-

The specialty finance company is contributing all of the collateral for the $259.7 million deal; by comparison, the previous deal included collateral contributed by Goldman Sachs.

January 22 -

The company has filed a request with a federal judge in Pennsylvania for a summary judgment in two counts against it, accusing the bureau of failing to provide evidence.

January 18 -

The sponsor is borrowing against 100% of the $225 million of Property Assessed Clean Energy assets used as collateral for the bonds.

January 17 -

It may not signal a recession, but structured finance pros are still preparing for a more risk-off environment.

January 16 -

That's in contrast with the sponsor's prior deal, completed in December, which tested the waters for mortgage bonds backed exclusively by second liens.

January 11 -

At Ginnie Mae, Michael Bright worked closely with Congress to fight churn in VA mortgages; he plans to bring the same collaborative approach to the Structured Finance Industry Group.

January 10 -

Michael Bright is resigning as acting president of Ginnie Mae to run the Structured Finance Industry Group, a trade association that's been without a CEO since Richard Johns resigned in July amid a reported split with the group's board.

January 10 -

S&P sees some potential integration risk that could materially affect the business being reinsured; in November it lowered its issuer credit ratings and financial strength ratings on Aetna.

January 9 -

The $748 million Navient Student Loan Trust 2019-1 looks a lot like the four FFELP deals the sponsor completed in 2018; it is backed by a mix of rehab (19.6%) and non-rehab (80.4%) loans.

January 9 -

David Klass is known for his insights into tax developments in the U.K. related to Brexit; he joins the firm after more than a decade at Gide Loyrette Nouel.

January 8 -

The asset manager obtained a leasehold on floors 28-50 of 620 Eighth Avenue through its purchase of Forest City; the property is now encumbered by $750 million of loans from four banks.

January 8 -

The deal, dubbed Hercules Capital Funding Trust 2019-1, comes just two months after the business development company completed a $200 million transaction.

January 8 -

Most of the properties were previously securitized in various conduit transactions in 2014 and 2015; they are now being bundled into a single transaction that returns $107.7 million of equity to the sponsor.

January 7 -

Loans from the top two originators, loan Depot and TIAA FSB (FKA Everbank), were purchased in bulk based on the respective originator’s guidelines, according to Kroll Bond Rating Agency.

January 4 -

This year saw elation over the rollback of risk retention for CLOs give way to concerns about leveraged lending, the 1st post-crisis downgrade of a subprime auto deal, the 1st AAA for commercial PACE, and much, much more.

December 31 -

The state has expanded the scope of ongoing legal actions against Avant and Marlette to include several securitization trusts and trustees.

December 27 -

The initial offering is just $80 million, but transaction documents allow RFS to issue up to $500 million, as long as certain conditions are met, which could dilute the control and voting rights of the existing noteholders.

December 24 -

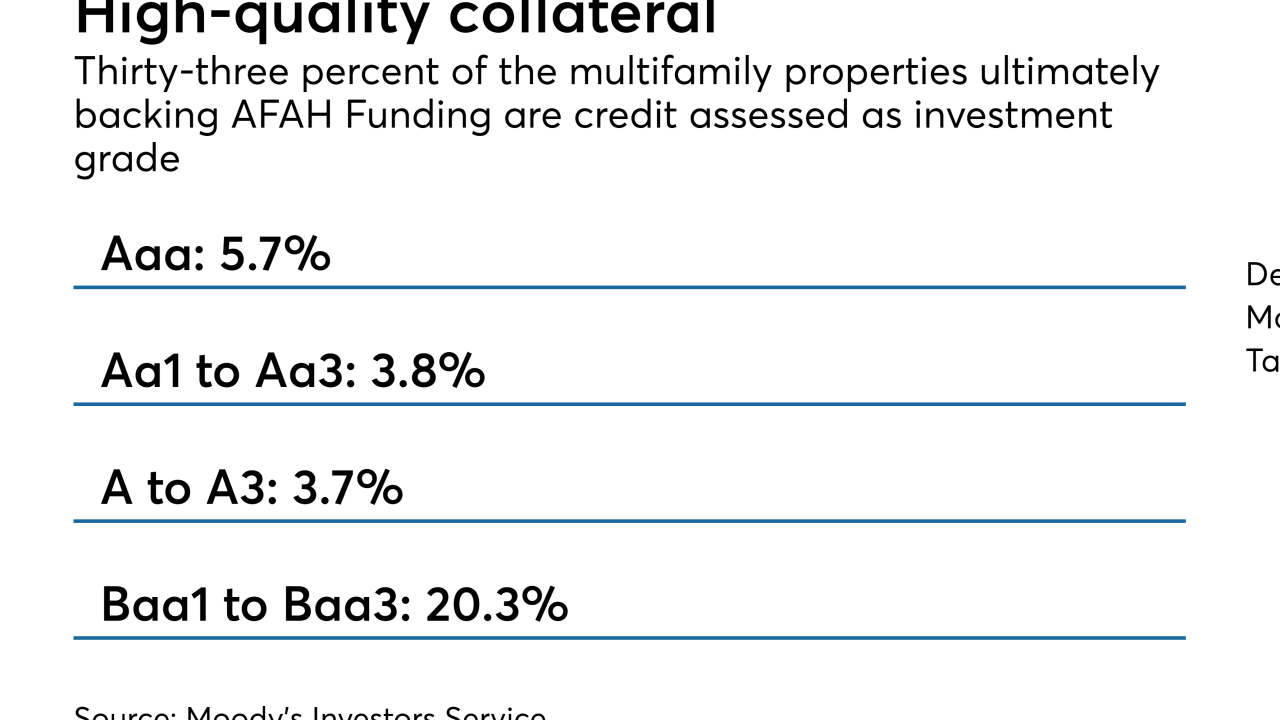

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

The wireless carrier has issued a total of $6.7 billion to year-to-date via four transactions; that's up from $2.65 via two deals in 2017 and a single, $1 billion deal in 2016.

December 19 -

The Property Assessed Clean Energy sector is getting a boost from the expansion of improvements eligible to be financed via tax assessments, including fire resiliency and total building renovations, according to DBRS.

December 19