-

President Trump and Consumer Financial Protection Bureau Director Richard Cordray appear locked in a game of chicken over his continued leadership of the agency

April 24 -

Online consumer lender Avant continues to boost quality of its underwriting, and this is helping to reduce its funding costs.

April 24 -

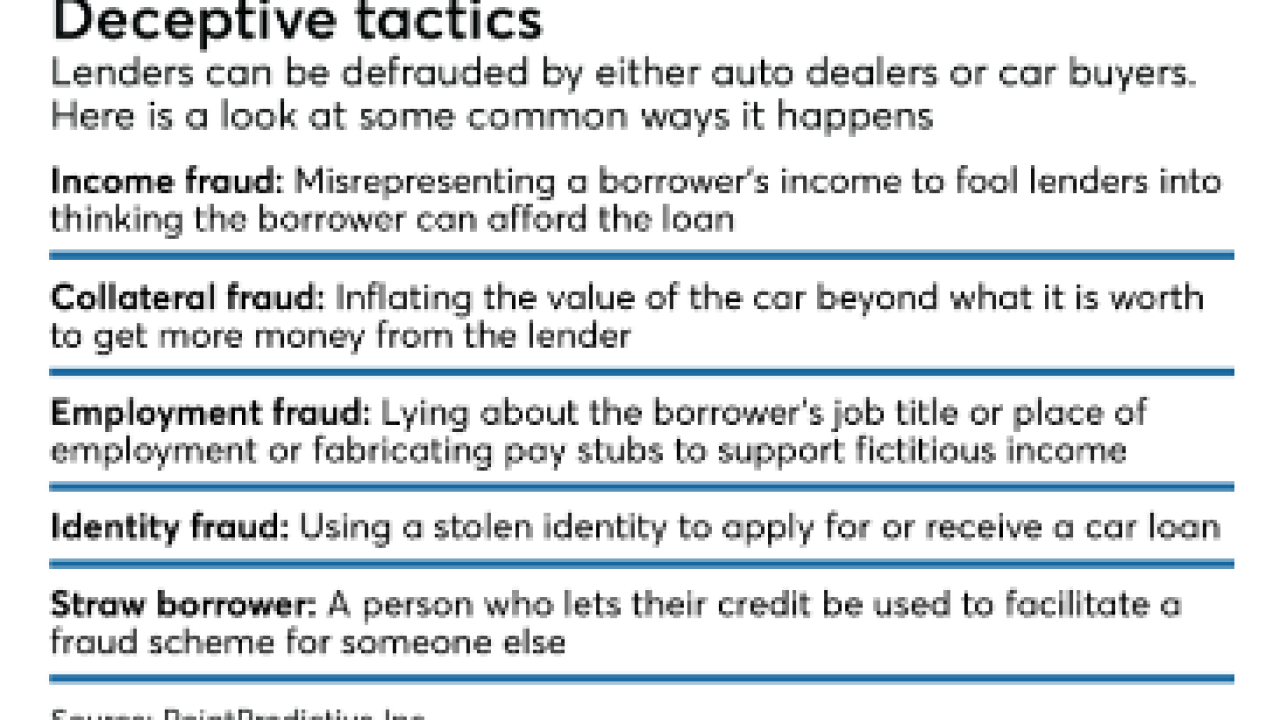

A $26 million settlement by Santander Consumer is shining a light on the hard-to-measure problem of auto dealer fraud, while also raising questions about the adequacy of lenders' efforts to combat bad behavior

April 24 -

Student loans are showing signs of growing too fast, perhaps the only market flashing a warning even as the economic recovery grows older, Citigroup Chief Financial Officer John Gerspach said

April 21 -

Dell and Ascentium launched a pair of equipment lease securitizations; NextGear readies notes backed by auto dealer inventory financing; Consumer Portfolio Services closes on auto ABS.

April 20 -

Navient is hopeful that its purchase of $6.9 billion of student loans from JPMorgan Chase could encourage other banks to consider selling their portfolios.

April 19 -

Supreme Court Justices appeared exasperated with both sides in a case that would define whether companies that buy distressed debt are covered under a federal statute setting limits on their activities.

April 18 -

Fintech companies can help consumers and small businesses obtain credit at lower costs, but it is critical to ensure that these innovative companies do not harm borrowers with predatory or discriminatory lending practices.

April 17 -

The Kentucky Higher Education Student Loan Corp. is planning to issue $40 million of bonds backed by both private and federally guaranteed student loans

April 13 -

S&P Global Ratings has rated its second marine shipping container securitization of the year in a $196 million transaction backed by leases managed by Seaco SRL.

April 13