-

If Fannie and Freddie are going to supply a government guarantee on mortgages, they might as well be part of the government.

December 9 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

The Federal Housing Finance Agency is scrapping a capital proposal it released last year and will seek comments on a new plan in 2020.

November 19 -

Lenders have bundled more than $18 billion worth of non-QM, private-label loans into bonds this year that they then sold to investors, a 44% increase from 2018 and the most for any year since the securities became common post-crisis.

November 18 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

The Supreme Court is ready to weigh in on the CFPB’s leadership structure, but both agencies are facing similar constitutional challenges, suggesting a broader impact of any decision.

November 4 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

A risk management model revision that decreased single-family loan-loss allowances and a strong mortgage lending environment contributed to consistent earnings results at Fannie Mae in the third quarter.

October 31 -

Freddie Mac will make haste to leave conservatorship in line with new regulatory directives, but it's uncertain how quickly it can move, CEO David Brickman said in an earnings call.

October 30 -

A lower court “erred” when it sided with Fannie Mae and Freddie Mac’s investors, the Justice Department said in its petition to the high court.

October 30 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

Freddie Mac is postponing the date it will make using its Servicing Gateway platform mandatory, and adding new requirements related to chargeoffs and interactions with document custodians.

October 11 -

A year after Fannie Mae launched its first credit-risk transfer securitization using a real estate mortgage investment conduit, Freddie is now electing to also opt for a REMIC format in offloading the credit risk to private investors.

October 10 -

Allowing the mortgage giants to retain profits resolves a short-term capital shortfall, but how much capital they would need after exiting conservatorship is still the bigger question.

October 4 -

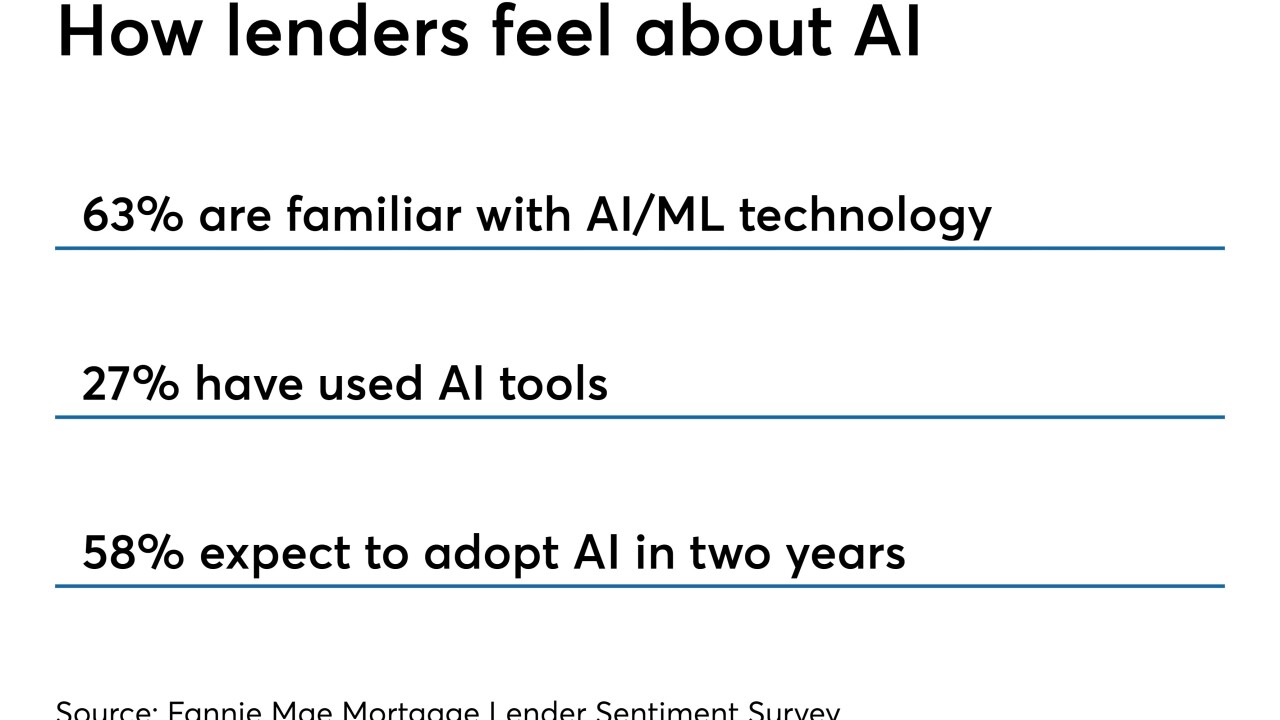

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

Freddie Mac is increasing the number of companies offering merged reports from the credit bureaus through integrations with its Loan Product Advisor automated underwriting system.

September 30