-

While other European-based banks have retreated from the United States, Santander is doubling down by building out its nationwide digital-banking platform. "Unequivocally," said U.S. CEO Christiana Riley, "the opportunity … is so clear."

May 7 -

Southern Auto Finance uses a heavily automated origination process that puts applicants through several rounds of vetting, including income and employment verification.

May 1 -

Outstanding loans eligible for repossession in December 2022 saw a 22.5% increase from December 2019, but redemptions were higher than pre-pandemic levels.

January 23 -

About $2 billion changes hands daily for the sale of new motor vehicles in the U.S., making auto dealers a prime use case for faster payments. So why aren't more using it?

December 11 -

Pagaya's artificial-intelligence model utilizes more data points in assessing whether a consumer is creditworthy than the handful typically used by traditional auto lenders, so it can find more consumers who would have previously been denied a loan.

September 7 -

CPS provides auto loans to U.S. consumers who have situational credit problems, but display an ability to pay their obligations, according to the company.

July 14 -

Rising balances and annual percentage rates alongside lower FICO scores mark used vehicle loan pool.

July 14 -

Car loans are among the bread-and-butter products for credit unions, but slowing demand and growing delinquencies are putting some pressure on the category.

March 7 -

The subprime auto lender has a good track record, but there are concerns about used-car prices normalizing, according to KBRA.

April 20 -

The deal’s sponsor has issued a small rated portion to investors and sold the remainder back to loan-originator.

November 19 -

The sponsor’s Fortune 500 parent provides comfort in the face of the subprime-auto industry’s woes.

November 16 -

Subprime borrowers whose credit scores have risen since they bought their cars are increasingly looking for a better deal. Credit unions and small banks are seizing the opportunity, often with the help of fintechs.

August 25 -

The price for the 20% stake in Santander Consumer USA Holdings that Santander does not already own is significantly higher than what the buyer first offered in July.

August 24 -

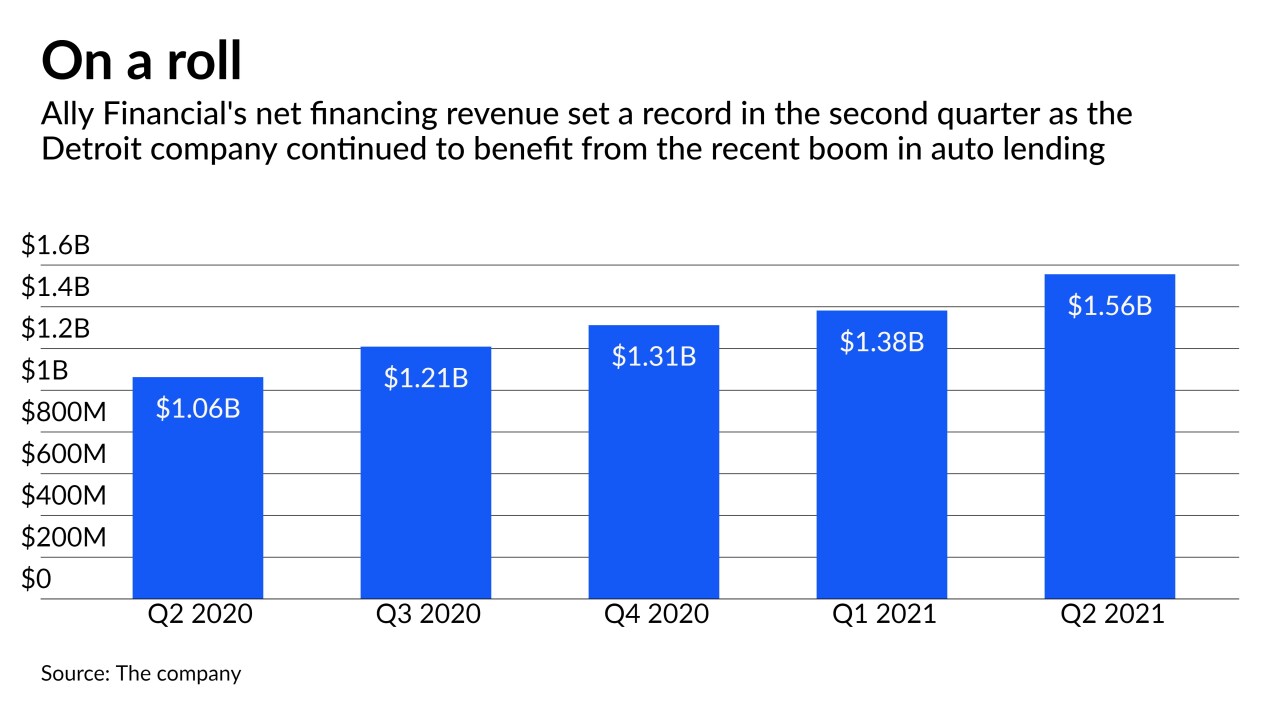

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

The Spanish bank’s U.S. holding company said it will pay a premium to purchase the publicly traded shares in Santander Consumer Holdings. The proposal is subject to the approval of the auto lender’s board of directors.

July 2 -

Surging used-car prices — brought on by a combination of strong consumer demand and limited new-vehicle supply — are boosting loan yields and profits at the Detroit company.

April 16 -

In the midst of the pandemic recession, banks have benefited from government stimulus payments to consumers, low interest rates and constraints on the supply of new vehicles. But intensifying competition and real concerns about borrowers’ ability to pay loans that went into forbearance could soon threaten profits and credit quality.

March 4 -

Rohit Chopra, President Biden’s nominee to lead the Consumer Financial Protection Bureau, has not minced words in calling out private companies for wrongdoing. He could get a grilling from Banking Committee Republicans and some opposition on the Senate floor.

February 26 -

The extension rates were the highest since the peak of lender deferrals granted in the wake of the COVID-19 outbreak.

February 24 -

The automaker is reportedly planning to apply for a bank charter so it could collect deposits and grow its own auto-finance business. That could create more competition for Ally, which was spun off from GM in 2006 but remains a key lending partner.

December 9