-

The asset manager obtained a leasehold on floors 28-50 of 620 Eighth Avenue through its purchase of Forest City; the property is now encumbered by $750 million of loans from four banks.

January 8 -

The deal, dubbed Hercules Capital Funding Trust 2019-1, comes just two months after the business development company completed a $200 million transaction.

January 8 -

Most of the properties were previously securitized in various conduit transactions in 2014 and 2015; they are now being bundled into a single transaction that returns $107.7 million of equity to the sponsor.

January 7 -

Loans from the top two originators, loan Depot and TIAA FSB (FKA Everbank), were purchased in bulk based on the respective originator’s guidelines, according to Kroll Bond Rating Agency.

January 4 -

This year saw elation over the rollback of risk retention for CLOs give way to concerns about leveraged lending, the 1st post-crisis downgrade of a subprime auto deal, the 1st AAA for commercial PACE, and much, much more.

December 31 -

The state has expanded the scope of ongoing legal actions against Avant and Marlette to include several securitization trusts and trustees.

December 27 -

The initial offering is just $80 million, but transaction documents allow RFS to issue up to $500 million, as long as certain conditions are met, which could dilute the control and voting rights of the existing noteholders.

December 24 -

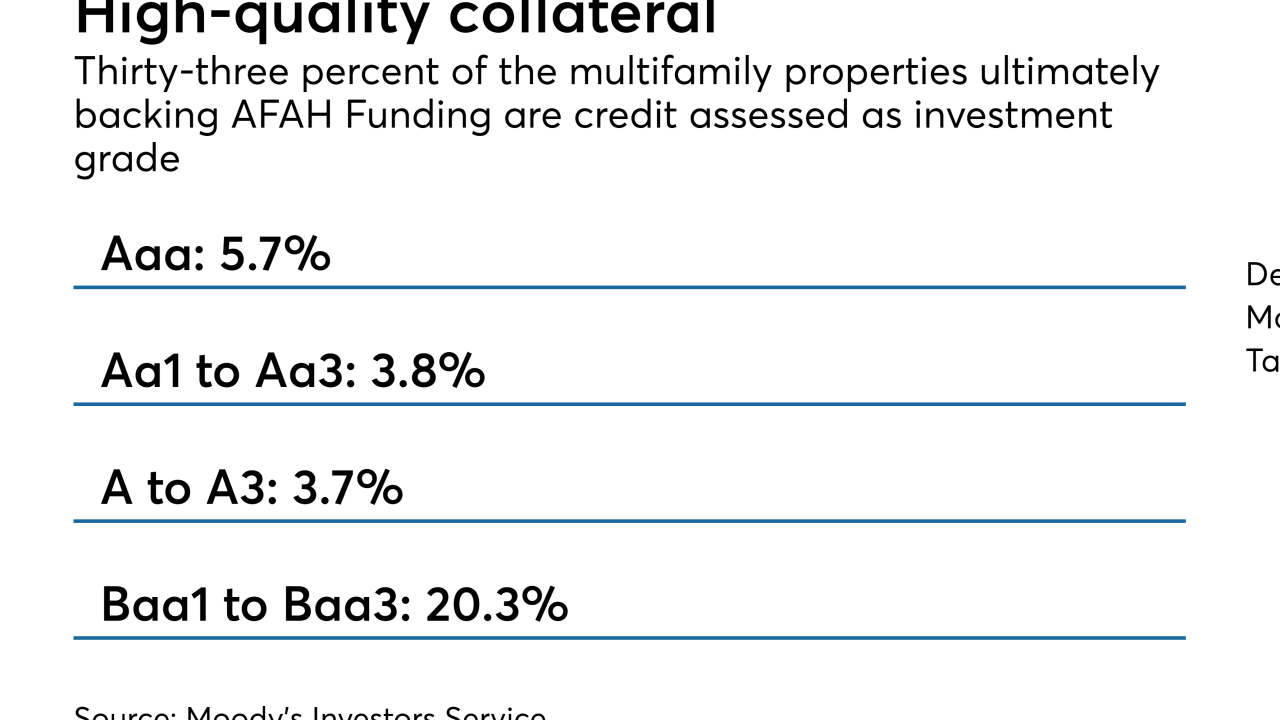

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

The wireless carrier has issued a total of $6.7 billion to year-to-date via four transactions; that's up from $2.65 via two deals in 2017 and a single, $1 billion deal in 2016.

December 19 -

The Property Assessed Clean Energy sector is getting a boost from the expansion of improvements eligible to be financed via tax assessments, including fire resiliency and total building renovations, according to DBRS.

December 19 -

Dividing the transaction into two tranches allowed the GSE to tailor the transaction to the risk appetite of participants, lowering the cost of reinsurance.

December 17 -

The $255 million Verus 2018-INV2 has more exposure to cashout refinancings than the prior deal, completed in April; on the plus side, borrowers in the latest deal have more equity in their homes.

December 13 -

The buyers obtained a $597 million mortgage and $53 million of mezzanine financing from Deutsche Bank and Wells Fargo to purchase the JW Marriott Grande Lakes and Ritz-Carlton Grande Lakes.

December 13 -

The electric car maker was able to offer less credit enhancement on the senior tranche of notes to be issued because residual value accounts for less of the collateral than its prior deal.

December 11 -

Carlyle Aviation Capital's AASET 2016-1 and ACG-affiliated Merlin 2016-1 each have a single aircraft on lease to Small Planet, according to Deutsche Bank Securities.

December 11 -

Both the $646M UBS 2018-C15 and the $796M MSC 2018-H4 deals have relatively low leverage, helped by the inclusion of loans with investment grade characteristics.

December 11 -

BSREP International, an entity controlled by Brookfield, obtained a £367.5 million mortgage and £91.9 million of mezzanine debt on CityPoint from Morgan Stanley.

December 7 -

This time, the $98.4 million of underlying collateral was originated by before the financial crisis by Citibank via its former student lending affiliate, the Student Loan Corp.

December 7 -

This marketplace lender's third securitization of the year again features fewer 60-month loans, slightly higher FICOs and lower coupons.

December 6 -

A joint venture between the REIT and two Chinese investors obtained a $364 million five-year, fixed-rate loan on the portfolio from Column Financial.

December 6