-

Federal Housing Finance Agency Director Mark Calabria discussed the possibility of having Fannie Mae and Freddie Mac operate under a consent order to allow the government-sponsored enterprises to be able to raise capital.

January 8 -

Getting Fannie Mae and Freddie Mac out of conservatorship has been an elusive goal. It will remain elusive, says DeMarco, in the absence of broader reform of housing finance, something that will require bipartisan support.

January 8 -

Consumer perception of the housing market ticked up slightly in December, as potential buyers remain bullish about making a home purchase in 2020, a Fannie Mae report said.

January 7 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 2 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

A risk-based capital rule for Fannie Mae and Freddie Mac is expected to top the agenda in 2020 as the companies’ regulator executes plans for their release into the private sector.

December 26 -

Mortgage rates ended the week little changed from the previous seven-day period and near historic lows for the year, according to Freddie Mac.

December 26 -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 19 -

A dozen of the nation's largest underwriters were accused of colluding with traders to artificially set prices on the secondary market for Fannie Mae and Freddie Mac securities.

December 17 -

The lawmakers say they need more information about the administration’s plans in order to conduct proper oversight.

December 17 -

Freddie Mac launched a groundbreaking multifamily structured pass-through deal that includes a class of floating rate bonds indexed to the Secured Overnight Financing Rate for the first time ever.

December 16 -

If Fannie and Freddie are going to supply a government guarantee on mortgages, they might as well be part of the government.

December 9 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

November 27 -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

The Federal Housing Finance Agency is scrapping a capital proposal it released last year and will seek comments on a new plan in 2020.

November 19 -

With economic expansion expected to keep churning through at least the first half of next year, Fannie Mae upwardly revised its single-family mortgage origination outlook for 2019 and 2020.

November 18 -

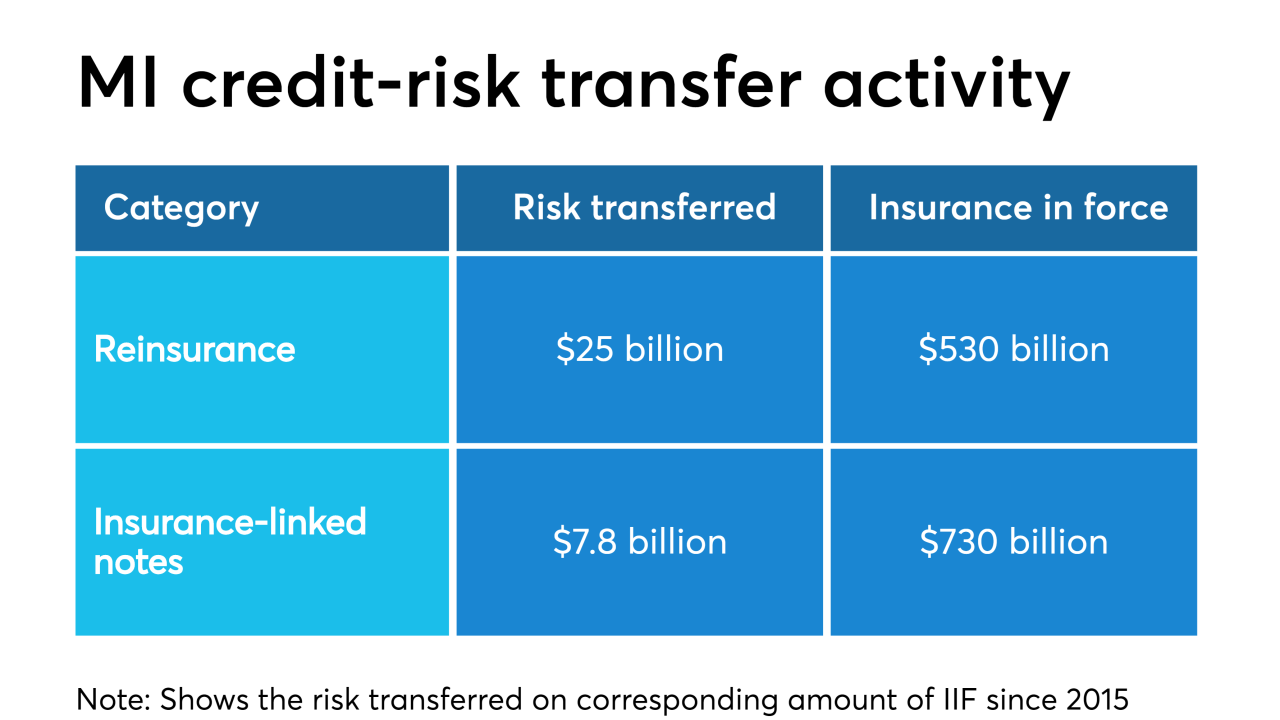

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5