-

If Trump is reelected, his administration would likely move forward with privatizing Fannie Mae and Freddie Mac and relaxing key rules, while a Joe Biden presidency would likely try to expand homeownership access and borrower protections.

August 24 -

There were questions about the GSEs' use of structured credit risk transfers in the single-family market given an earlier pandemic-related market disruption.

August 21 -

Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

August 20 -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

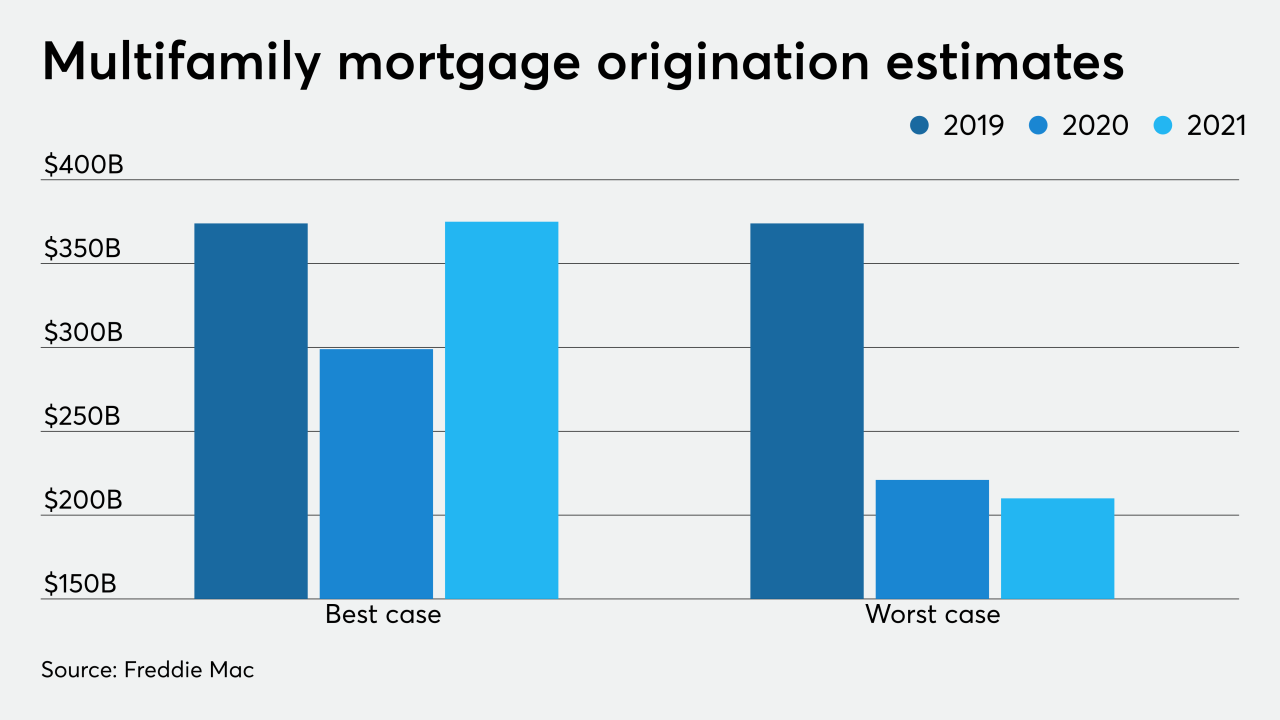

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

From guidelines for remote appraisal alternatives to the ways that forbearance affects borrowers' ability to get new loans, here are five examples of mortgage requirements that have been in flux since the coronavirus outbreak in the United States.

July 29 -

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

July 22 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

Issuers approved for the program will receive written authority to use "digital collateral" for a limited number of securitizations.

July 20 -

A recent ruling declaring the Consumer Financial Protection Bureau’s structure unconstitutional signaled that a similar outcome awaits the Federal Housing Finance Agency. But the FHFA will argue in a new case that it does not deserve the same fate.

July 14 -

The council created by the Dodd-Frank Act to identify systemic risks launched a review of the market as part of an activities-based approach that shifts focus away from targeting individual firms.

July 14 -

B. Riley FBR raised its ratings for both Fannie Mae and Freddie Mac to sell from neutral on the possibility the net worth sweep is declared illegal.

July 13 -

The high court ruled June 29 that the structure of the Consumer Financial Protection Bureau violated the separation of powers.

July 9 -

Guarantee fees became the main source of revenue for government-sponsored enterprises during conservatorship, and reverting to a private stockholder model could create a need for more revenue.

July 6 -

The mortgage insurer is receiving $528 million of coverage in the event of defaults in a $44 billion loan pool.

July 2 -

Legal experts say it is now more likely that the Supreme Court will strike down the single-director governance framework for Fannie Mae and Freddie Mac’s regulator.

July 2 -

In a letter to Director Mark Calabria, 17 organizations requested an additional 60 days to weigh in on the proposal meant to strengthen Fannie Mae and Freddie Mac's balance sheets post-conservatorship.

July 1 -

Multifamily borrowers with loans from Fannie Mae and Freddie Mac will get an extended break for coronavirus-related hardships if they continue to give their tenants relief as well.

June 30