-

Express Settlement Loans, or E-Loans, extended to customers enrolled in a debt relief program, and Consolidation Loans, or C-Loans, for more qualified borrowers are in the pool.

January 13 -

The largest bank in the country bulked up its reserves by $2.2 billion for potential credit hits from the Apple card portfolio, which JPMorgan is taking over from Goldman Sachs.

January 13 -

The true-up mechanism is charged annually, but can be paid more frequently to ensure notes make timely payment of principal and interest of the 2025 revenue bonds and related financing costs.

January 12 -

Another strong year for aircraft leasing and ABS is expected for 2026, due partly to limited growth prospects from equity capital.

January 12 -

Sponsored by American Water, the deal funds service contracts on HVAC, plumbing and external water lines.

January 9 -

The deal comes to market as President Trump suggested barring institutional buyers from snatching up single-family homes, the type of properties secure the bulk of SEMT 2026-INV1.

January 8 -

ODF II will focus on originating senior and junior commercial rea estate debt investments across major U.S. markets, focused on multifamily properties.

January 8 -

Analysts at RBC Capital Markets said the plan is bad news for Invitation Homes and American Homes 4 Rent, but the companies "are long past the time of significant growth in home count

January 8 -

While Westlake's customer accounts usually have credit bureau scores ranging from 500 to 700, the WLAKE 2026-1 collateral pool's non-zero weighted average credit bureau score was 620.

January 7 -

Largely strong credit qualities were offset because by loans on single-family homes in the pool dropping by 0.5%, and that the percentage of loans that received due diligence decreased by 0.4%.

January 7 -

With limited seasoning and primarily a clean payment history, OBX 2026-NQM1 had a seasoned probability of default of 33.3% among the AAA stresses and 11.4% among the B.

January 6 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

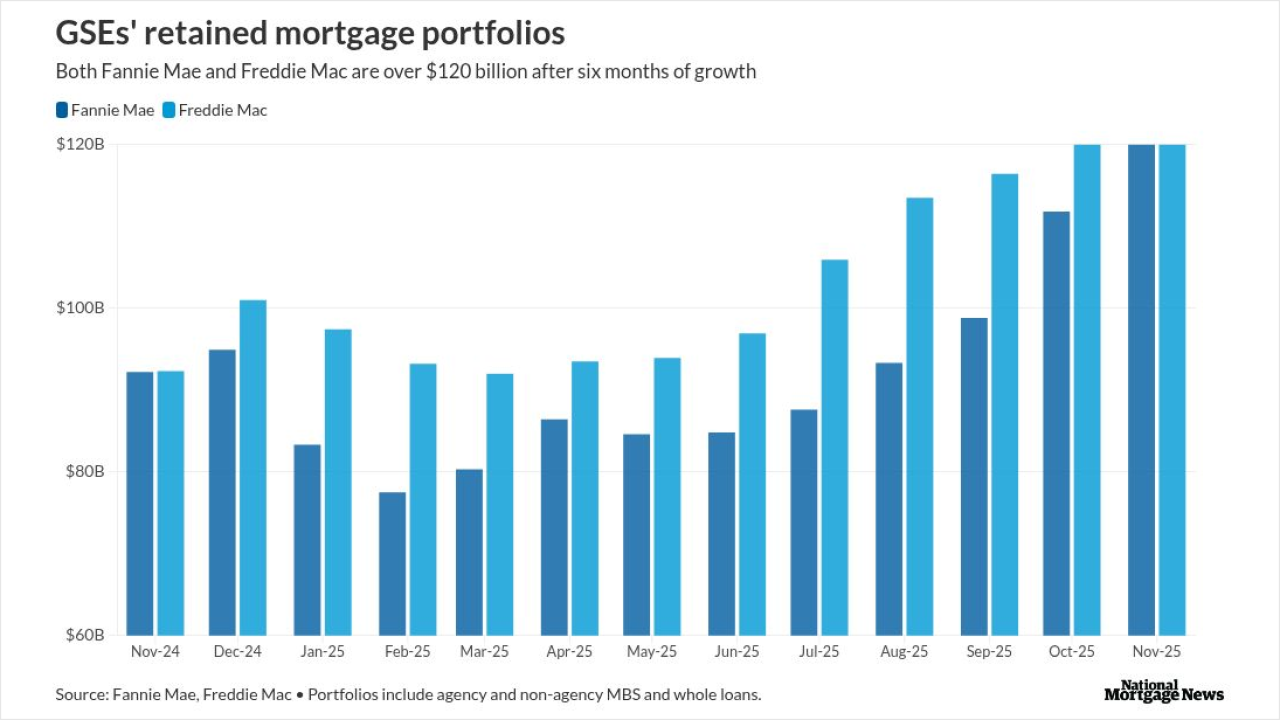

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

Initially, all the class A notes will benefit from total hard credit enhancement that represents 6.10% of the note balance, and the components give the notes a strong credit boost.

January 5 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

The pool of mostly multifamily properties has a cap rate of 9.49%, and an LTV rate of 75.1%.

January 2 -

The dollar volume of unsecured consumer loan rose dramatically. But as consumer lending rises, so do the default risks.

January 2 -

Despite a limited representation and warranty framework, the entire pool has experienced third-party due diligence, which reduces the risk of future violations.

December 31 -

Signs point to less aggressive uptier LMEs while sponsored borrowers pursue new structures to circumvent restrictions.

December 30 -

A significant portion of the loans in the pool by balance, 44.5%, are designated at non-QM, according to DBRS, adding that about 50% of the loans in the pool were made to investors for business purposes.

December 29