-

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

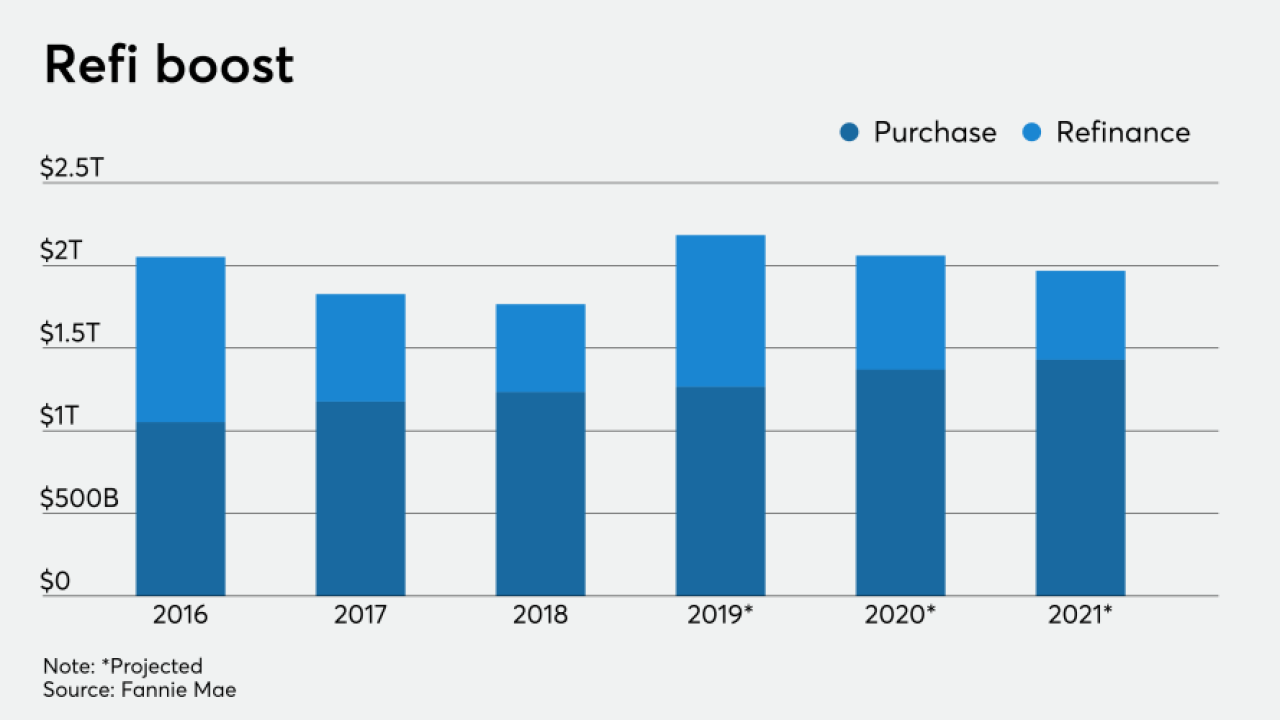

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

Five MBS pools of predominantly non-QM mortgages have been launched into the market by originators and loan aggregators, according to ratings agency presale reports published since Monday.

February 13 -

The biggest issuers of bonds tied to the benchmark tapped to replace U.S. dollar Libor are suddenly pulling back, a potential blow to efforts by regulators to wean the financial system off a much-maligned reference rate.

February 11 - LIBOR

The government-sponsored enterprises’ plan to cease accepting loans pegged to the London interbank offered rate a year ahead of its scheduled expiration is expected to hasten action in securitized markets.

February 10 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

With policymakers focused on ending Fannie Mae and Freddie Mac’s conservatorship, their regulator is reorganizing key units and adding staff to position itself for the long term.

February 3 -

The regulator said the investment bank and financial services company will help in the process of strengthening Fannie Mae and Freddie Mac’s capital standing for their eventual exit from conservatorship.

February 3 -

Now that the Consumer Financial Protection Bureau says it will scrap an unpopular standard for so-called qualified mortgages, the big question is what will take its place.

February 2 -

With interest rates expected to stay low while wages and the overall economy grow in conjunction, Fannie Mae again boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

January 22 -

The agency is sending a strong message that it won’t rush to end an exemption for Fannie Mae and Freddie Mac while also signaling longer-term changes that will affect all lenders.

January 21 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

Federal Housing Finance Agency Director Mark Calabria discussed the possibility of having Fannie Mae and Freddie Mac operate under a consent order to allow the government-sponsored enterprises to be able to raise capital.

January 8 -

Getting Fannie Mae and Freddie Mac out of conservatorship has been an elusive goal. It will remain elusive, says DeMarco, in the absence of broader reform of housing finance, something that will require bipartisan support.

January 8 -

Consumer perception of the housing market ticked up slightly in December, as potential buyers remain bullish about making a home purchase in 2020, a Fannie Mae report said.

January 7 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 2 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

A risk-based capital rule for Fannie Mae and Freddie Mac is expected to top the agenda in 2020 as the companies’ regulator executes plans for their release into the private sector.

December 26