-

Toyota Motor Credit, DriveTime and AmeriCredit are marketing their second securitizations of 2017; Nissan Motor Credit is selling bonds backed by floorplan receivables; Mercedes-Benz Financial Services Canada i is issuing U.S.-dollar denominated notes.

May 4 -

After more than two days of debate, the House Financial Services Committee on Thursday approved its sweeping Dodd-Frank Act rollback bill.

May 4 -

CIBC is planning to issue additional notes backed by credit-card receivables from its CARDS II Trust, according to presale reports from Fitch Ratings, DBRS and Moodys Investors Service.

May 3 -

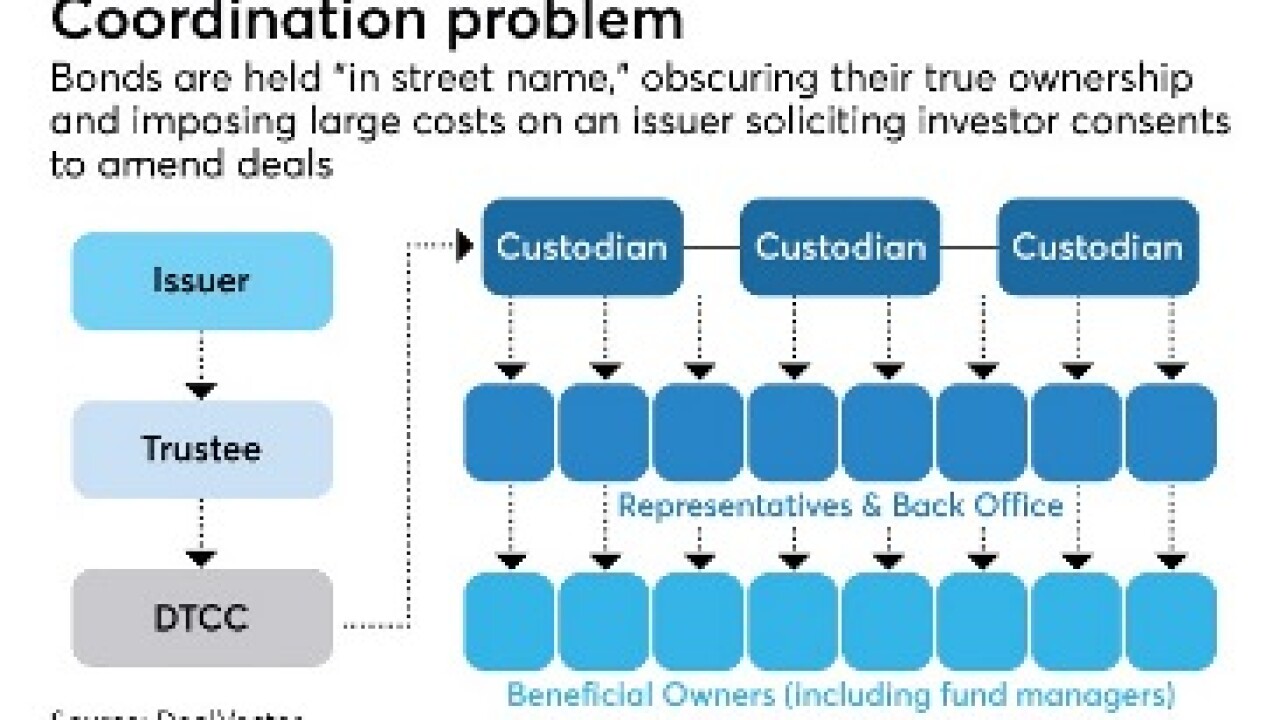

Navient and Nelnet, the two largest student loan servicers, avoided downgrades on some $18 billion of bonds by extending their maturities. Getting the required consents from investors would normally take ages, but recent innovations speeded the process.

May 3 -

Citibank Credit Card Issuance Trust is issuing its latest revolving Citiseries securitization through $1.1 billion in notes backed by prime credit-card receivables. Also, IHS Market notes the tightening spreads in many U.S. consumer ABS asset classes.

April 28 -

The Consumer Financial Protection Bureau ordered an auto loan servicer on Wednesday to pay $2.4 million in fines and redress to consumers for failing to abide by a 2015 consent order alleging it bullied members of the military.

