-

The Spanish bank's German retail lending unit is securitizing a fifth pool of mostly unsecured personal loans from an €83.5 billion portfolio.

November 20 -

The aerospace components manufacturer, one of the largest-held obligors in U.S. CLOs, is consolidating loans and tightening coupon spreads from 300 to 275 basis points over Libor.

November 10 -

Deal volume of $95 billion through 10 months is at a pace that would make 2017 the second-busiest year for post-crisis CLO issuance; AAA spreads, meanwhile, have reached three-year tights.

November 7 -

The loans are part of a €1.8 billion bad-loan purchase that Mars Capital, an Oaktree "vulture fund," made of high-risk mortgages from Irish banking authorities in 2014.

November 6 -

The deal, DLL Securitization Trust 2017-A, is unusual in that it is backed almost entirely by agricultural equipment; other lessors such as CNH and John Deere securitize a mix of agricultural and construction equipment.

November 6 -

Strong legal and structural protections earned the debt top grades from Kroll and Fitch. S&P wasn't as bullish.

November 2 -

In addition to insurance premiums, borrowers in the pool use the loans for annual membership fees of sport or leisure facilities or professional bodies.

October 30 -

Nearly 1.4 million residential properties were vacant as of the end of the third quarter, representing 1.58% of all U.S. residential properties, according to Attom Data Solutions.

October 26 -

British regulators are touting the success of their so-called regulatory sandbox. Their American counterparts have been unable to agree on a comprehensive scheme to foster innovation.

October 23 -

Coping with merging two securitization platforms and the integration of GE Capital's former fleet lease and management business, the Canadian lessor has seen 30-plus and 60-plus delinquencies more than triple.

October 18 -

More than 90% of the collateral for Ford Credit Canada's CAN$614M transaction is popular light-duty trucks that have propelled the automaker's leading 15.5% domestic market share.

October 16 -

Ocwen Financial Corp. is settling allegations by Alabama and Minnesota that it engaged in improper mortgage activities, bringing the total of states it has settled with to 17.

October 13 -

The allure of promised savings persuaded most Chicago City Council members.

October 11 -

Over 80% of the cars are diesel-engine vehicles, bringing potential volatility to the portfolio cash flows given the public debate over potential panning such cars in several European urban centers.

October 11 -

A wave of corporate loan refinancings is putting collateralized loan obligations afoul of a covenant designed to safeguard their own investors.

October 11 -

Belmont Green Finance, which began originating loans in late 2016, has gathered up its first round of originations through 3Q2017 in a transaction that will issue up to £230.6 million in notes.

October 6 -

Chicago hopes to get into the market by year's end with the first of up to $3 billion of refunding under new credit.

October 5 -

Ocwen Financial Corp. received more breathing room on the legal front as the Securities and Exchange Commission is not pursuing an enforcement action against the company regarding its debt collection practices.

October 4 -

The French specialty lender, owned by a consortium of mutual insurers, is pooling over 54,000 loans it originated and services for clients of its shareholders.

October 4 -

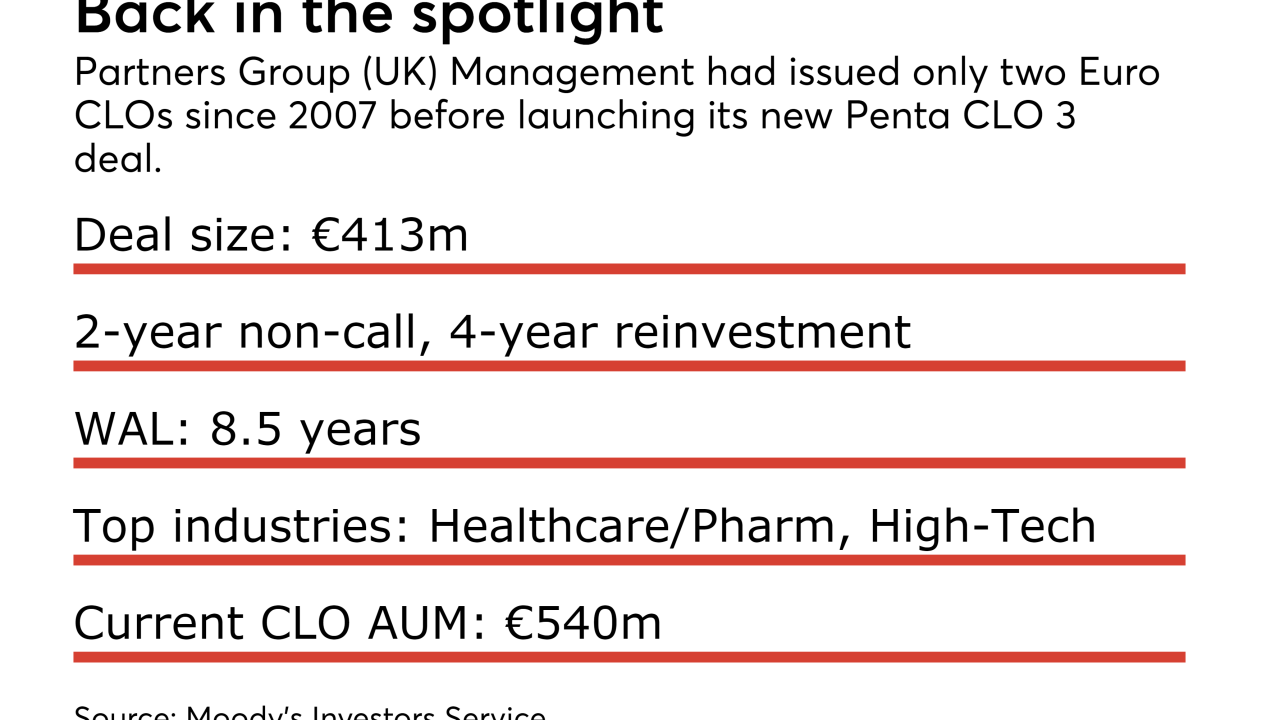

Penta CLO 3 is the first CLO since 2015 for the UK subsidiary of Swiss global asset management Partners Group Holdings AG.

October 2