-

It may not signal a recession, but structured finance pros are still preparing for a more risk-off environment.

January 16 -

A few took advantage of deep discounts to scoop up collateral for new deals on the cheap; others swapped out some of their weakest credits for more highly rated loans.

January 15 -

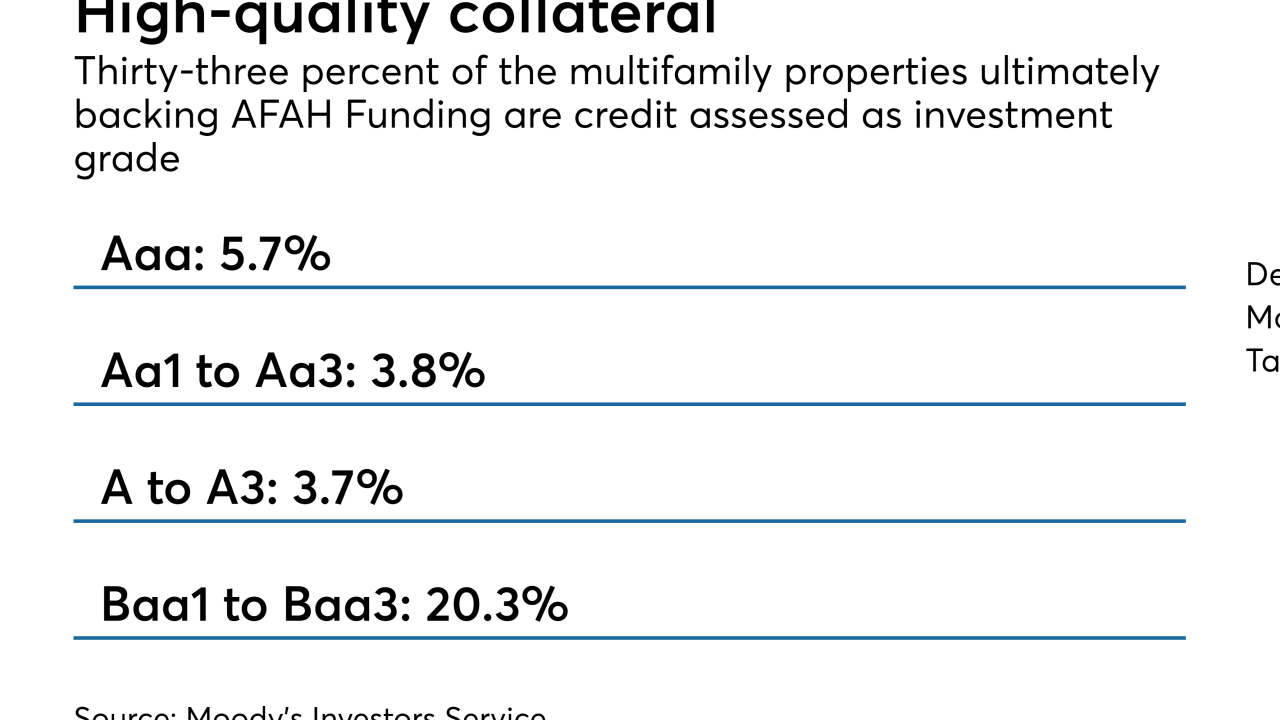

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

The Property Assessed Clean Energy sector is getting a boost from the expansion of improvements eligible to be financed via tax assessments, including fire resiliency and total building renovations, according to DBRS.

December 19 -

CleanFund has created a division that helps structure Property Assessed Clean Energy financing to meet a mortgage lender's credit criteria; its also talking to lenders about co-financing the energy upgrades.

December 3 -

At Ginnie Mae, Michael Bright worked closely with Congress to fight churn in VA mortgages; he plans to bring the same collaborative approach to the Structured Finance Industry Group.

January 10 -

They differ slightly from those released earlier by the Fed-convened ARRC, including language making it easier to ditch a SOFR-derived benchmark in favor of a new benchmark that has yet to be developed.

December 26 -

The Office of the Comptroller of the Currency has gotten the ball rolling for financial technology firms trying to operate a national platform, but the FDIC and Federal Reserve should act to remove other policy roadblocks.

December 17