April 26 -

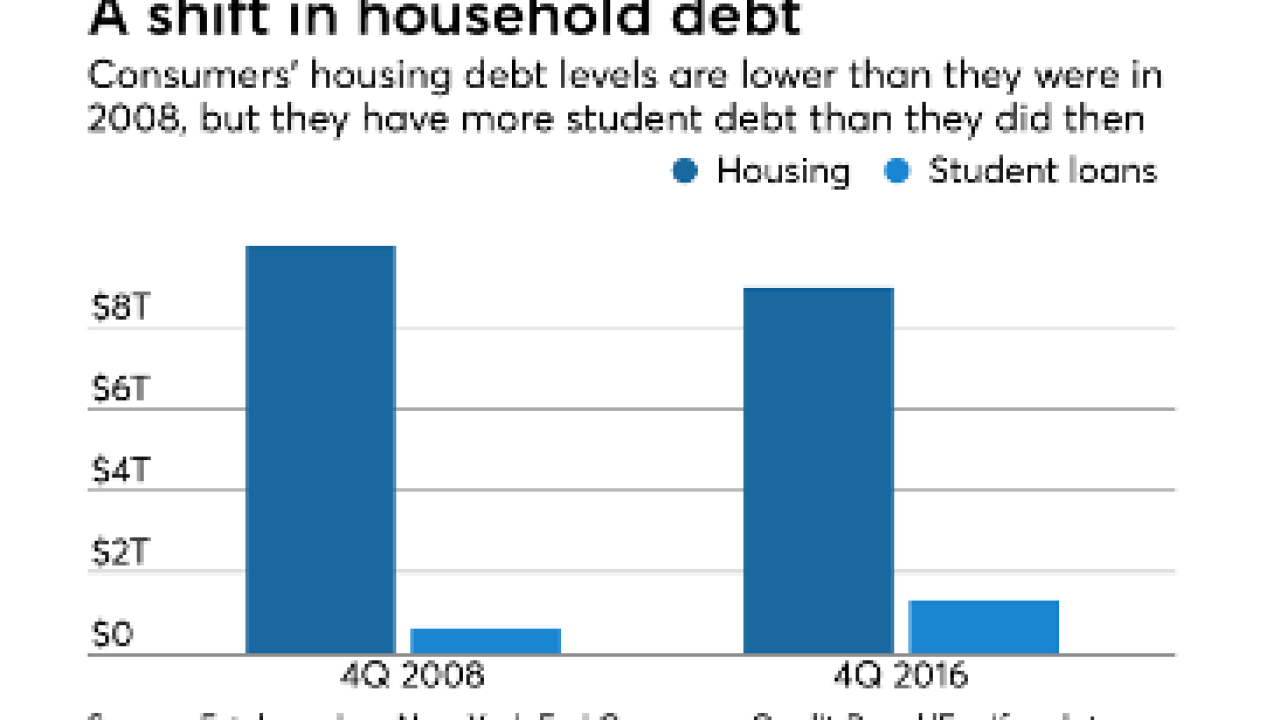

Fannie Mae has made three selling guide changes aimed at helping the growing number of borrowers with student debt qualify for home loans, and may begin testing other similar proposals related to this goal.

April 25 -

President Trump and Consumer Financial Protection Bureau Director Richard Cordray appear locked in a game of chicken over his continued leadership of the agency

April 24 -

Online consumer lender Avant continues to boost quality of its underwriting, and this is helping to reduce its funding costs.

April 24 -

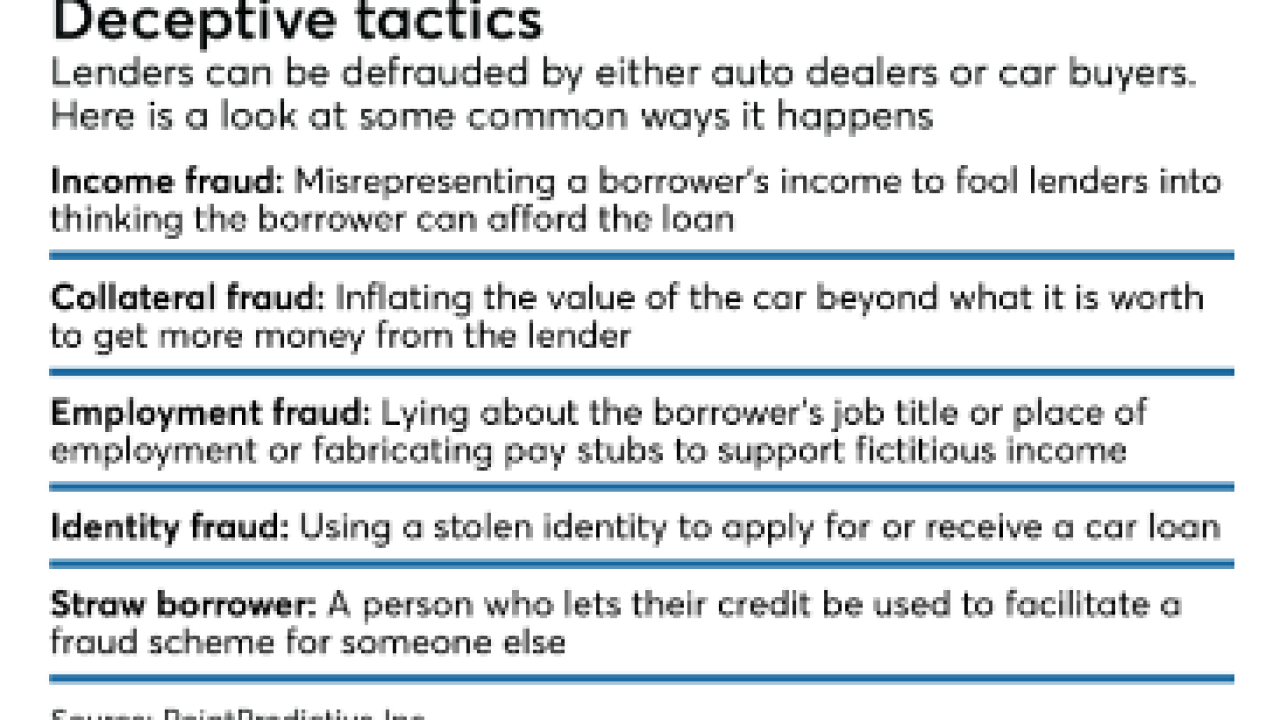

A $26 million settlement by Santander Consumer is shining a light on the hard-to-measure problem of auto dealer fraud, while also raising questions about the adequacy of lenders' efforts to combat bad behavior

April 24