-

The percentage of borrowers who have asked to temporarily suspend payments due to coronavirus-related hardships is down overall, but in the Ginnie Mae market, they're still inching up.

September 21 -

Fannie Mae and Freddie Mac have been slammed for planning an additional refinancing charge to cover COVID-related losses, but the head of the Federal Housing Finance Agency defended the policy in House testimony.

September 16 -

Electronic notes did come in handy this year given the mortgage industry's need to operate remotely, but they also increase the government-sponsored enterprises' responsibility for monitoring the risk of multiple counterparties.

September 15 -

The government-sponsored enterprise’s seller/servicer guide is now integrated into the online portal. Freddie also improved the readability of loan-level reporting it provides, and has further changes in the works.

September 15 -

The guidelines are somewhat similar to those the Federal Housing Finance Agency established for the government-sponsored enterprise market in response to the high number of loans impacted by coronavirus-related hardships.

September 11 -

The Federal Housing Finance Agency's proposal could undermine the companies’ mission to support the housing market and penalize consumers in underserved communities, industry and consumer groups say.

September 8 -

Following its deadline for written comments on the topic last month, the Federal Housing Finance Agency is scheduling events that will focus on two key themes emerging in responses.

September 1 -

Arch's second CRT transaction this year to obtain indemnity reinsurance for mortgage-insurance premiums comes at a time it is also experiencing rising 60-plus-day delinquencies on its outstanding securitized pools.

August 31 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

August 25 -

If Trump is reelected, his administration would likely move forward with privatizing Fannie Mae and Freddie Mac and relaxing key rules, while a Joe Biden presidency would likely try to expand homeownership access and borrower protections.

August 24 -

There were questions about the GSEs' use of structured credit risk transfers in the single-family market given an earlier pandemic-related market disruption.

August 21 -

Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

August 20 -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

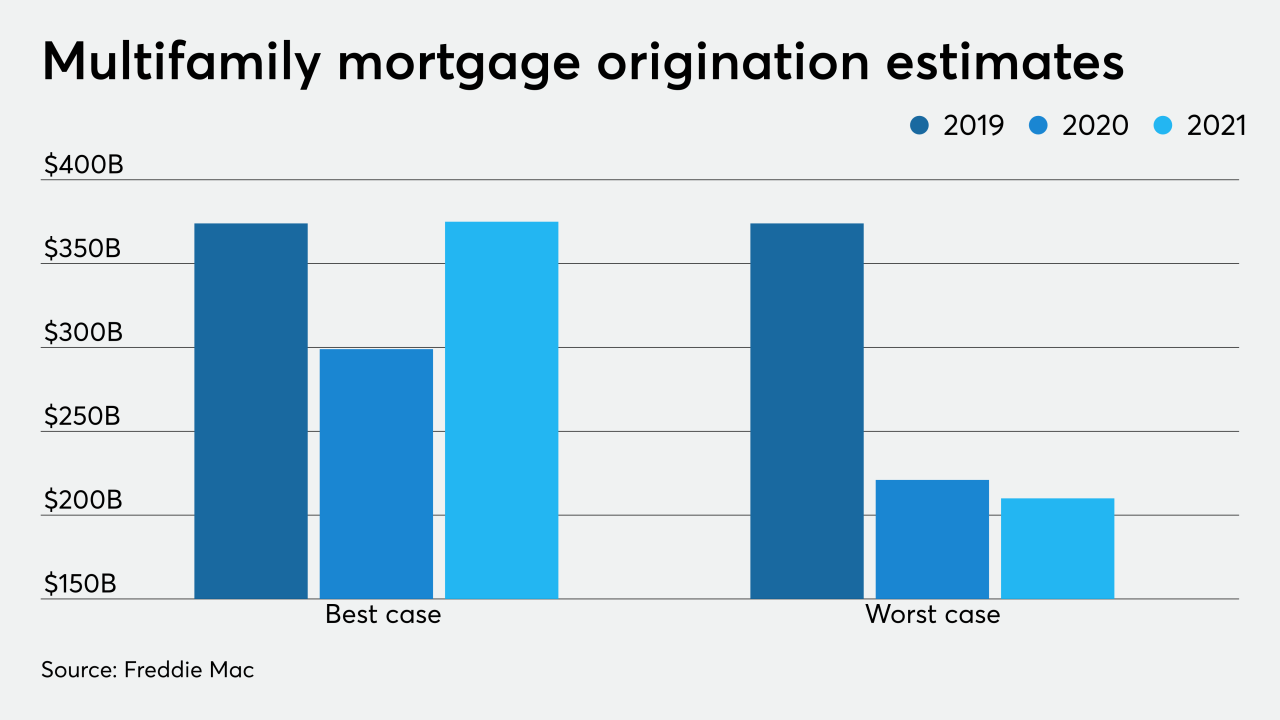

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

From guidelines for remote appraisal alternatives to the ways that forbearance affects borrowers' ability to get new loans, here are five examples of mortgage requirements that have been in flux since the coronavirus outbreak in the United States.

July 29 -

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

July 22 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20