-

Orico, a Japanese finance company, is pursuing its sixth multi-currency prime auto loan securitization in a $336.5 million deal that includes several tranches of U.S.-dollar denominated bonds.

March 6 -

Subprime auto lender Westlake Financial Services is hoping asset-backed investors can stomach a bigger dose of regulatory risk.

March 6 -

Avis Budget Car Rental is piecing together the markets second rental-car fleet transaction of the year in a $500 million transaction.

March 5 -

ECMC Group is marketing another $409 million of notes backed by federally guaranteed student loans that were once delinquent but are now making timely payments.

March 5 -

Verizon has launched its third overall securitization of device payment plan (DPP) receivables with a $1.29 billion notes offering carrying slightly heavier risks for investors than its first pair of deals in 2016.

March 5 -

GM Financial and Toyota Motor Credit wasted no time in returning to the securitization market following the conclusion of an industry confab in Las Vegas; the two are marketing nearly $3 billion of prime auto-related bonds.

March 2 -

Securitization pros compared notes on regulatory compliance and learned about the risks and rewards of fintech; here are the highlights of the Structured Finance Industry Group;s annual confab.

March 1 -

The worsening trend for subprime lenders amid an otherwise healthy consumer economy is a puzzling development that even auto loan securitization experts were somewhat at a loss to explain at SFIG Vegas.

February 28 -

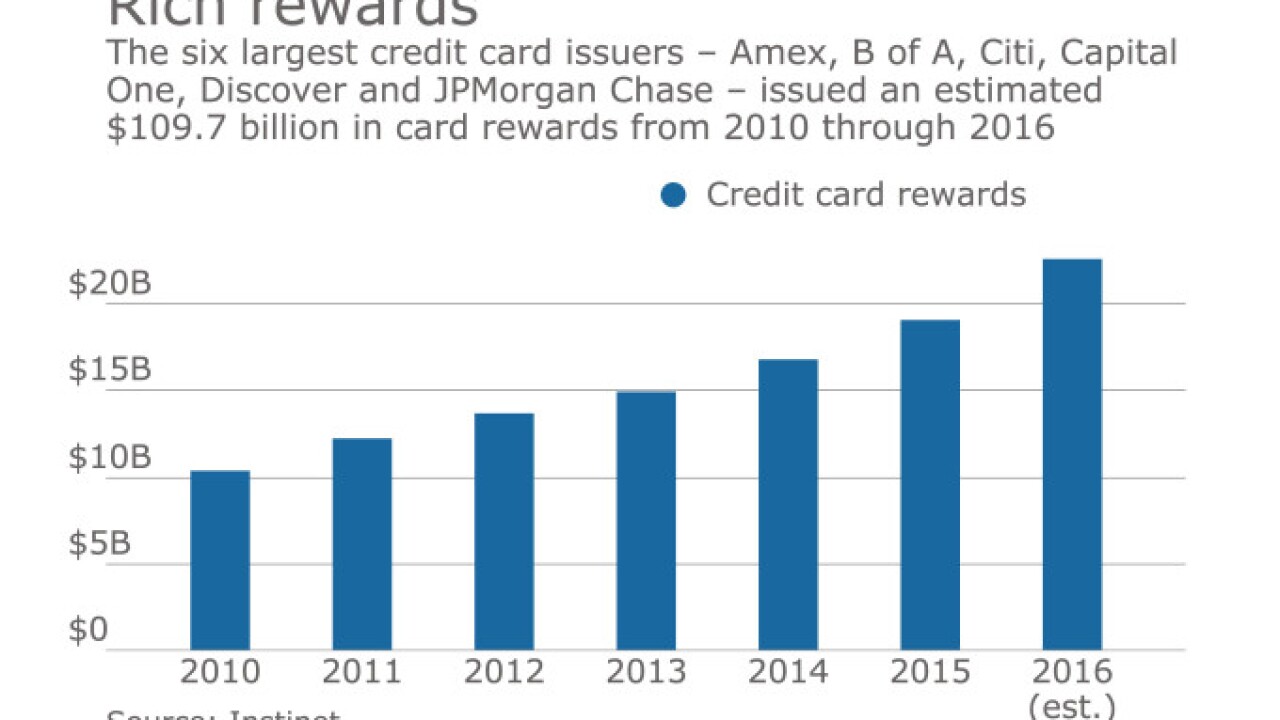

Lost in the battle between banks and retailers which is being fought with renewed vigor in the early days of the Trump administration is any consideration of how caps on interchange fees have affected consumer spending patterns.

February 28 -

Securitization pros are guardedly optimistic about the Trump Administrations impact on the industry, even if no one expects to see a rollback of regulations imposed by the Dodd-Frank Act in the immediate future.

February 27