-

The tech-driven asset management firm announced it had closed a $115 million asset-backed securities deal led by Cantor Fitzgerald, with unsecured consumer loans acquired from Prosper Marketplace.

By Glen FestAugust 22 -

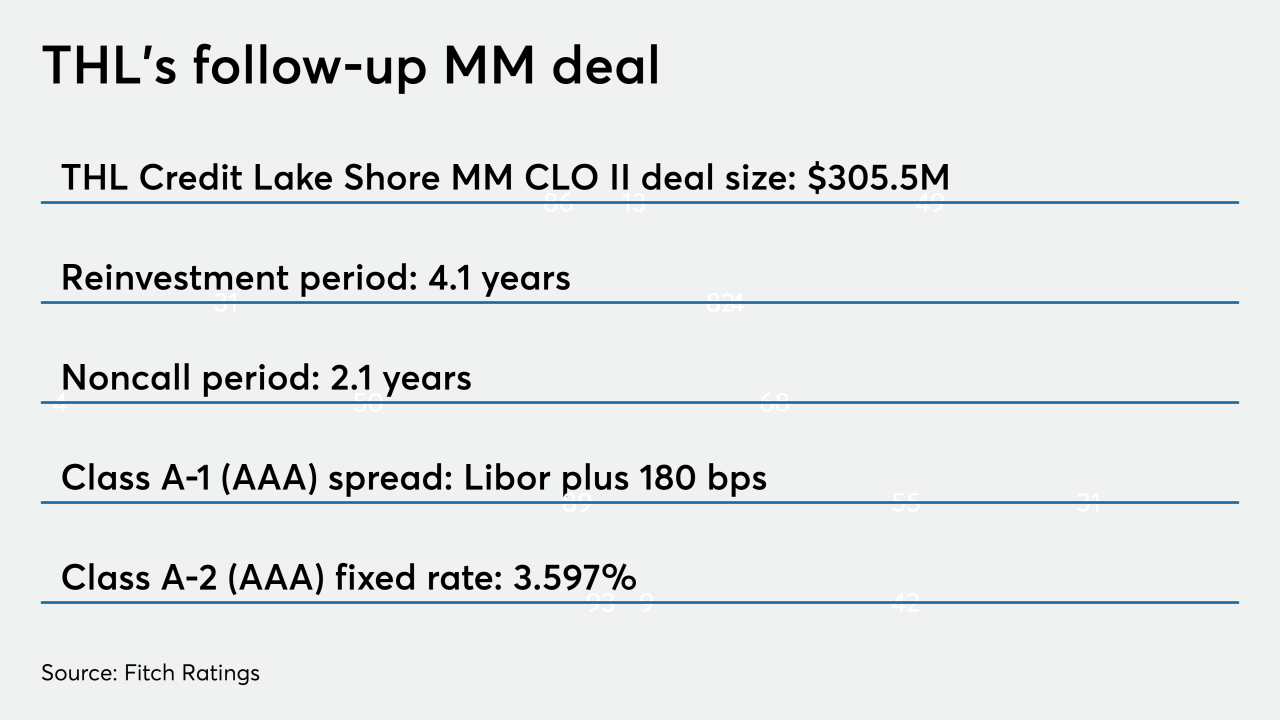

The manager will have four years to actively buy and trade loan assets in THL Credit Lake Shore MM CLO II, compared to two in THL's debut deal from March.

By Glen FestAugust 21 -

The new $258.4 million NP SPE IX transaction is scheduled to pay off in just seven years, compared to 10 years on NP's last deal in 2017.

By Glen FestAugust 21 -

The LendingPoint 2019-1 trust will market $169.4 million in notes backed by 18,760 loans with a collective balance of $178.3 million.

By Glen FestAugust 20 -

The collaborative workspace officer provider, which filed for its IPO last week, will be securitizing a $240 million loan used in the purchase of the San Francisco building where it leases space to member clients.

By Glen FestAugust 19 -

Citigroup's global markets realty arm is sponsoring a $362 million securitization of recently originated high-balance, nonagency mortgages, a change of pace from its recent focus on RPL deals.

By Glen FestAugust 16 -

Captive finance lenders in recent years have been steadily reliant on used cars for asset-backed collateral. That’s not the case with American Honda Finance Corp.

