-

Impact investing has long centered on environmental and social purpose, but governance could make huge strides as an ESG consideration in 2020.

January 20 -

Marketplace consumer loan ABS volume is expected to rise in 2020, aided by strong 2019 economic tailwinds benefiting originations as well as favorable federal regulatory proposals that could encourage more securitizations.

December 29 -

Mosaic Solar Loan Trust 2019-2 is bringing to market $208 million in asset-backed securities that are secured by residential solar consumer loans.

October 28 -

The company has rolled out an online platform for firms considering marketplace loans as an asset class.

October 10 -

Kubota Credit Corp.’s $800 million asset-backed transaction is not expected to generate any additional losses than forecast for the finance company’s previous ABS in 2018, according to presale reports.

May 22 -

Social Finance is supplying lower levels of credit enhancement to its third consumer-loan securitization of 2019.

May 16 -

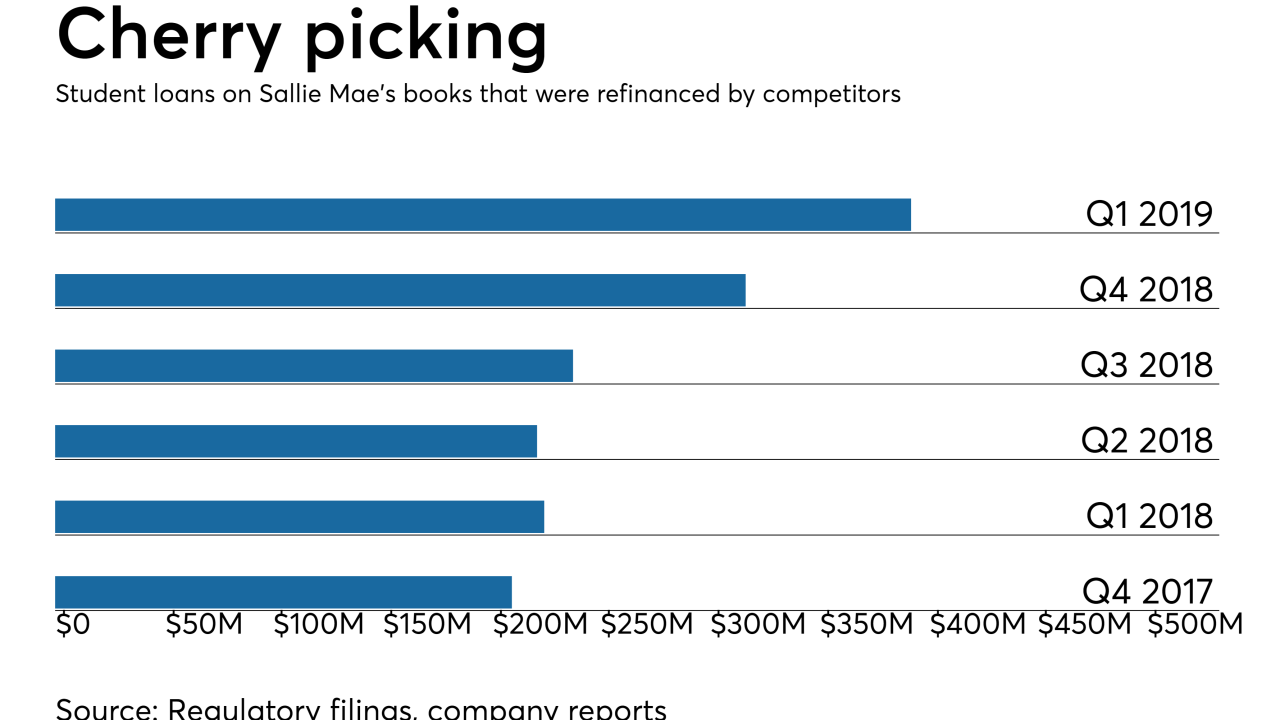

SLM Corp. wants to "target the people our competitors are targeting and bring on their federal balances" CFO Steven McGarry said during an earnings call.

April 18 -

Losses on Conn’s consumer loans are stabilizing, and the electronics and appliance store chain sees an opportunity to reduce the level of credit enhancement for its latest securitization.

April 11 -

The Structured Finance Industry Group wants Treasury and the IRS to issue a notice that a change from Libor to an alternative index would not be treated as a taxable exchange.

March 31 -

The company spun out of DriveTime is paying for the privilege, however; it's offering 50.3% credit enhancement on the senior notes of the $338 million deal rated by Kroll.

March 15