-

Trade associations representing mortgage lenders and securities market participants are asking the Federal Housing Finance Agency to rethink a plan to restrict pooling options for loans sold into uniform mortgage-backed securities.

January 23 -

Macro factors point to a solid year in the securitization market but wild cards abound, many of them political.

January 13 -

As the 2020s begin, perhaps it’s best to borrow a page from the Fed’s 2019 playbook: Take your best shot at forecasting the road ahead, but don’t hesitate to react to important new information.

January 1 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

Pepper Residential Securities Trust No. 25 is relying on rigorous servicing to ensure the performance of its collateral of low-doc, high-loan-to-value loans made to borrowers with unfavorable credit records, according to details from an S&P Global presale report.

October 29 -

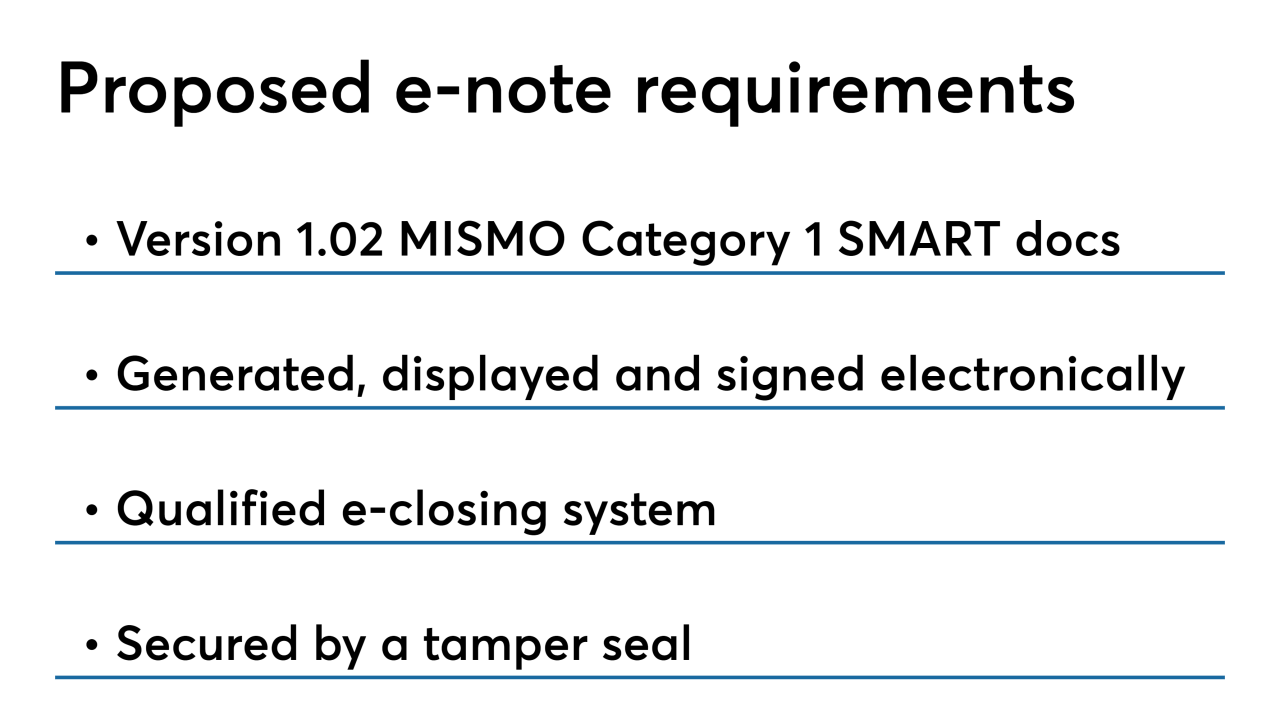

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

The loans underlying the $465 million securitization that OBX 2019-EXP3 Trust is launching will provide a test of the market’s willingness to accept concentration risk in a high-quality pool of mortgages.

October 25 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

Live Well Financial CEO Michael Hild has been charged with misrepresenting the value of a bond portfolio in parallel actions by the U.S. Attorney's Office and the Securities and Exchange Commission.

August 30 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25 -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

President Trump has signed the Protecting Affordable Mortgages for Veterans Act, which aims to address concerns that rules around certain VA refinances were impeding those loans' inclusion in secondary market pools.

July 26 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12 -

Prepayment speeds for loans included in agency mortgage-backed securities were up approximately 20% both monthly and annually during May as the decline in interest rates boosted activity, according to Keefe, Bruyette & Woods.

June 11 -

The consolidation of the two companies' securitization platforms into a single bond market became official on Monday.

June 3 -

The launch of a combined securitization platform for Fannie Mae and Freddie Mac is meant to ease the transition to a new housing finance system. But questions remain about how the mortgage sphere will adapt to the single security.

May 31 -

The investment research firm plans to merge DBRS' ratings business with its existing Morningstar Credit Ratings Service.

May 29 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21