-

Lower interest rates could bolster loan demand, credit quality and securities portfolios. But they could also curb lending profitability faster than they ease deposit costs, crimping net interest margins and eating into near-term profits.

By Jim DobbsAugust 26 -

Increased demand from borrowers may hinge on Federal Reserve Chair Jerome Powell and his colleagues cutting interest rates this fall.

By Jim DobbsAugust 22 -

A Northwest credit union announced plans this week to buy a community bank, lifting the 2024 total of such deals to 13 and putting the year on track to set a record. The all-time annual high of 16 was set in 2022.

By Jim DobbsAugust 14 -

There were 27 bank acquisitions worth $5.45 billion announced in the second quarter as of mid-June. That was more than the $5.2 billion combined value of deals announced over the previous five quarters.

By Jim DobbsJune 24 -

Atlanta Postal Credit Union's bid to acquire Affinity Bank marked the 11th deal overall this year involving a credit union buying a bank, matching the total for all of 2023. Separately, members voted against the merger of two credit unions in Indiana.

By Jim DobbsMay 31 -

West Coast Community Bancorp agreed to acquire 1st Capital Bancorp in an all-stock deal slated to close in the fourth quarter.

By Jim DobbsMay 21 -

Bank stocks are up this year as interest rates have leveled off and there are hopes that pressure on lenders' profits could moderate.

By Jim DobbsMay 8 -

In talks with OCC officials, "it became obvious that we would not gain near-term approval given their recent experience with multifamily and CRE positions," FirstSun CEO Neal Arnold says. The companies announced other revisions to their deal, too.

By John ReostiMay 3 -

Consolidation has slowed since the pandemic, but UMB's agreement to buy Heartland Financial — the largest deal in three years — is one of several merger announcements in the past two weeks. Talks among other potential buyers and sellers are said to be picking up.

By Jim DobbsApril 30 -

Should the all-stock transaction close as planned later this year, Wintrust Financial in the Chicago area would gain about $2.7 billion of assets.

By Jim DobbsApril 15 -

A solid majority of decision-makers at these companies expect to expand their workforces again this year, a Citizens Financial survey found. Loan losses are normally low in eras of economic expansion.

By Jim DobbsApril 9 -

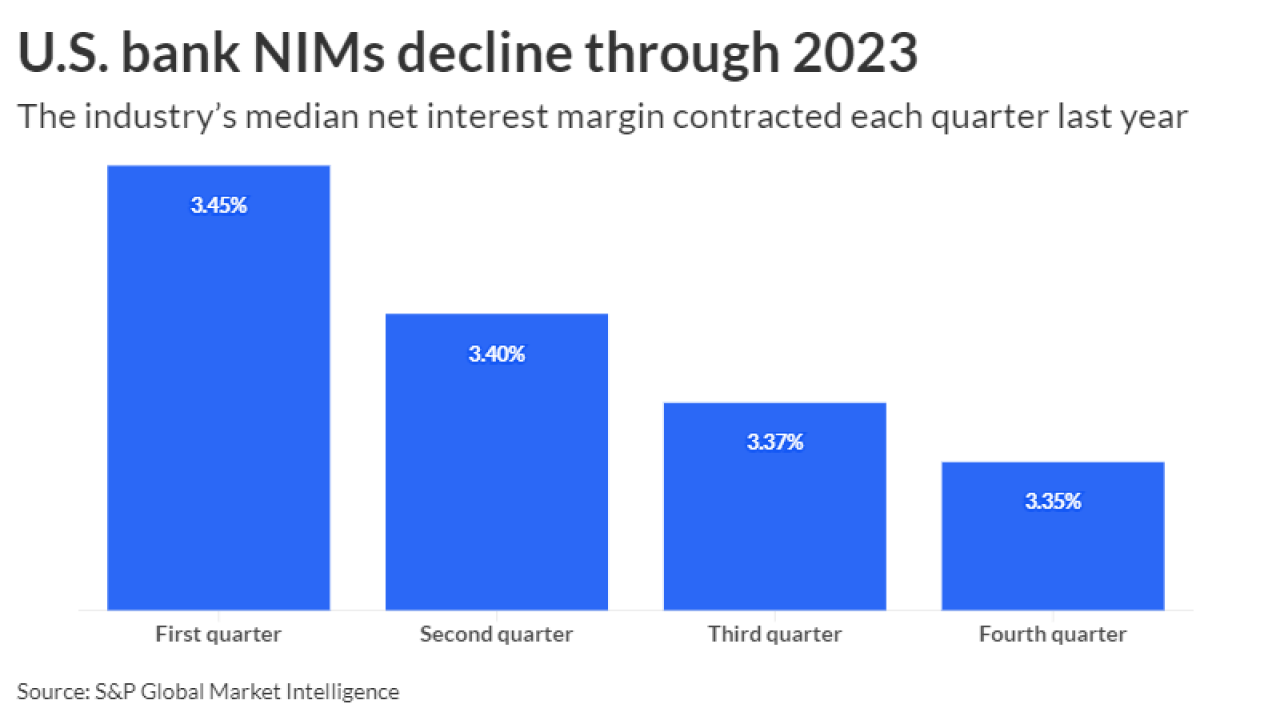

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

By Jim DobbsApril 2 -

First National has agreed to buy Touchstone Bankshares. The combined company would have more than $500 million each of deposits and loans.

By Jim DobbsMarch 26 -

Bank mergers and acquisitions have slowed in recent years amid recession fears and other economic uncertainties. But bank consolidation is a century-old trend that's expected to rev up again as early as this year due to higher costs, tougher regulation and fierce competition.

By Jim DobbsMarch 15 -

The USDA forecasted farm profits will plunge 26% this year, potentially creating credit quality challenges for lenders.

By Jim DobbsFebruary 23 -

The deal involving Southern California Bancorp and California BanCorp, expected to close in the third quarter, would form a $4.6 billion-asset lender with a footprint spanning San Diego, Greater Los Angeles and the San Francisco Bay Area.

By Jim DobbsJanuary 30 -

As part of a settlement with the Justice Department, Patriot Bank must invest more than $1 million of the total in a loan subsidy fund for minority homeowners and take other corrective steps in its everyday business. The bank denied any wrongdoing.

By Jim DobbsJanuary 17 -

Funding pressures moderated in recent months, but loan charge-offs climbed. With festering concerns about a vulnerable economy, the potential for elevated credits costs could loom large over the upcoming bank earnings season.

By Jim DobbsDecember 21 -

The lawsuit accuses Navy Federal of violating the Fair Housing Act and the Equal Credit Opportunity Act after a CNN report that the lender approved a lower percentage of Black and Latino mortgage applicants.

By Jim DobbsDecember 18 -

The Pittsburgh-based regional bank expects to save $325 million next year as it reduces its staff by 4%. Executives said the cuts are necessary because revenue has fallen amid a surge in interest rates and a decline in loan volumes.

By Jim DobbsOctober 13