By Glen FestAugust 15 -

Despite management reversal initiatives, the restaurant chain's declining sales and rising leverage prompted Kroll to downgrade notes from its 2017 franchise-fee securitization. The notes were previously downgraded this year by S&P.

By Glen FestAugust 15 -

The $217.7 million BX 2019-MMP Mortgage Trust is a securitization of an interest-only loan issued to Blackstone Real Estate Partners backed by the cash flow from the apartments, in New York’s Upper East Side, Murray Hill and Chelsea neighborhoods.

By Glen FestAugust 14 -

The $435.5 million Crown Point CLO 8 is a broadly syndicated collateralized loan obligation that has a “significantly below average” WARF of 2678, indicating a portfolio with a greater share of safer leveraged loans than other CLOs.

By Glen FestAugust 13 -

All of the loans were originated by Greystone, an investment group based in New York that originated multifamily and health care facility loans for Fannie Mae, Freddie Mac, the FHA and various commercial mortgage-backed securities.

By Glen FestAugust 13 -

The decline in the share of "cured" delinquent loans is a potential signal for increased securitization losses in the months to come.

By Glen FestAugust 13 -

The increases are mostly at the junior debt levels of deals, according to the Refinitiv research unit.

By Glen FestAugust 12 -

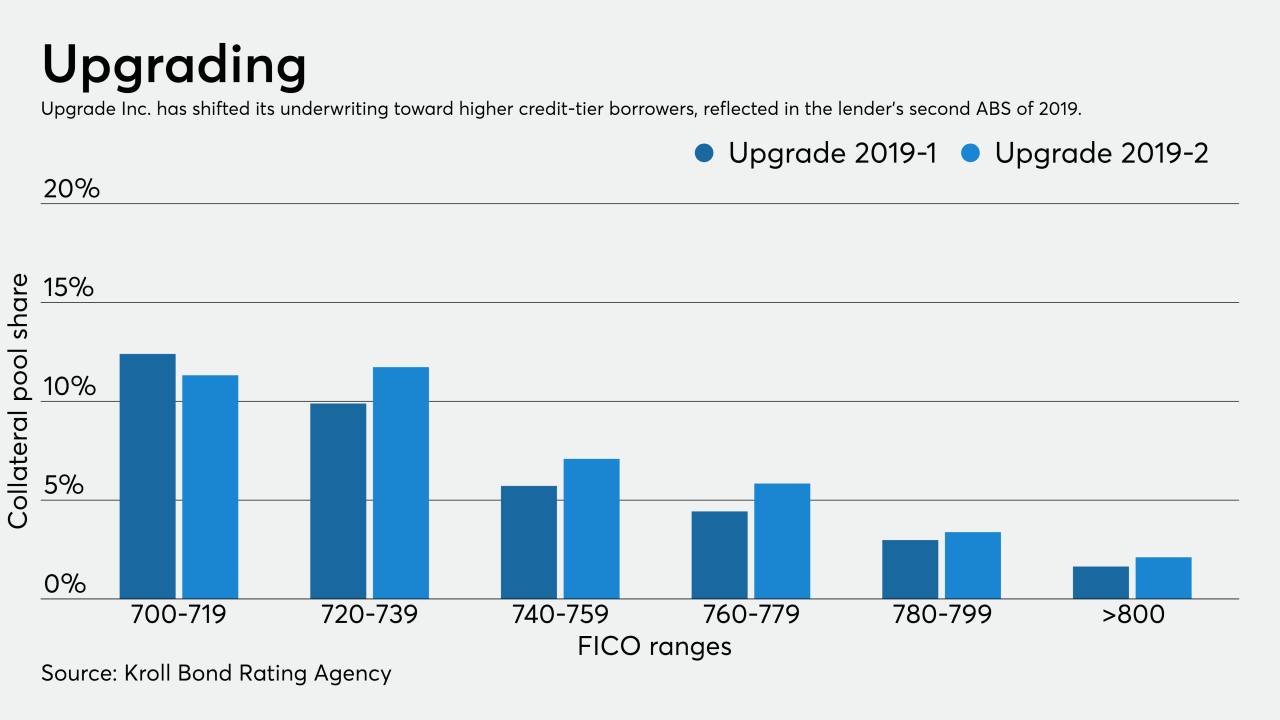

Online consumer lender Upgrade Inc. is including more higher-credit tier borrowers in its next securitization, reflecting the company’s focus this year on reducing lending to non-prime credit segments.

