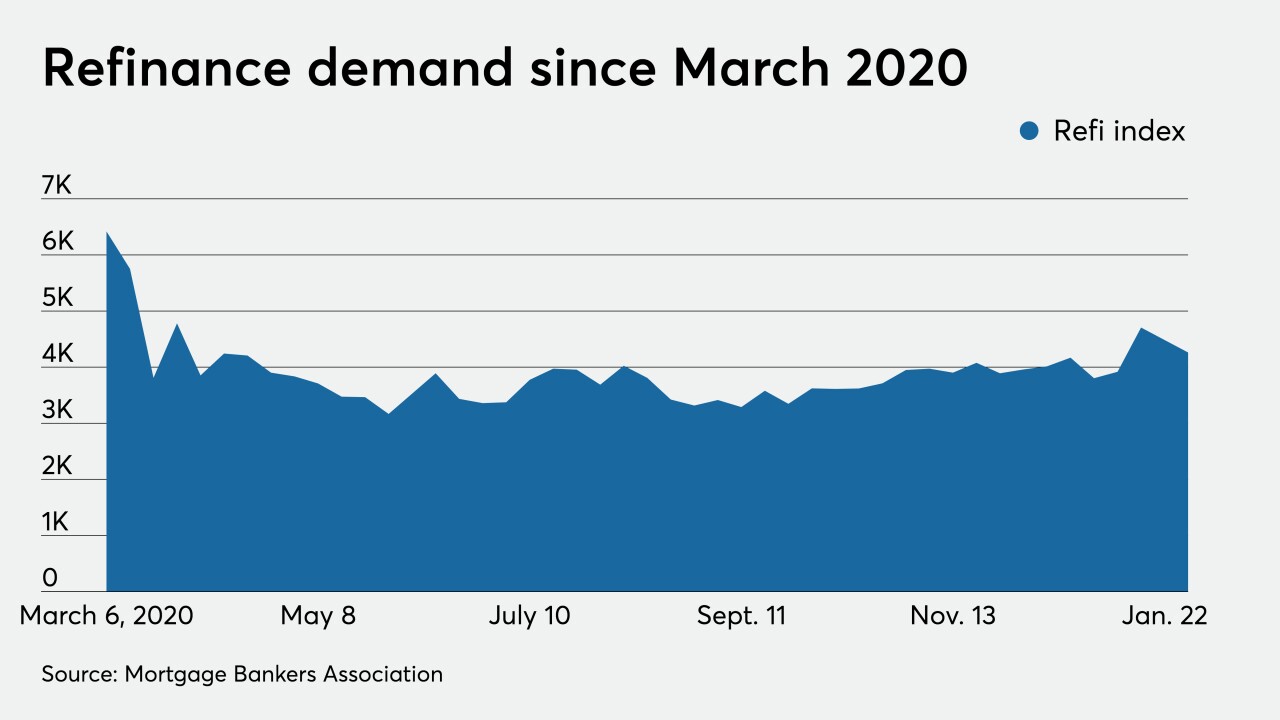

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

Volumes were at a record high in the final quarter of 2020 but lenders didn’t make quite as much since gains on loan sales to the secondary market fell.

March 23 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

The Federal Housing Finance Agency is preparing to retire certain loan underwriting flexibilities after extending them one additional month to April 30.

March 12 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

The expansion of borrower data collected in the new URLA upends an industry standard and lenders are experiencing some growing pains.

March 3 -

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

The newly public digital mortgage giant is relying on a diverse set of loan channels to take on competitors in an increasingly crowded field, CEO Anthony Hsieh said in an earnings call this week.

February 18 -

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive.

February 17 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27