-

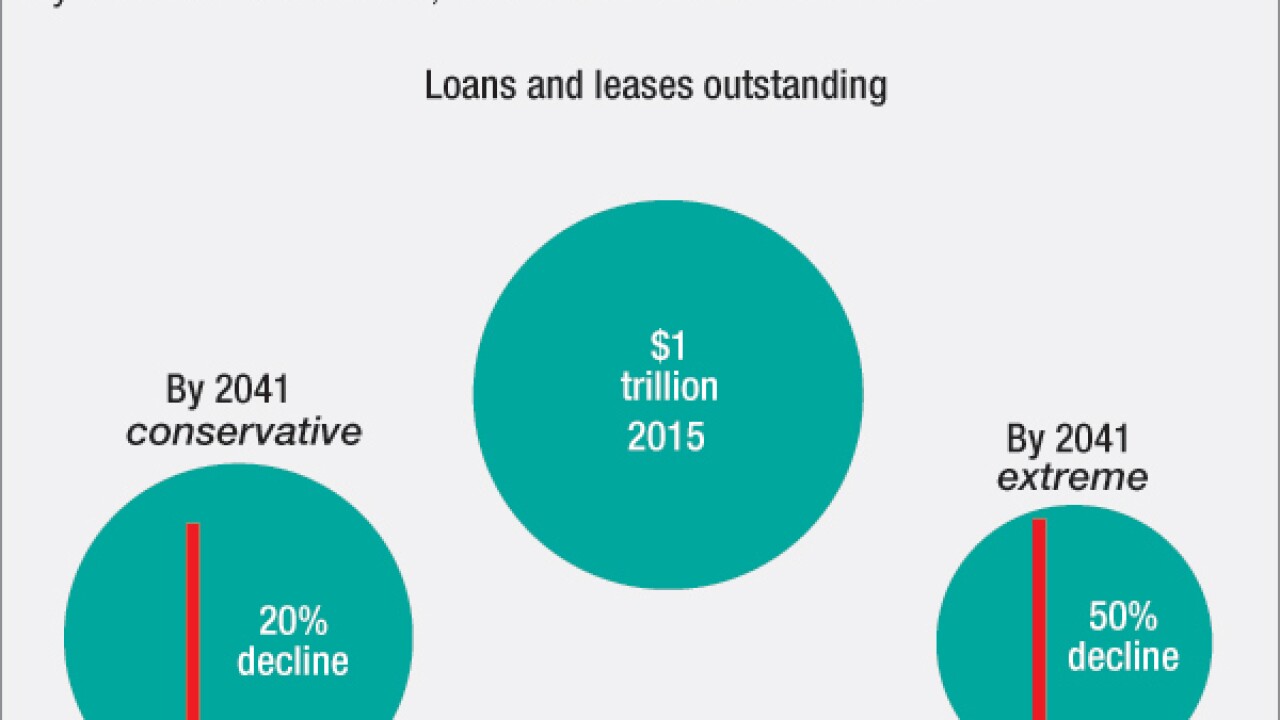

Americans' longstanding relationship to automobiles owning them, driving them is set for a dramatic shift, and so is auto finance.

July 13 -

Online marketplace lenders found themselves in the congressional crosshairs Tuesday just as some lawmakers are attempting to provide the industry with sought-after reforms.

July 12 -

OneMain is testing investor appetite for a new kind of subprime auto loan, one that allows borrowers to cash out some of the equity in their vehicles. OneMain, formerly known as Springleaf Financial, is one of the first to securitize a pool of primarily cash-out refinancing auto loans.

July 11 -

Sallie Mae Bank is preparing its second private student loan securitization of the year, according to Fitch Ratings.

July 11 -

Banks that stuck with student lending after the financial crisis are finding the business far less risky than it used to be.

July 11 -

BMW of North America's owner trust is issuing its first auto-loan securitization in nearly two years, while CarMax is coming out with its second of 2016. Also, Nissan is planning to issue its first dealer floorplan ABS of the year.

July 7 -

New rules designed to stop U.S. companies from moving their tax addresses offshore are so written so broadly that they could disrupt the securitization market, a trade group warned Thursday.

July 7 -

World Omni Financial Corp. is making its annual trip to the securitization market with auto leases.

July 5 -

Bank of Montreal (BMO) is backing its third receivables-backed securitization of the year, but the first split-denomination ABS transaction of 2016 in the $1.1 billion deal. TD Bank's Evergreen Trust is also marketing a US/Canadian dollar denominated securitization.

July 5 -

The Supreme Court's decision Monday not to hear a closely watched lending case leaves unresolved some key questions for the U.S. financial industry.

June 27