-

The Minneapolis-based banking giant is enjoying its biggest year ever for 7(a) lending, with volume up 40%, as borrowers "are still coming to us," its SBA chief said.

September 6 -

Prophecies about a wave of bank failures caused by sickly CRE loans haven't yet come true. But there are still plenty of caution signs in a saga that will take years to play out.

September 6 -

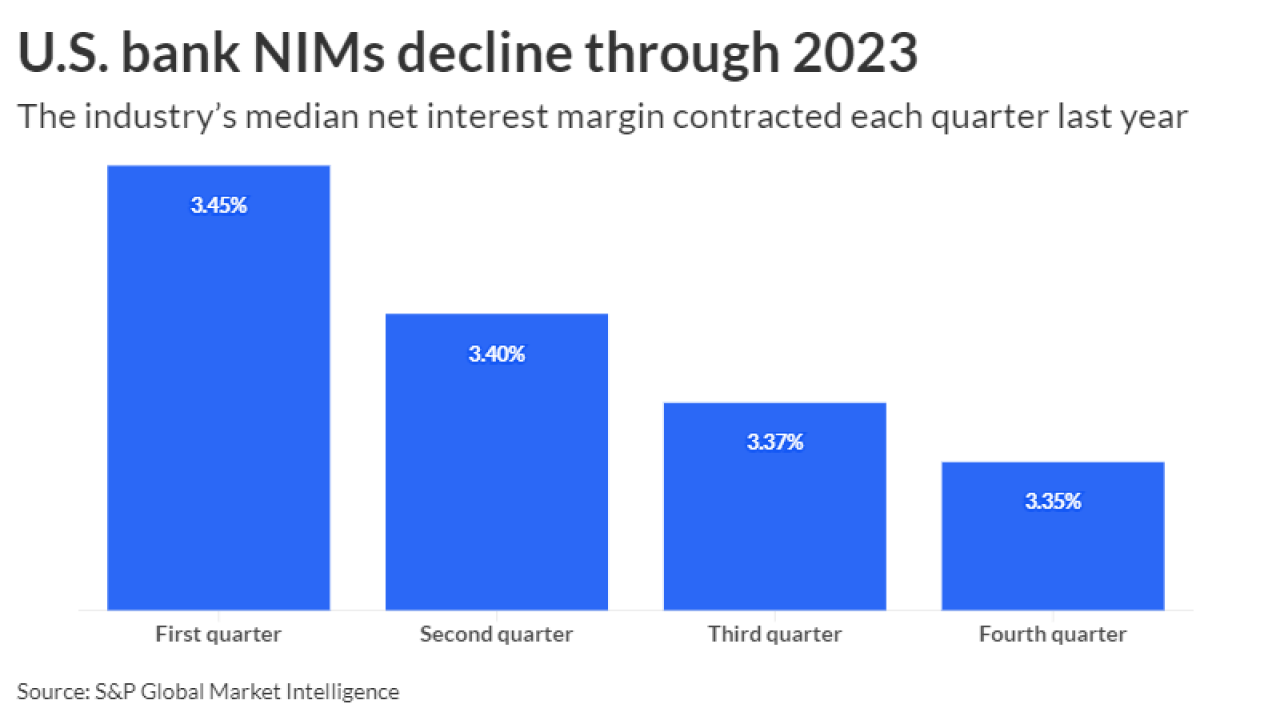

Lower interest rates could bolster loan demand, credit quality and securities portfolios. But they could also curb lending profitability faster than they ease deposit costs, crimping net interest margins and eating into near-term profits.

August 26 -

Increased demand from borrowers may hinge on Federal Reserve Chair Jerome Powell and his colleagues cutting interest rates this fall.

August 22 -

Asset manager-led transactions targeting asset-based finance (ABF) gained momentum following the regional banking crisis, which are typically the go-to for consumer and small business loans.

August 19 -

There is no subordination for the class A notes, but managers opted for much more overcollateralization, which stands at 18.0% as a percentage of the initial pool balance.

August 12 -

The agency admitted navigating the different rules and regulations involved in its four existing lines of credit proved time consuming and confusing and kept some lenders from offering them altogether.

August 2 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

The Consumer Financial Protection Bureau extended the deadline for lenders with the highest volume of small-business loans to July 18, 2025, and will not assess penalties for reporting errors for a year.

June 25 -

West Coast Community Bancorp agreed to acquire 1st Capital Bancorp in an all-stock deal slated to close in the fourth quarter.

May 21 -

Bank stocks are up this year as interest rates have leveled off and there are hopes that pressure on lenders' profits could moderate.

May 8 -

Net charge-offs at the Charlotte, North Carolina-based bank increased by more than 80% in the first quarter compared with a year earlier. BofA executives say that the rising losses were in line with the bank's risk appetite.

April 16 -

A solid majority of decision-makers at these companies expect to expand their workforces again this year, a Citizens Financial survey found. Loan losses are normally low in eras of economic expansion.

April 9 -

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Dean Wheeler will drive the firm's growth push in the U.S. and follows the London firm promoting Serenity Morley to COO, to drive growth globally.

April 2 -

The banking giant has launched an online platform that links small-business owners and entrepreneurs in need of capital to community development financial institutions. The platform was developed in partnership with Community Reinvestment Fund USA.

March 27 -

The top three industries includes software, healthcare and software development, accounting for 18.45%, 7.89% and 5.12%, respectively.

March 22 -

Two tranches of class A and B notes will raise $80 million from investors, to support Kalamata's business financing small business loans and merchant cash advances.

March 21 -

The Long Island-based lender has released a number of new details about its reconfiguration following a $1 billion capital injection led by two former Trump administration officials.

March 12