-

The tech-driven asset management firm announced it had closed a $115 million asset-backed securities deal led by Cantor Fitzgerald, with unsecured consumer loans acquired from Prosper Marketplace.

By Glen FestAugust 22 -

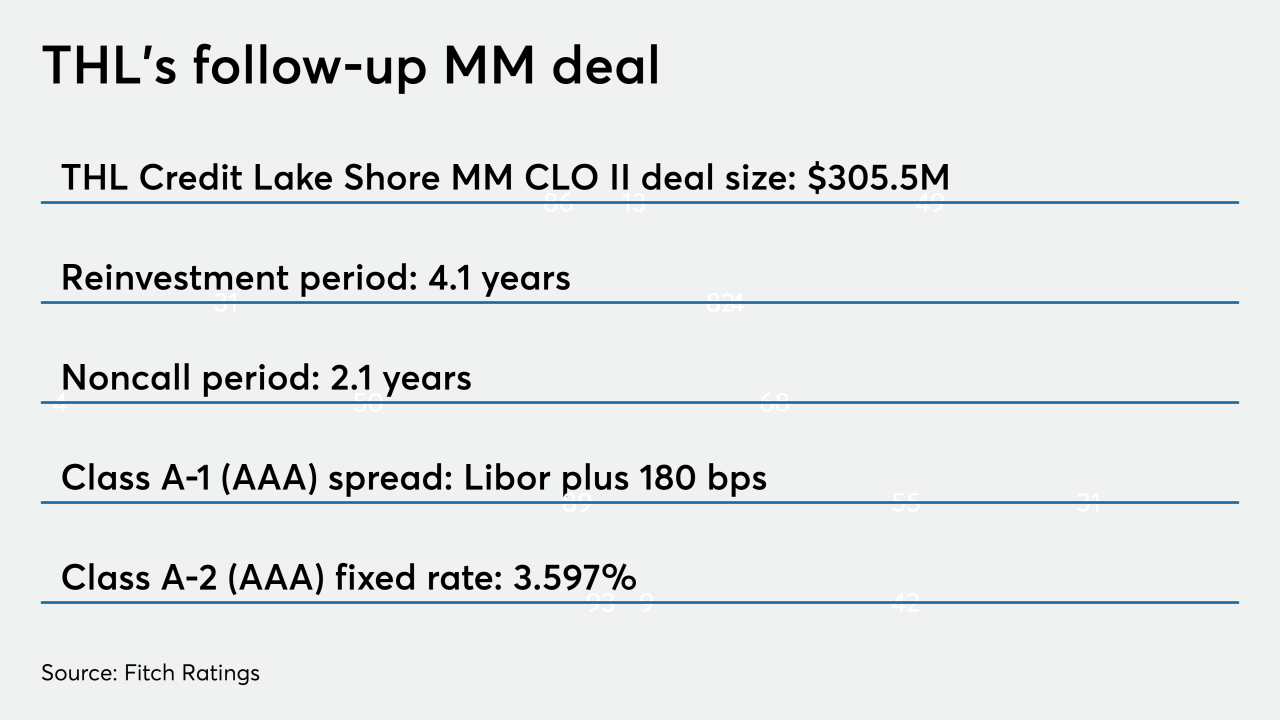

The manager will have four years to actively buy and trade loan assets in THL Credit Lake Shore MM CLO II, compared to two in THL's debut deal from March.

By Glen FestAugust 21 -

The new $258.4 million NP SPE IX transaction is scheduled to pay off in just seven years, compared to 10 years on NP's last deal in 2017.

By Glen FestAugust 21 -

The LendingPoint 2019-1 trust will market $169.4 million in notes backed by 18,760 loans with a collective balance of $178.3 million.

By Glen FestAugust 20 -

The collaborative workspace officer provider, which filed for its IPO last week, will be securitizing a $240 million loan used in the purchase of the San Francisco building where it leases space to member clients.

By Glen FestAugust 19 -

Citigroup's global markets realty arm is sponsoring a $362 million securitization of recently originated high-balance, nonagency mortgages, a change of pace from its recent focus on RPL deals.

By Glen FestAugust 16 -

Captive finance lenders in recent years have been steadily reliant on used cars for asset-backed collateral. That’s not the case with American Honda Finance Corp.

By Glen FestAugust 15 -

Despite management reversal initiatives, the restaurant chain's declining sales and rising leverage prompted Kroll to downgrade notes from its 2017 franchise-fee securitization. The notes were previously downgraded this year by S&P.

By Glen FestAugust 15 -

The $217.7 million BX 2019-MMP Mortgage Trust is a securitization of an interest-only loan issued to Blackstone Real Estate Partners backed by the cash flow from the apartments, in New York’s Upper East Side, Murray Hill and Chelsea neighborhoods.

By Glen FestAugust 14 -

The $435.5 million Crown Point CLO 8 is a broadly syndicated collateralized loan obligation that has a “significantly below average” WARF of 2678, indicating a portfolio with a greater share of safer leveraged loans than other CLOs.

By Glen FestAugust 13