-

Tesla’s sponsorship of the $940.95 million Tesla Auto Lease Trust 2019-A comes as the battery-electric vehicle (BEV) manufacturer has regained its footing with a surprise third-quarter profit and overcome recent manufacturing woes on its mass-market Model 3 vehicle.

November 19 -

The 2015 decision posed new legal challenges for institutions trying to sell loans to third parties, but the federal regulatory agency proposed steps Monday for banks and debt parties to evade state interest rate caps.

November 18 -

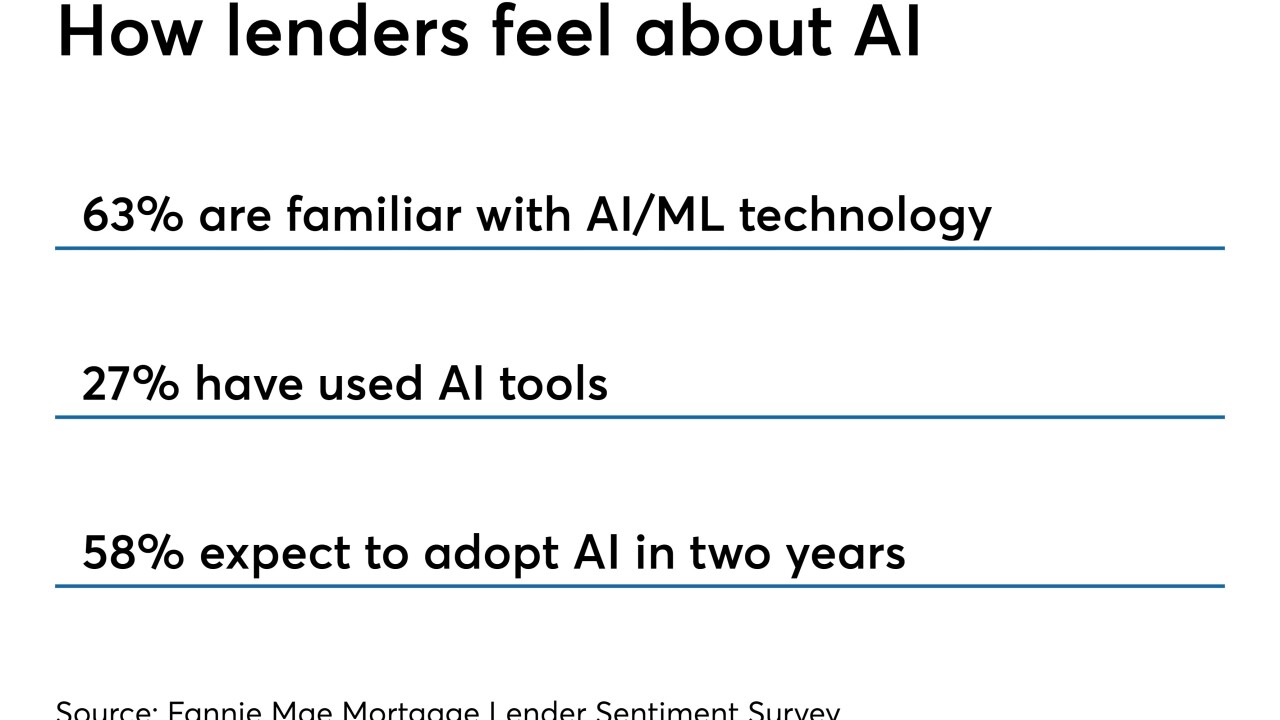

Banks and lenders have made inroads in analytics and automation with machine-learning technology. Will asset management follow suit?

November 18 -

According to a presale report from Kroll, the additional notes will carry the same ratings and terms on the five counterpart classes of $700 million in outstanding notes.

November 13 -

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12 -

Over 75% of loans reported mark-to-market declines in prices in the secondary market – or 4.7 loans for every loan price that advanced, according to the LSTA.

November 8 -

According to presale reports, Mercedes-Benz Auto Lease Trust (MBALT) 2019-B will have only two months over the life of the deal in which there is more than a 5% concentration of expected lease maturities.

November 8 -

Loss expectations are up slightly for the second retail auto lease securitization of the year for RAC King the parent company of the regional “buy here/pay here” used-car chain American Car Center.

November 7 -

At a forum convened by the CFPB, several bank and fintech executives argued that long-delayed rules required under the Dodd-Frank Act can help fight discrimination and shine a light on unsavory practices in the market for small-business credit.

November 6 -

The San Francisco fintech company has agreed to pay a $110,000 fine for failing to comply with a 2017 state law that requires mortgage servicers to be licensed.

November 4 -

Lenders including Barclays and Deutsche Bank have been left holding at least $1.5 billion of leveraged loans that they've struggled to sell over the past several months, according to people with knowledge of the matter.

October 24 -

No investor wants to touch the riskiest high-yield debt. The bank’s asset manager says it’s cheap enough that there are opportunities.

October 22 -

S&P's review of leveraged-loan deals across multiple sectors found only 17% of lenders have provisions that would disallow borrowers from transferring collateral assets to unrestricted subsidiaries outside lender reach.

October 21 -

The $5 billion financing package may also include around $1 billion of secured debt that would be sold to investors, as well as about $1.7 billion in letters of credit that would be split among participating banks

October 14 -

Kroll Bond Rating Agency has tracked rising levels of annualized net losses in marketplace-loan securitizations except for, ironically, the riskiest pools it tracks from unsecured subprime lenders: both losses and delinquencies for subprime lenders' outstanding securitizations have fallen from September 2018 levels.

October 11 -

The company has rolled out an online platform for firms considering marketplace loans as an asset class.

October 10 -

Barely noticed in a corner of the financial markets, leveraged loans originally worth about $40 billion are staging their own private meltdown.

October 9 -

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

In the pool of 46,070 vehicles in the $1 billion pool or 59,863 in the $1.3 billion pool, none are equipped with diesel engines that were at the center of Volkswagen’s worldwide emissions scandal in 2015.

September 26 -

Digital-first lenders more than doubled their market share in the last four years, according to a report by Experian.

September 25