Paramount Equity Mortgage, the company founded in 2003 by former Oracle sales executive Hayes Barnard, is having another go at financing solar panel installations.

Paramount Equity was incorporated California in 2003 to provide residential mortgage loans and branched out into solar financing in 2009. It sold this business to SolarCity in 2013, and Barnard then served as SolarCity’s chief revenue officer until the August 2016, according to his LinkedIn profile. SolarCity subsequently sold itself to Tesla in November 2016.

As Tesla

Now Loanpal is making its first trip to the securitization market, a move that will certainly impact the future appetite of whole loan investors, either positively or negatively. Loanpal currently has arrangements with six partners to sell a fixed amount of loans over a fixed period of time for a predetermined amount; each "forward flow" arrangement has different terms, according to Kroll. The securitization will demonstrate how easily these investors can cash out.

The transaction, Mill City Solar Loan 2019-1, will issue four classes of notes totaling $241.4 million. Kroll expects to assign an A rating to the senior tranche of notes, which benefits from 20.46% credit enhancement. By comparison, that’s more than 3.0 percentage points higher than the 17.23% enhancement on the single-A rated tranche of Mosaic’s most recent securitization, which was completed

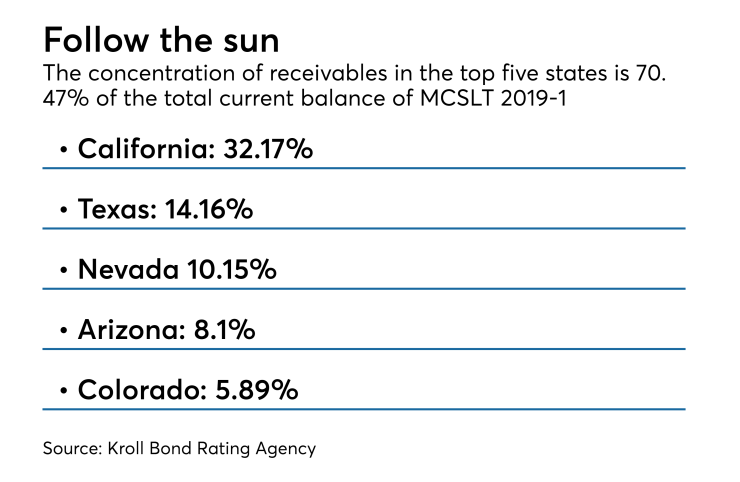

Goldman Sachs is the structuring agent and initial purchaser of MCSL 2019-1. Goldman is also contributing some of the $272.2 million of collateral for the deal; the rest was contributed by an entity called CVI SL Investment Trust, per Kroll.

As with any solar loan securitization, there are multiple risks for investors to consider, including a limited amount of performance data, the impact of manufacturers and installers of solar panels on performance, the fact that borrowers’ monthly payments may increase, changes in technology, and the fact that borrowers, and not installers, are responsible for operation and maintenance.

Since Loanpal has only been originating solar loans since November 2017, it could not provide KBRA with more than 13 months of performance data on loans that may be outstanding for as long as 20 years. “These solar loans have not been through a full loan life-cycle and therefore losses could be higher than what they are currently experiencing,” the presale report states. Additionally, no monthly vintages have seasoned beyond 18 months, where customers are expected to apply the tax credit they receive on the installation to prepay the loan. Monthly payments on loans where the borrower elects not to apply the tax credit to pay down the balance of the loan may step up as the amortization is recalculated.

The initial collateral pool will consist primarily of loans that have achieved their permission to operate (PTO), however 7.13% have completed their installation, but not yet achieved their PTO. If a loan fails to achieve PTO within a specified time period, Loanpal will repurchase them.

These loans have balances of $5,000 to $100,000, original terms of 10 to 20 years and interest rates of 2.99% to 5.99%.

Most of the borrowers in the pool are of prime quality. The weighted average FICO score is 749 and borrowers with a FICO score greater than 699 representing approximately 77% of the current principal balance. There are no borrowers with a FICO of less than 650. However, there are 88 loans, representing approximately 0.95% of initial pool balance, where the borrower was subject to a bankruptcy proceeding during the four years prior to being approved for the solar loan.

Loanpal has appointed a third party, LeaseDimensions of Portland, Oregon, as subservicer; however, it remains liable for the performance of the subservicer.