-

Forbearance rose for the first time since October 2022 in one report. Delinquencies jumped from a near-record low in another. Experts debate the ramifications.

July 24 -

Even as the world's economy expands at a solid pace, deficits have piled up thanks to heavy spending in the wake of the pandemic.

July 23 -

The deal brings Kiavi's half-year issuance to almost $1 billion, and after selling all its offered notes, was open to potentially selling rated RTL securitizations in future offerings.

July 23 -

The pool, collectively, has a cap rate of 8.57%, with an in-trust loan-to-value (LTV) at the cutoff date of 102.3%, and an appraisal LTV of 61.5%.

July 23 -

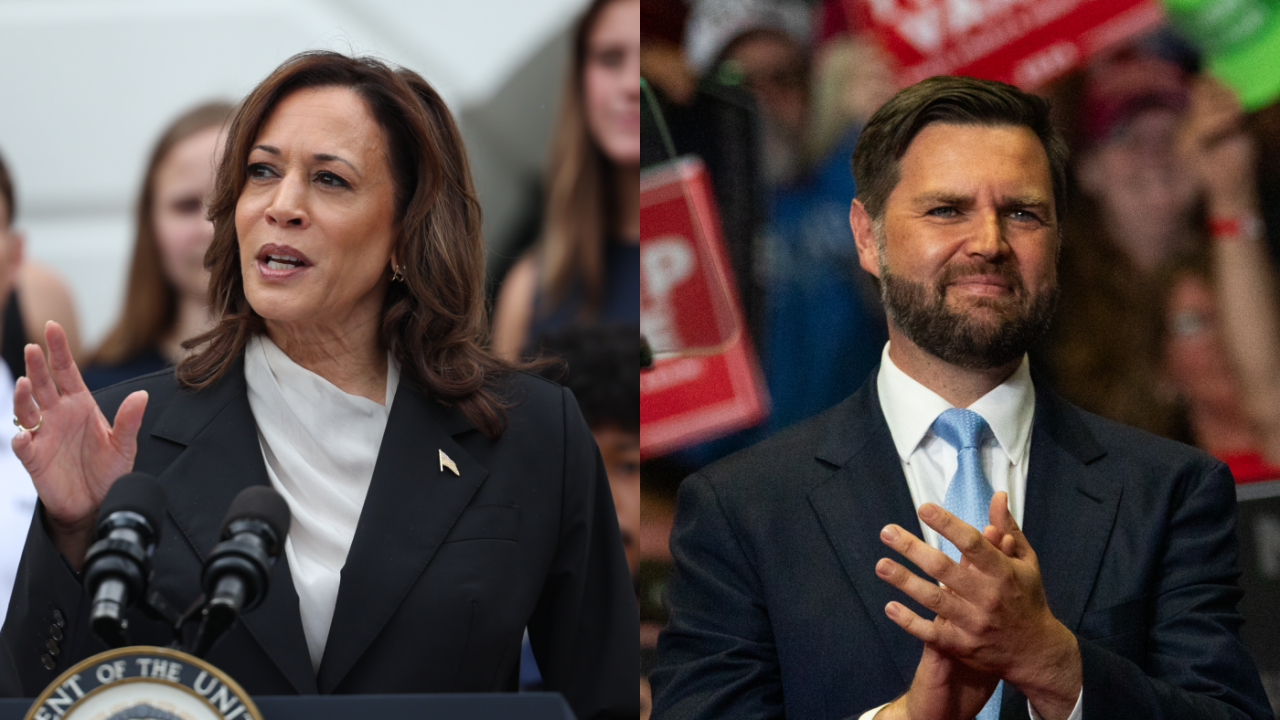

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

Yields across maturities rose by three to five basis points as volumes picked up in midday Monday trading in New York.

July 22 -

BHI has extended the revolving line of credit agreement with Lendbuzz to $50 million, and Janus' B-BBB Collateralized Loan Obligation ETF has surpassed $1 billion in assets.

July 22 -

While the company is still analyzing the error that caused many Windows systems to crash, it said a logic error in a channel file was the cause. Here's what that means.

July 22 -

Most of the notes, classes A1 through A4, have a total initial hard credit enhancement of 9.19%. Classes B, C and D have initial credit enhancement levels of 6.09%, 2.50% and 125%.

July 22 -

Investors are set to start the week scrambling to decide if President Joe Biden's decision to end his reelection campaign and endorse Vice President Kamala Harris increases or decreases Donald Trump's chances of regaining power.

July 21