-

The online lender is taking advantage of the cheaper funding this could provide to refinance a $610 million facility that does not expire for another year.

March 8 -

The upstart lenders have been chipping away at credit cards’ consumer-lending dominance by offering fixed-rate loans with predictable repayment plans. Now the card giants are fighting back.

March 8 -

Brick-and-mortar retail isn’t dead yet. Though the trend of retailers closing stores in the face of stiff competition from e-merchants is certainly troubling to commercial real estate lenders, it would be a mistake to conclude that all retail loans are risky. Here's a look at which ones are the safest and, potentially, the scariest.

March 5 -

The Atlanta company, which reported fourth-quarter results Tuesday, said that the lending partnership with American Express will launch in Atlanta, Chicago, Dallas, Los Angeles and Dallas within the next 60 days.

March 5 -

The captive lender is already underwriting and managing leases for GM electric cars in China; it is also buying and managing fleets for GM’s Maven ride-sharing program launched in the U.S. in 2016.

February 25 -

Personal loan balances hit an all-time high in 2018, while fintech lenders widened their market share lead over banks and credit unions, according to new data from TransUnion.

February 21 -

Some 35% of vehicles backing Driver UK Master Compartment 5 have diesel engines; presale reports do not indicate the percentage that meet more stringent EU emission standards.

February 21 -

Amid widespread concern about their exposure to leveraged lending, the debt rating agency says banks have sufficient earnings and capital cushions to continue investing in the sector.

February 20 -

The online consumer lender trimmed its losses in the fourth quarter and says an adjusted, non-GAAP metric suggests it's on the path to getting out of the red later this year.

February 19 -

More than 83% of the vehicle-lease value in Ford Motor Credit's $1.1 billion lease securitization is tied into trucks, minivans and utility models.

February 15 -

Credit enhancement and expected loss levels in Upstart's 2019 securitization debut have risen from its previous deal last August.

February 14 -

Barclays, BMO, Citibank, Goldman Sachs and ING contributed to the online student lender, which last year made over $1 billion in loans.

February 14 -

The bureau wants to further remove the threat of legal liability for firms that test products benefiting consumers, but the attorneys general say the agency cannot provide immunity from state law.

February 12 -

The online lender founded by Renaud Laplanche contributed half of the collateral for the $226.9 million transaction. It's also retaining a 5% economic interest in the deal.

February 12 -

The installment lender, which bills itself as an alternative to payday lenders, targets underserved communities and operates through a network of retail partners.

February 12 -

GM Financial is front-loading the $1.2 billion deal with early maturities, according to presale reports; Hyundai Capital is also readying a $710 million transaction.

February 8 -

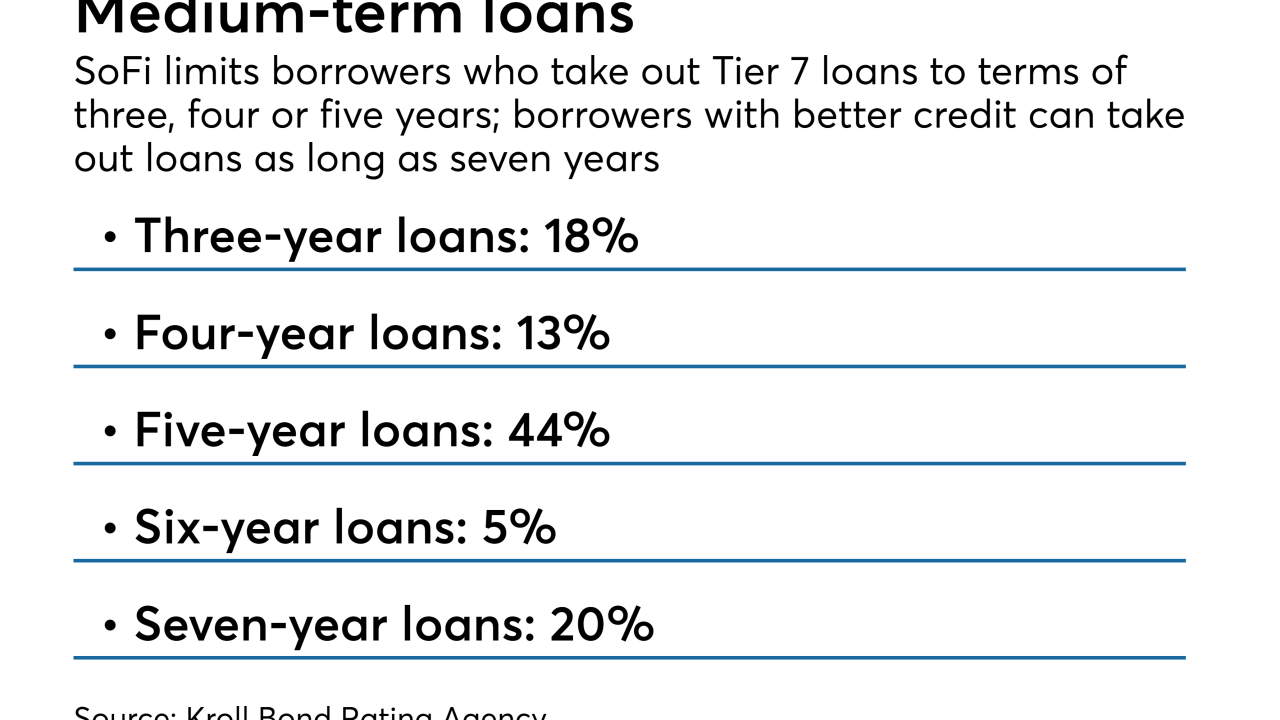

Tier 7 loans, which have lower limits on free cash flow and allow negative personal income, account for 7.26% of the collateral for the online lender's next transaction, according to Kroll.

February 8 -

In a major victory for small-dollar lenders, the agency plans to rescind underwriting requirements that were the centerpiece of the rule drafted by a Democratic appointee.

February 6 -

As the consumer lender announced its seventh consecutive profitable quarter, its CEO bragged that his company is better positioned than the likes of Goldman Sachs and LendingClub.

February 1 -

Lenders are glad the agency worked swiftly through a backlog of paperwork, but they're worried funds will get cut off if the government closes again.

February 1