-

Since Nov. 21, investors have withdrawn a net $14.88B from the loan fund market amid concerns the Fed will limit rate hikes in 2019; the exodus makes loans even more of a buyer's market for CLOs.

January 2 -

Steven Kolyer, a 27-year veteran of law firm Clifford Chance, was recruited to build out the burgeoning practice advising lenders and arrangers in bridge-loan CRE financing.

January 2 -

This year saw elation over the rollback of risk retention for CLOs give way to concerns about leveraged lending, the 1st post-crisis downgrade of a subprime auto deal, the 1st AAA for commercial PACE, and much, much more.

December 31 -

They differ slightly from those released earlier by the Fed-convened ARRC, including language making it easier to ditch a SOFR-derived benchmark in favor of a new benchmark that has yet to be developed.

December 26 -

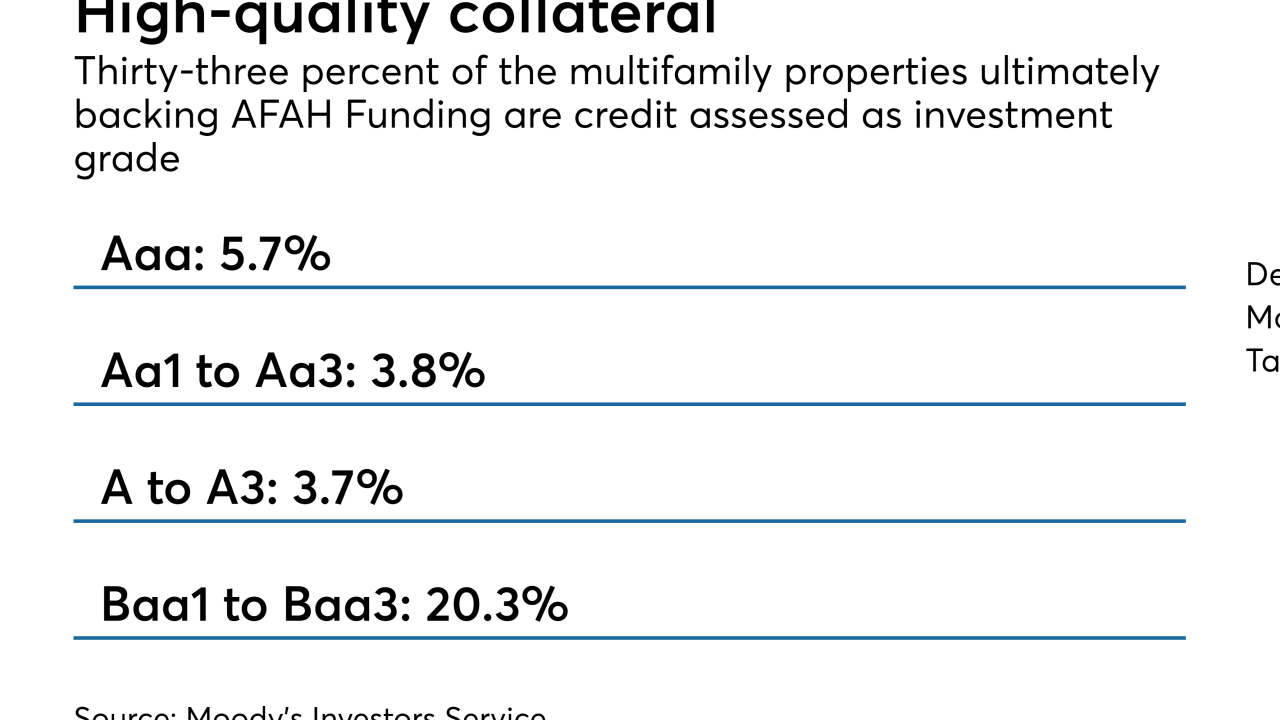

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

A Wells Fargo report this week shows that market spreads for the triple-A notes backed by collateralized loan obligation assets are at 128, a level not seen since May 2017.

December 21 -

The $500 million AIG CLO 2018-1, AIG's first deal since selling off its asset management business in 2010, is priced at 132 basis points over three-month Libor.

December 20 -

The €350 million Providus CLO II is backed exclusively by loans to mid-market firms that meet the private equity firm's sustainability criteria; at closing, 90% of the collateral has been identified.

December 20 -

The LA-based manager is pricing the replacement AAA notes of Oaktree EIF III Series 1 inside recent market averages through a limited, brief noncall extension.

December 17 -

Stuart Morrissy, a leveraged finance specialist, joins the law firm from the New York office of Milbank, Tweed, Hadley & McCloy.

December 16