Polo Rocha is a Mexico-based freelance reporter who worked at American Banker from 2021 to early 2025, covering consumer finance and national banking trends. He previously covered the Federal Reserve at S&P Global Market Intelligence and state politics at WisPolitics.com. He graduated from the University of Wisconsin-Madison and has a master's in finance degree from Johns Hopkins University.

-

The bank’s decision to offer home improvement loans directly will not have a material impact on profits at the Atlanta-based fintech, according to GreenSky.

By Polo RochaAugust 12 -

The digital lender, which bought Radius Bancorp in February, still expects to record a full-year loss partly because of merger-related costs. But its stock price soared Thursday after it reported second-quarter net income of $9.37 million.

By Polo RochaJuly 29 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

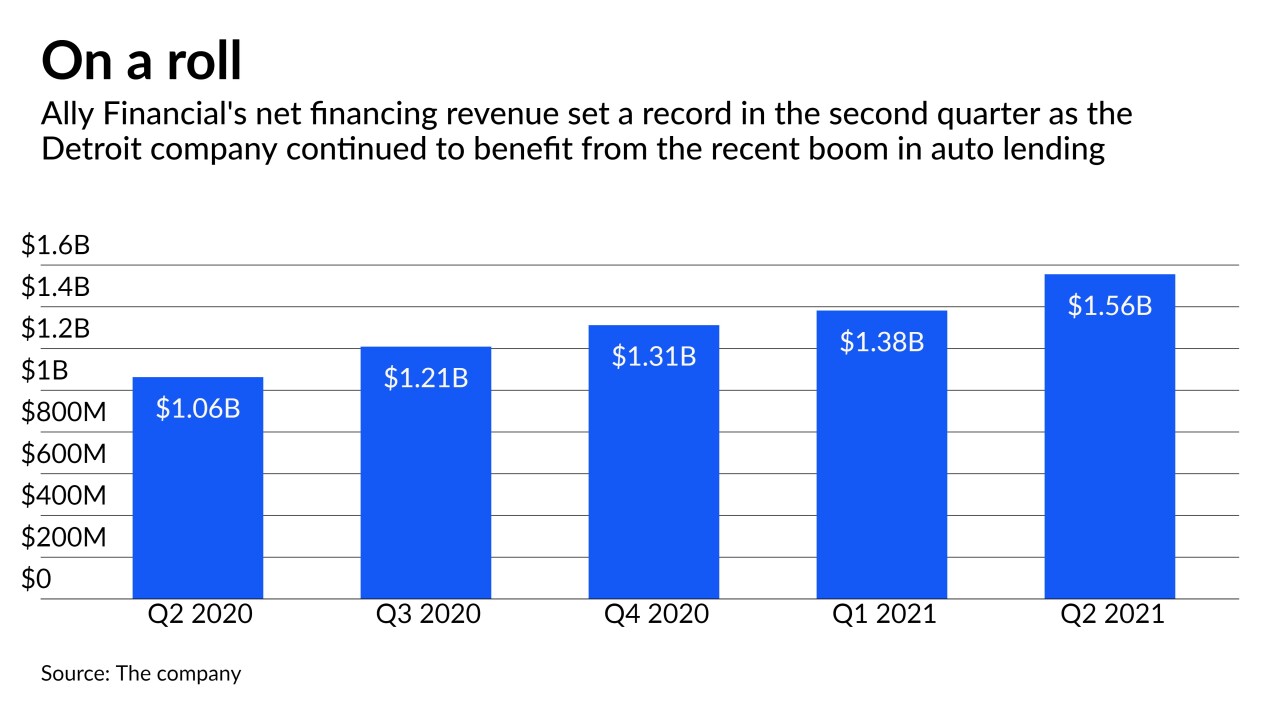

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

By Polo RochaJuly 20 -

The Spanish bank’s U.S. holding company said it will pay a premium to purchase the publicly traded shares in Santander Consumer Holdings. The proposal is subject to the approval of the auto lender’s board of directors.

By Polo RochaJuly 2 -

Cannabis, though still illegal at the federal level, continues to inch into the financial mainstream. Small credit unions and lenders as large as Valley National and East West have moved beyond just taking deposits from marijuana companies.

By Polo RochaJune 21 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

By Polo RochaMay 19