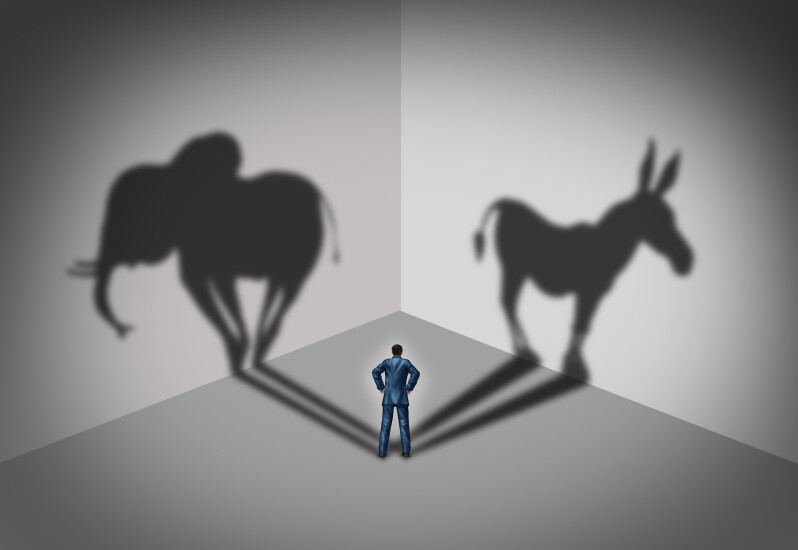

Conventional wisdom suggests that in business, it's often smartest not to take sides in politics. Figures in the mortgage industry have long understood this, largely supporting both Democrats and Republicans in about equal measure over time.

But this isn't any ordinary election year.

"With the pandemic, everybody’s mind is somewhere else," said Bill Cosgrove, president and CEO of Union Home Mortgage.

Between the coronavirus, increased party polarization, and protests that have put more of a focus on racial equity issues, the mortgage industry is contending with the impact of various national crises, which are affecting the various segments of the field in different ways.

Achieving a bipartisan consensus these days "is tough on any issue, and certainly will be on fair housing," said Bill Killmer, senior vice president for legislative and political affairs at the Mortgage Bankers Association.

The industry will need to be more flexible in its positions because the business depends on broad coalitions to exert federal influence.

But achieving cohesion amid difficult conditions isn’t altogether unfamiliar territory.

"This happens every four years and it does result in a little disruption," said Allen Price, a senior vice president at BSI Financial Services. "We particularly saw disruption in 2008 and now we’re seeing it in the current election cycle. The mortgage … industry is doing now what it was doing then: adapting."

Below we examine five divisions within the ranks of the housing industry that are likely to emerge or deepen in the course of the election and how the business will bridge them, comprised of larger players out-donating the rest of the field, partisan splits on industry priorities, disagreement on the best approach to fair housing, the niche considerations of mortgage brokers, and the varying philosophies on creating influence in Washington.