-

For the fifth time since early 2016, American Honda Finance is hedging on oversubscribed demand for its prime-loan receivables-backed notes with a potential upsizing.

By Glen FestFebruary 15 -

Onex reset a deal, agreeing to a higher coupon on the AAA-rated senior notes, in order to gain a five-year reinvestment period extension; it substantially narrowed spreads on subordinate notes.

By Glen FestFebruary 15 -

It will use proceeds from the issuance of $640 million of bonds backed by wireless tower leases to help repay two deals totaling $755 million that were issued in 2013.

By Glen FestFebruary 13 -

Eliminating the requirement that CLO managers keep skin in the game of deals should boost issuance, but this could result in weaker credit quality of collateral as competition for loans increases.

By Glen FestFebruary 13 -

The transaction is backed by nearly three times as many Audi, Volkswagen and Skoda as VW's previous UK auto-loan ABS; it also features a longer revolving period.

By Glen FestFebruary 12 -

Nearly 52% of the pool in the captive-finance company's first 2018 vehicle-lease securitization involves contracts for popular crossover models like the Chevrolet Equinox, the GMC Acadia and Cadillac XT5.

By Glen FestFebruary 12 -

A three-judge panel for the D.C. Circuit Court of Appeals has sided with the LSTA in its lawsuit seeking to reverse rules requiring CLO managers to hold "skin in the game" under Dodd-Frank.

By Glen FestFebruary 9 -

The three offerings push the first-quarter volume of subprime auto loan asset-backeds past $5 billion, an indication of unwavering demand for the risky asset class.

By Glen FestFebruary 9 -

Players as small as Oxford Lane and as large as the Carlyle Group have money to put to work funding risk retention and investing opportunistically; trends could attract more first-time managers.

By Glen FestFebruary 8 -

The deal is backed by an unusually concentrated portfolio of just 19 loans on properties being rehabbed or converted to a new use; by property type, the biggest exposure is to hospitality, at 19.7%.

By Glen FestFebruary 8 -

Voya Alternative Asset Management is replacing and consolidating seven fixed- and floating-rate tranches with five new variable-rate classes that each gained lower rates than predecessor notes.

By Glen FestFebruary 7 -

The Los Angeles-based distressed-debt specialist has $20.5 billion in dry powder, including over $8.8 billion in uncommitted capital stored in a dormant opportunities fund.

By Glen FestFebruary 7 -

Westmont Hospitality Group has secured a $360 million first mortgage and $40 million mezzanine loan from Barclays and Morgan Stanley that is secured by a portfolio of 89 Red Roof locations in 25 states.

By Glen FestFebruary 6 -

Investors will have to weigh a deterioration in credit of many accounts in Ally's managed portfolio; since it completed its prior floorplan securitization in June 2016.

By Glen FestFebruary 5 -

It's deep and liquid, and spreads are tight. To many, a deal with a few idiosyncratic risks — not to mention cool factor — just offers a chance to pick up a little extra yield.

February 2 -

S&P Global Rating's London office made the rare move to downgrade the junior-most notes in a 2016 CLO issued by a Danish credit manager due to a deterioration in portfolio maintenance levels.

By Glen FestFebruary 2 -

The Houston-based carrier will use proceeds from its first equipment trust certificate deal to finance the delivery of 16 new Boeing jets, replenishing its aging fleet.

By Glen FestFebruary 2 -

Over 94% of the collateral pool consists of diesel-engine vehicles, even though diesel cars have had waning interest among French drivers in the past decade.

By Glen FestFebruary 1 -

The pooling of loans and leases for Volvo- and Mack-brand trucking and construction equipment is modeled largely on the credit and portfolio characteristics of seven prior securitizations by Volvo's VFS subsidiary.

By Glen FestFebruary 1 -

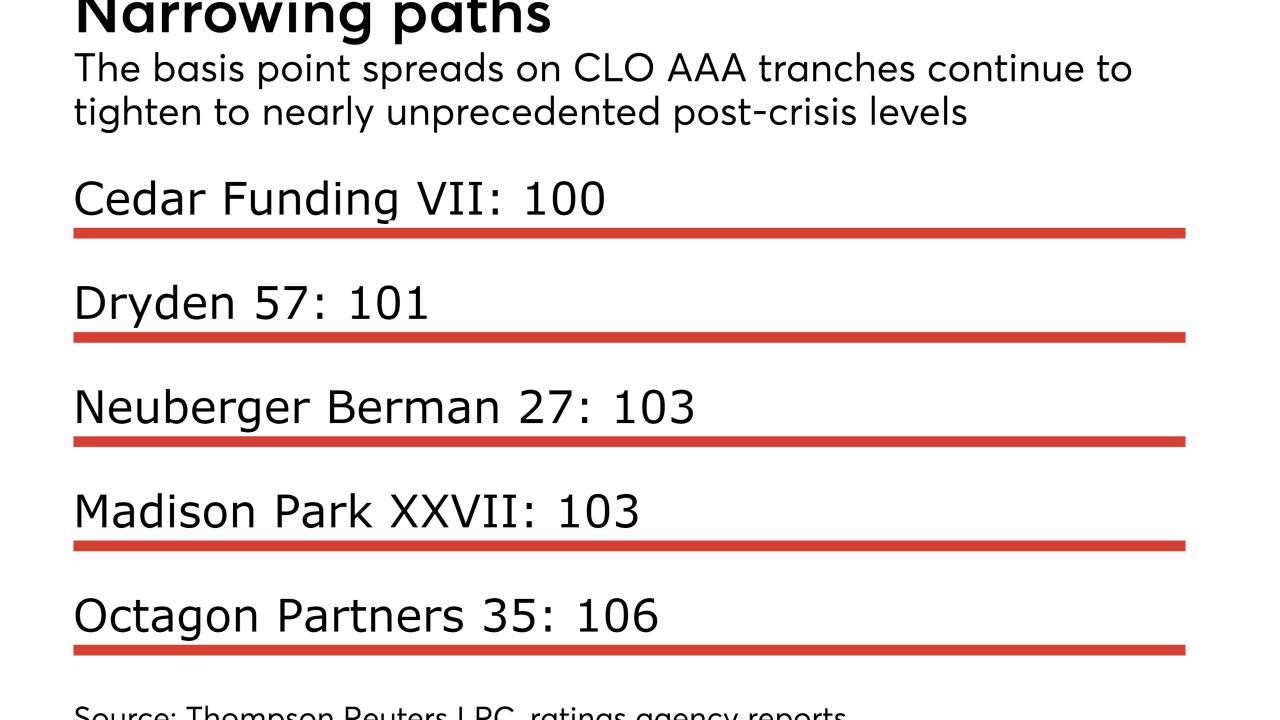

Aegon Asset Management's new Cedar Funding CLO VII is expected to price its senior triple-A notes at 100 basis points above Libor, carrying on a 2017 trend of tightening spreads.

By Glen FestJanuary 31