By Glen FestAugust 12 -

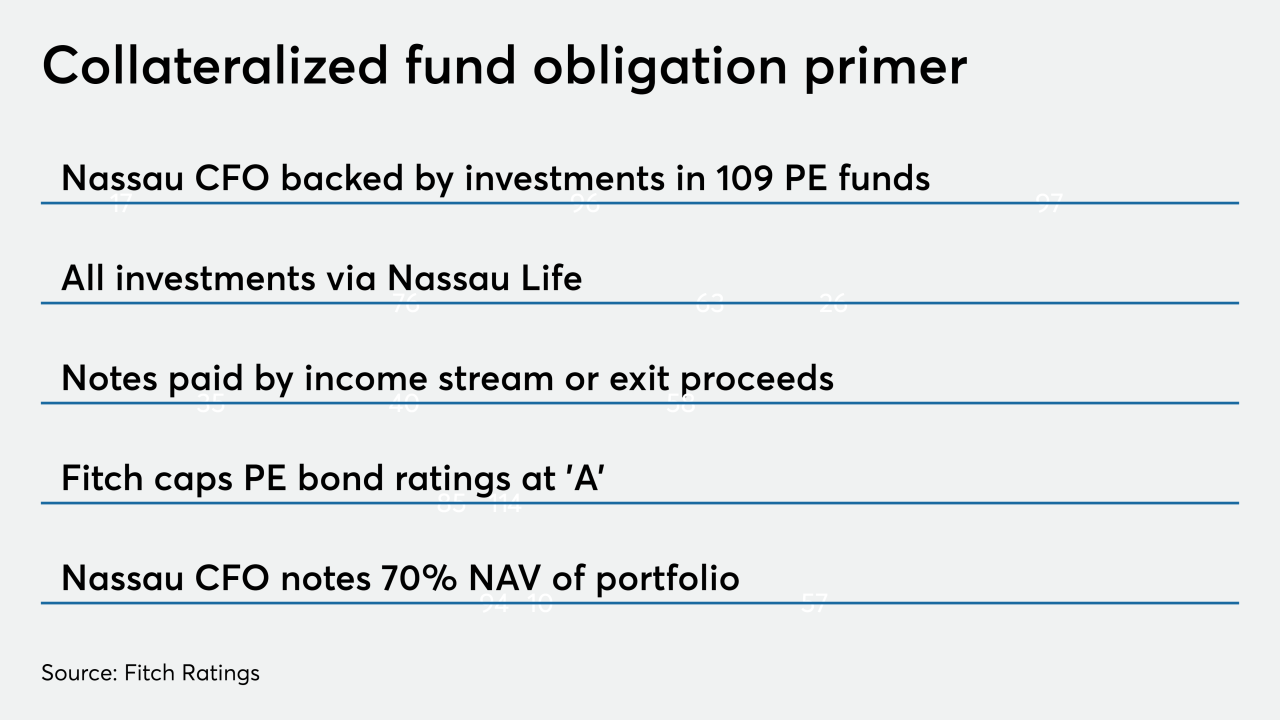

Nassau Financial Group is following the lead of a Singapore sovereign wealth fund into the fledgling asset-backed securities class of private-equity bonds.

By Glen FestAugust 12 -

Lighter seasoning compared to American Credit Acceptance's last loan portfolio issuance is the primary reason, say ratings agencies.

By Glen FestAugust 8 -

Regional Toyota captive finance lender World Omni has its highest-ever average FICO for a securitization of prime auto-lease receivables. But it also is pooling a portfolio of contracts that have a highly concentrated mix of lease maturities.

By Glen FestAugust 8 -

The online SME lender is marketing $198.45 million in notes backed by U.S. originations. Funding Circle has previously issued ABS deals backed by small-business loans in its native UK.

By Glen FestAugust 7 -

The deal coincides with that of another first-time whole-biz issuer this week, Primrose School Franchising Co. Primrose is marketing the franchise fees and revenues of its chain of early childhood education and day care centers.

By Glen FestAugust 6 -

Primrose School Franchising Co. is marketing $275 million in bonds backed by a whole-business securitization of royalties and revenues from the firm’s rapidly expanding 405-school franchised network of early childhood/pre-K education and day care centers.

By Glen FestAugust 5