-

The worsening trend for subprime lenders amid an otherwise healthy consumer economy is a puzzling development that even auto loan securitization experts were somewhat at a loss to explain at SFIG Vegas.

February 28 -

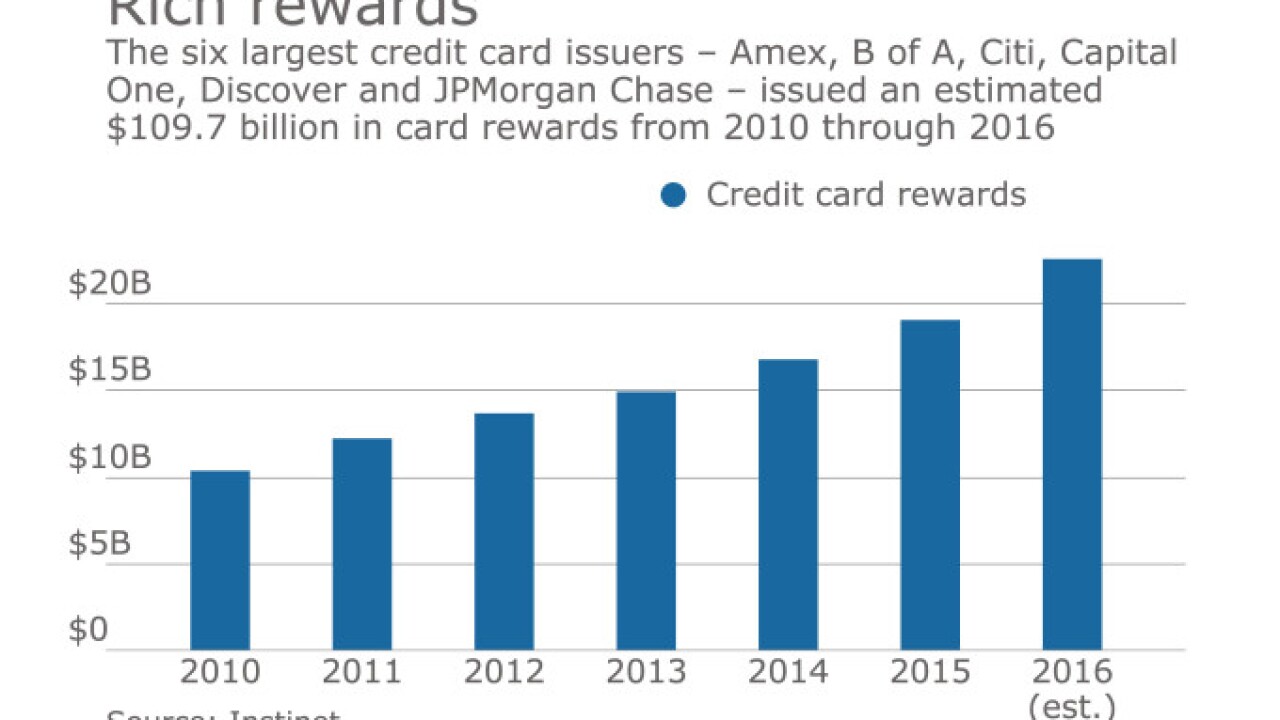

Lost in the battle between banks and retailers which is being fought with renewed vigor in the early days of the Trump administration is any consideration of how caps on interchange fees have affected consumer spending patterns.

February 28 -

Securitization pros are guardedly optimistic about the Trump Administrations impact on the industry, even if no one expects to see a rollback of regulations imposed by the Dodd-Frank Act in the immediate future.

February 27 -

The Structured Finance Industry Group is teaming up with the trade association for the blockchain industry to explore ways that distributed ledger technology can be used to speed up transaction processing and improve transparency.

February 27 -

World Omni Financial Corp. is leasing cars to consumers with lower credit scores, and the risk is being compounded by the fact that so many leases mature at the same time.

February 27 -

Panelists at SFiG Vegas questioned just how different marketplace lenders are from more traditional lenders.

February 27 -

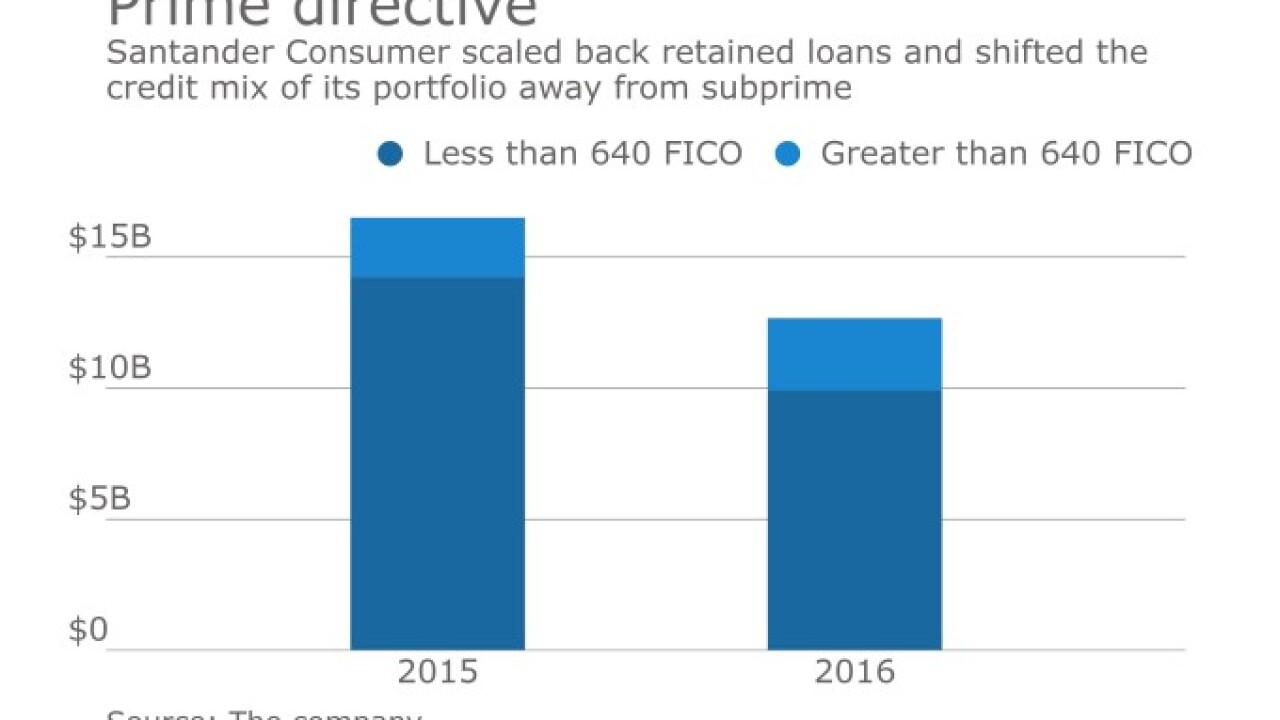

Santander Consumer USA Holdings plans to increase lending to consumers with solid credit scores after being squeezed by higher losses on its subprime auto book.

February 23 -

The Prime Collateralised Securities Initiative is aiming to boost synthetic securitization, which offer an alternative way for European banks to free up capital for more lending.

February 23 - Europe

Volkswagens U.K. finance arm is marketing £750 million ($884 million) of bonds backed by auto leases.

February 22 -

The industrys reliance on these yardsticks to estimate the riskiness of a pool of borrowers is mathematically flawed.

February 21