-

The sponsor has only identified $552 million of collateral for the $610 million deal; it has another four months to put the remaining $88 million to work in additional assets.

March 26 -

The money manager is preparing to refinance a $400 million deal originally printed in March 2016 that is currently grandfathered from risk retention rules - without bringing the deal into compliance.

March 21 -

The €413.5 million BlackRock European CLO V is the fourth euro-denominated CLO to launch this month, and asset manager's first since BlackRock Euro CLO IV priced in November.

March 20 -

Octagon is refinancing a 2013-vintage CLO for the second time, while Anchorage is using the assets of a deal issued in 2012 (and later refinanced in 2016) for its first new-issue deal of 2018.

March 20 -

The gap between long and short reinvestment periods for U.S. collateralized loan obligations that reset rates has widened in 2018 as managers contend with different market signals, says Fitch.

March 19 -

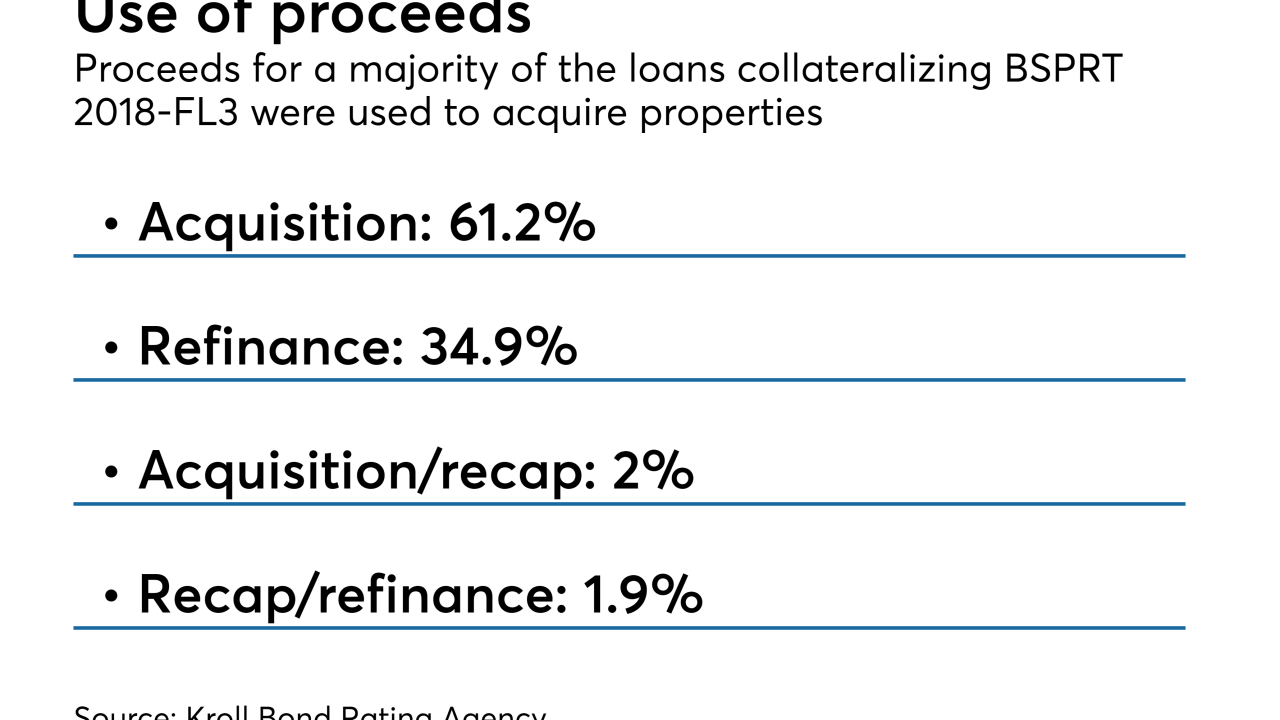

Nonbanks are originating more commercial mortgages on fixer-uppers in response to a sharp drop in the cost of funding in the securitization market. These deals are said to be "vastly different" than other CRE instruments that sustained big losses in the crisis — so far.

March 16 -

CBAM, the leading CLO issuer by volume in 2017, had a shorter non-call for its senior-note stack; Apex has split the AAA paper into three variable-priced tranches.

March 15 -

Two privately placed static CLOs and the newly priced Palmer Square CLO 2018-1 add up to more than $1.5 billion in new CLO assets under management for the Kansas City-metro area manager.

March 14 -

The €413 million transaction will issue exchangeable notes for the five senior tranches, allowing regulated U.S. banks the opportunity to invest, even though the portfolio includes bonds.

March 13 -

It's the busiest start to the year, post-financial crisis, for collateralized loan obligations, according to Thomson Reuters, and nearly 60% higher than the pace set in the first two months of 2017.

March 7