-

Dont expect much of an impact on structured finance next year from the Fed rate hike and its decision to raise rates gradually.

December 16 -

Specialty lender Regional Finance Co. has obtained a $75 million amortizing loan from Wells Fargo Bank that will be secured by automobile receivables.

December 15 -

Most investors in a recent survey said they want to ditch the pricing benchmark now used for many kinds of securitization.

December 14 -

SolarCity is marketing what may be the first securitization of loans to finance the purchase and installation of solar panels by consumers.

December 14 -

California regulators on Monday identified 14 companies that the state is targeting as part of its recently announced inquiry into the marketplace lending industry.

December 14 -

California officials have opened a broad inquiry into the marketplace lending business, seeking data from industry participants that will be used to assess the effectiveness of the state's current regulatory regime.

December 11 -

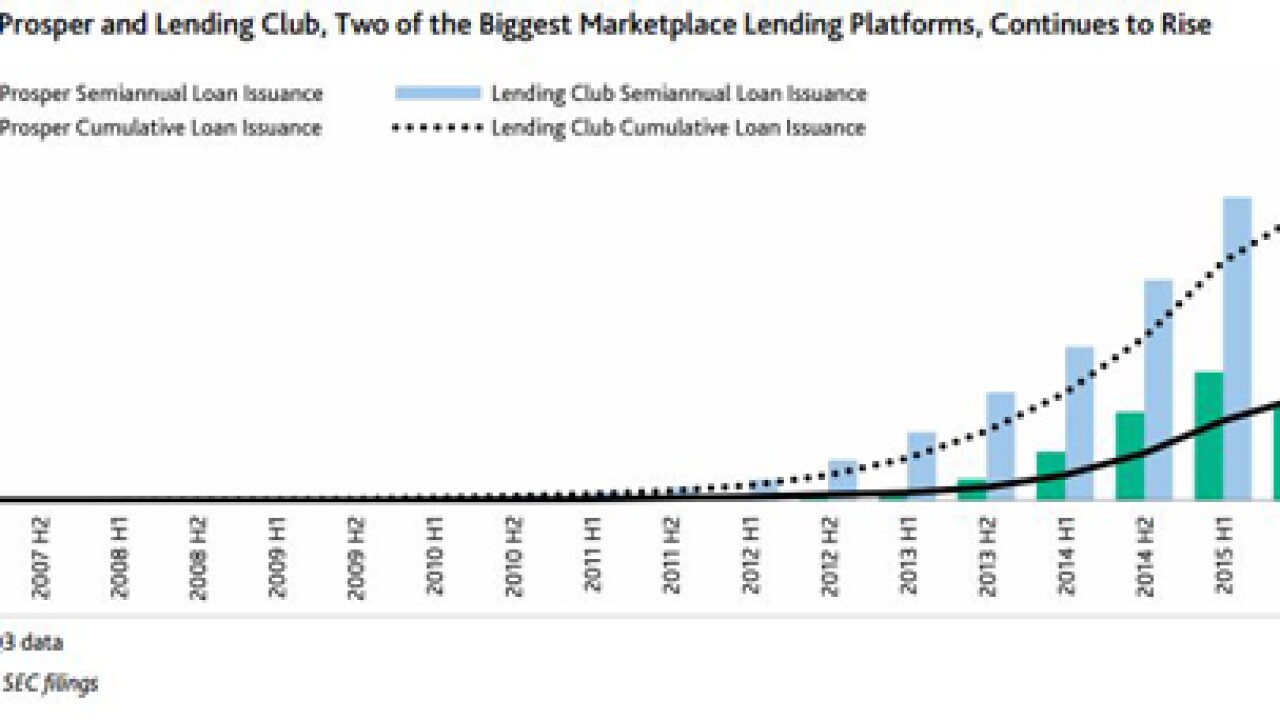

Marketplace lenders started 2015 as darlings of the securitization market, but their white hot growth started to attract calls for more regulation as the year unfolded.

December 10 -

Underwriting standards will keep slipping for auto loans over the next year but deals performance won't suffer, according to Moody's Investors Service 2016 Auto ABS Outlook.

December 9 -

The Obama Administrations efforts to ease the debt burdens of college students have had unintended consequences for investors in federally guaranteed student loans.

December 9 -

Rated bonds backed by online marketplace loans might include subprime consumer loans for the first time next year. This is one of predictions that analysts at Moodys Investors Service made in a recent report on the sector.

December 8