-

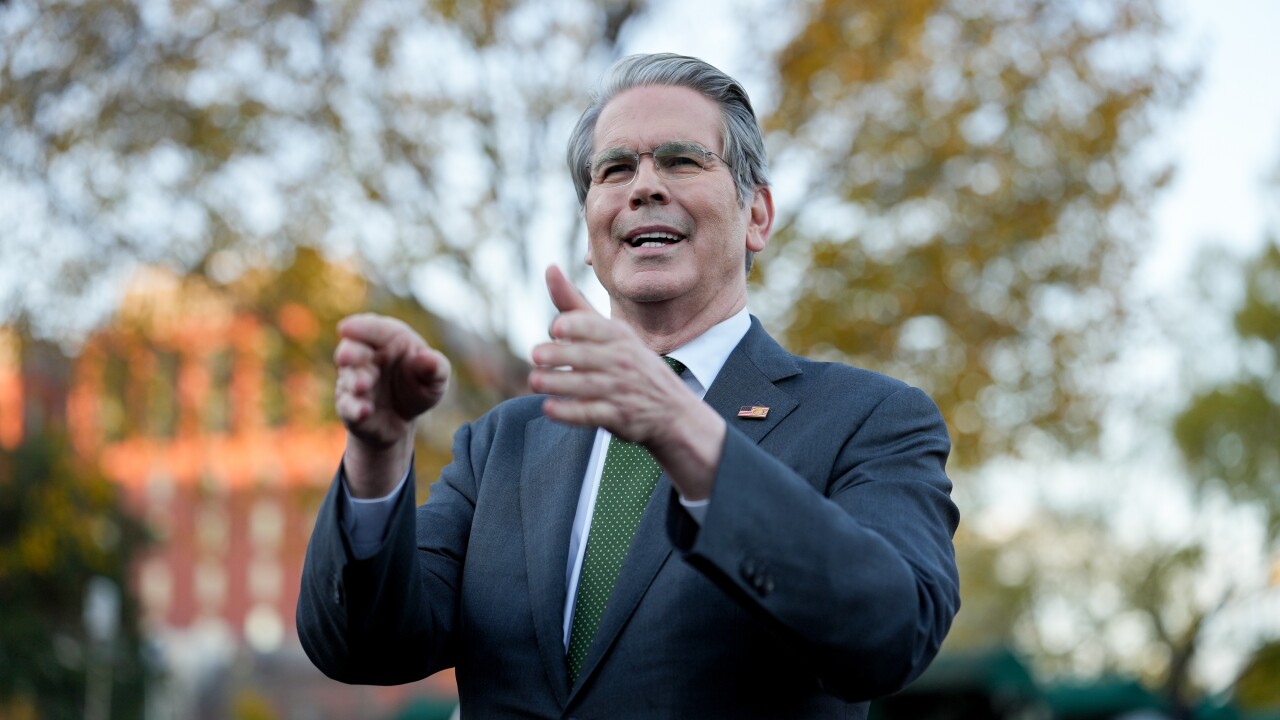

The billionaire and legacy government-sponsored enterprise investor says there is a quick interim fix and they should eventually leave conservatorship.

November 18 -

GDLP 2025-3 has a so-called vertical risk retention structure, where 95% of the collateral balance is allocated to the noteholders, while retained interest noteholders will hold the rest.

November 18 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Spread premiums on esoteric ABS attract new types of investors, including those managing insurers' assets.

November 18 -

Dislocation funds seek gains by snapping up beat-up assets of a company whose debt prices have slumped amid market turmoil or because of industry challenges.

November 18 -

If class A notes fail a credit enhancement rest, a cumulative default ratio amortization event occurs, or the pool balance is 10% or less, then GSKY 2025-3 will move to a sequential pay structure.

November 17 -

The two privately discussed what a move could look like, with the Trump administration "receptive" to welcoming Switzerland's largest bank, the newspaper said.

November 17 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Trump, who has touted the billions raised in US tariff revenue this year, has talked about the checks as public frustration mounts over the cost of living.

November 16 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14