-

The sponsor’s Fortune 500 parent provides comfort in the face of the subprime-auto industry’s woes.

November 16 -

Subprime borrowers whose credit scores have risen since they bought their cars are increasingly looking for a better deal. Credit unions and small banks are seizing the opportunity, often with the help of fintechs.

August 25 -

The price for the 20% stake in Santander Consumer USA Holdings that Santander does not already own is significantly higher than what the buyer first offered in July.

August 24 -

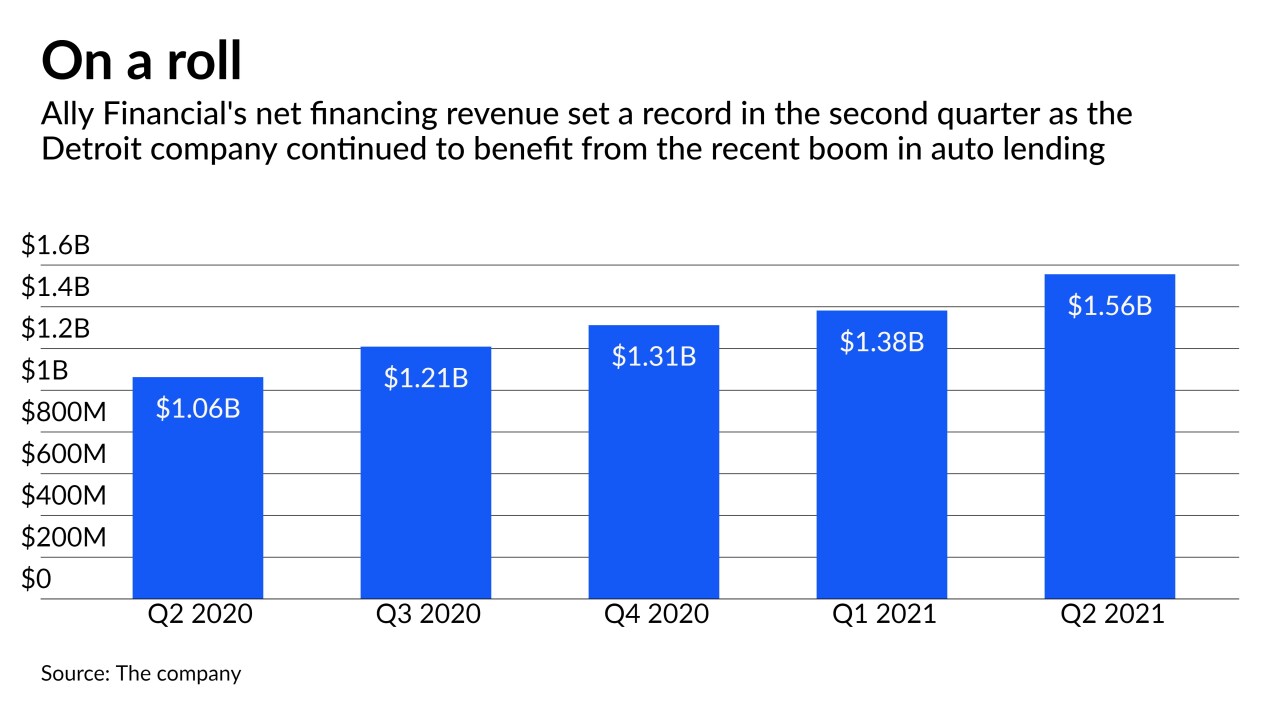

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

The Spanish bank’s U.S. holding company said it will pay a premium to purchase the publicly traded shares in Santander Consumer Holdings. The proposal is subject to the approval of the auto lender’s board of directors.

July 2 -

Surging used-car prices — brought on by a combination of strong consumer demand and limited new-vehicle supply — are boosting loan yields and profits at the Detroit company.

April 16 -

In the midst of the pandemic recession, banks have benefited from government stimulus payments to consumers, low interest rates and constraints on the supply of new vehicles. But intensifying competition and real concerns about borrowers’ ability to pay loans that went into forbearance could soon threaten profits and credit quality.

March 4 -

Rohit Chopra, President Biden’s nominee to lead the Consumer Financial Protection Bureau, has not minced words in calling out private companies for wrongdoing. He could get a grilling from Banking Committee Republicans and some opposition on the Senate floor.

February 26 -

The extension rates were the highest since the peak of lender deferrals granted in the wake of the COVID-19 outbreak.

February 24 -

The automaker is reportedly planning to apply for a bank charter so it could collect deposits and grow its own auto-finance business. That could create more competition for Ally, which was spun off from GM in 2006 but remains a key lending partner.

December 9 -

Payment rates for auto lenders and credit card issuers have remained strong despite a spike in unemployment. Whether these trends continue into 2021 will depend largely on the actions of Congress and the pace of medical advances.

November 2 -

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

October 28 -

Kathy Kraninger’s job status would be in question if Joe Biden wins the White House. If the president is reelected, she may continue balancing a deregulatory agenda with her unexpectedly tough stance on enforcement.

October 2 -

Market conditions allowed for a larger bond issuance, as well as interest rate pricing that was less than half that of the coupons the captive-finance lender offered investors from its prior May issuance of auto loan asset-backed securities.

September 22 -

For the second consecutive month, the average extension rate in June for troubled loans due to pandemic-related stresses on borrowers shrank in both prime and subprime loan sectors.

August 18 -

Credit card balances declined most sharply as consumers cut back their spending due to the coronavirus pandemic and associated shutdown orders, the New York Fed said Thursday. But delinquencies also fell across all debt categories, thanks to government and lender relief efforts.

August 6 -

The enhanced jobless benefits in the coronavirus relief law enacted in March helped limit delinquencies and maintain consumer spending, analysts say. In their follow-up stimulus plan, Senate Republicans want to cut those benefits from $600 to $200 a week.

July 28 -

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22 -

The coronavirus impact in the U.,S. alone has resulted in a 30% year-over-year decline across securitizations, CLOs and MBS.

July 22 -

Some 60% of Ally’s auto originations in the second quarter were used-vehicle loans, the highest percentage in the company's history.

July 17