- Europe

GMAC is issuing its eighth asset-backed UK transaction in a £385.8 million (US$481.3 million) bond offering backed by individual and small-business vehicle lease contracts.

March 22 -

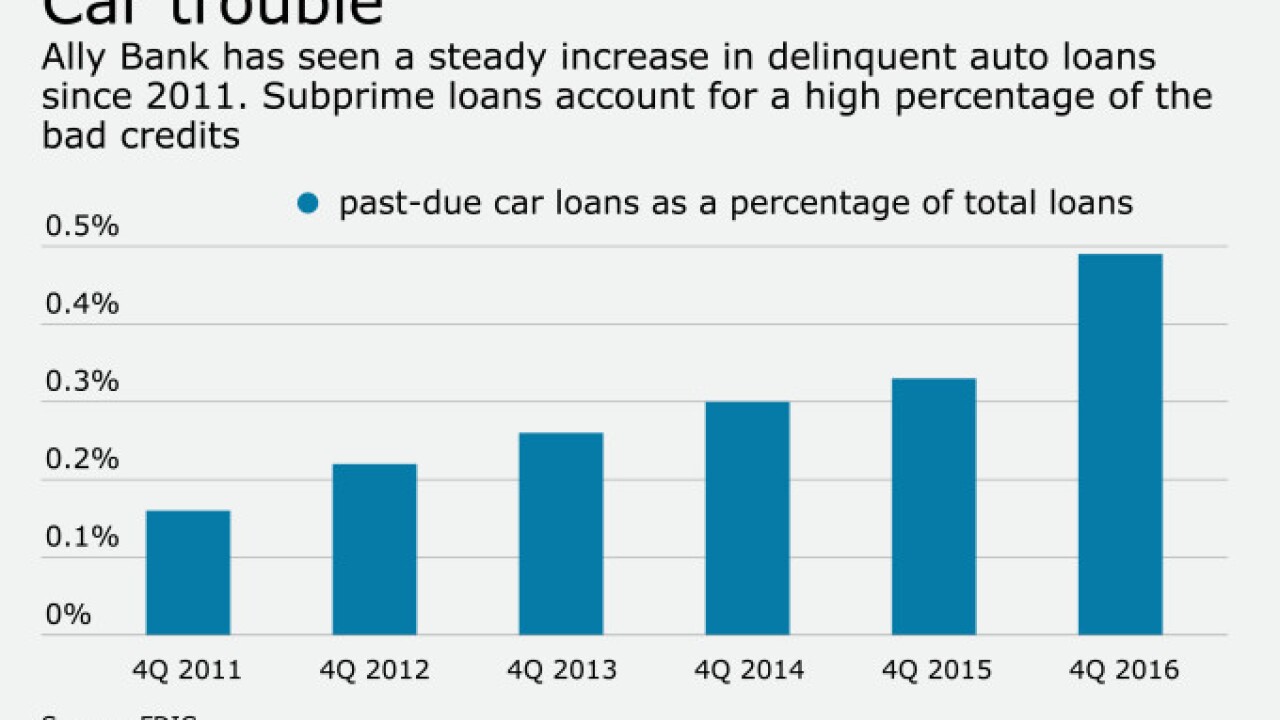

Fitch Ratings says the auto loan and lease sectors will continue to experience deteriorating credit performance throughout 2017, as defaults accelerate among subprime borrowers and used-car values in decline.

March 22 -

Signs of growing weakness in the U.S. auto loan market are hurting the bottom line at one of the nations largest car lenders.

March 21 -

Capital One is securitizing $1.15 billion in consumer and small-business credit-card receivables, in its first asset-backed card series notes transaction since August.

March 20 -

In a Q&A, CommonBond CEO David Klein discusses how an OCC charter might benefit customers by lowering the cost to run a student loan refinancing

March 19 -

The Justice Department told a federal appeals court on Friday that President Trump should have the authority to fire the head of the Consumer Financial Protection Bureau.

March 19 -

Five prime lenders have launched $5.5 billion in new loan- and lease-backed securitizations, including the second transaction of the year for Ally Financial.

March 16 -

SoFi Lending Corp. is marketing its second student loan securitization of the year.

March 16 -

Social Finance Inc.s online borrowers are defaulting at higher rates than underwriters for one of its bond deals had expected, the latest sign that an industry that hoped to upend banking is now getting tripped up by bad loans.

March 14 - Europe

Multilease AG, the finance arm of a Swiss auto importer, is making its first strip to the European securitization market.

March 14