-

Industrial Logistics Properties Trust obtained a $650 million, 10-year fixed-rate mortgage on the portfolio from four banks; a $390 portion is being securitized in a single-borrower deal.

February 21 -

The $291 million Arroyo Mortgage Trust 2019-1 is significantly smaller then the sponsor's inaugural deal, which weighed in at $1.25 billion and was completed in April 2018.

February 20 -

SmartStop Asset Management is tapping the securitization market to help finance the $350 merger of two real estate investment trusts that it manages, cashing out $56 million of equity in the process.

February 20 -

The state's tougher oversight has stripped Property Assessed Clean Energy of its go-to project financing status among contractors. That shift may result in adverse selection.

February 15 -

The rating agency has developed rating criteria for bonds backed by oil and gas royalties, though such deals would be capped at the 'A' rating category.

February 14 -

The real estate investment trust obtained $230 million of loans from four banks: Citi, Barclays, BofA and Deutsche. A $200 million first mortgage is being securitized.

February 13 -

The $756 million GSMS 2019-GC38 is backed by with 36 loans secured by 53 properties; nine of the loans (29.2% of the total balance) are secured in whole or in part by 12 single-tenant properties.

February 11 -

Howard Goldwasser and Skanthan Vivekananda will be based in New York and Los Angeles, respectively.

February 11 -

Golub Capital BDC has also obtained shareholder approval to boost leverage, but David Golub said this was designed to give the middle-market lender more flexibility.

February 8 -

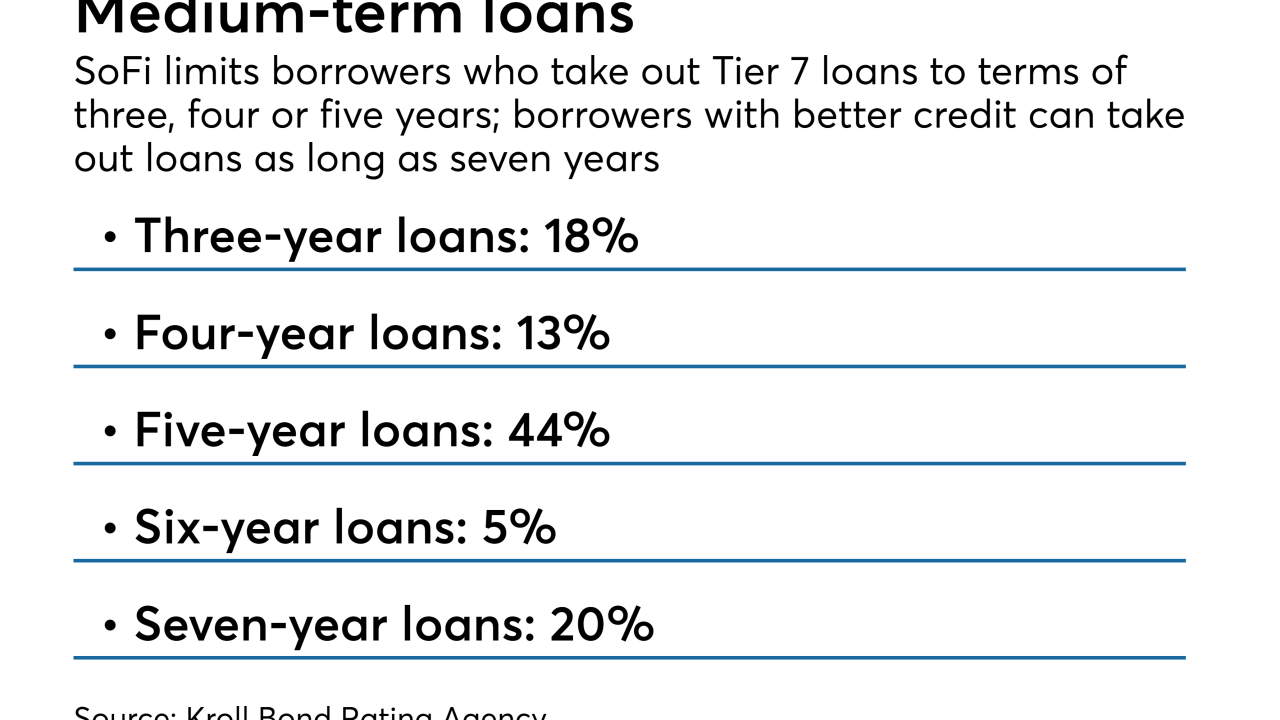

Tier 7 loans, which have lower limits on free cash flow and allow negative personal income, account for 7.26% of the collateral for the online lender's next transaction, according to Kroll.

February 8 -

For the first time in almost two years, borrowers are taking out floating-rate loans to refinance their student debt. So Navient is testing investor appetite for floating-rate bonds backed by refinance loans.

February 6 -

Jonathan Levine, who represents asset managers and private funds in their investments in distressed situations, joins the firm from Morrison & Foerster.

February 5 -

At least 25 business development companies have obtained board approval to increase leverage in line with a new regulatory limit, but most are subject to a one-year cooling-off period, according to DBRS.

January 31 -

The loan used as collateral is part of $410 million of financing the sponsor obtained from Societe Generale to refinance the redevelopment of a 10-story mixed-use building on Eleventh Avenue in Manhattan.

January 30 -

Office buildings account for roughly 40% of the collateral, and much of it is in suburbia, where defaults and losses can be higher, according to S&P Global Ratings.

January 29 -

The remainder of the collateral was contributed by Goldman Sachs, which is also holding onto 5% of the risk in the deal to comply with risk retention rules.

January 28 -

A $1.1 billion mortgage from four banks on eight buildings in Cambridge, Mass., is being bundled into collateral for CAMB Commercial Mortgage Trust 2019-LIFE.

January 24 -

The only change to the deal is a slightly smaller prefunding amount; one loan that had been expected to be acquired after settlement has already been closed.

January 24 -

Now that the noncompete has expired, Navient plans to market private student loans to borrowers in school; the servicing giant is also free from restrictions on marketing refinance loans through Earnest.

January 23 -

Since the financial crisis, only one other sponsor, Invictus Capital Partners, has issued publicly rated mortgage bonds backed entirely by investor loans.

January 23