-

Nearly half of the properties are in New York (30.3%), New Jersey (10.4%) or Florida (8.7%), states that require a court to sign off on a foreclosure, a lengthy process that could affect the timing of payments.

September 26 -

There are four loans with investment grade characteristics that help boost the overall credit metrics of the collateral pool.

September 26 -

On Friday, the U.S. International Trade Commission voted 4-0 that imported panels are crippling American manufacturers, giving President Trump until January to decide whether to impose tariffs.

September 24 -

The sponsor obtained a $1 billion mortgage from JPMorgan, Goldman and Citi; proceeds will be used to repay $715 million of debt taken out in 2015 to acquire the original portfolio from Apollo Global Management.

September 22 -

HELOCs make up approximately 11.51% of the collateral; 22.5% of the HELOC borrowers are currently eligible to make draws up to their credit limit.

September 21 -

Some 109 securitized commercial mortgages totaling about $5.5 billion carry the retailer; the largest is a $400 million single-asset deal backed by a portfolio of 123 stores.

September 20 -

Changes under consideration in federal student lending policy could create huge opportunities for private student lenders.

September 19 -

Vandy Fartaj, the firm’s chief capital markets officer, says a novel deal structure allows the real estate investment trust to issue additional term notes its portfolio of mortgage servicing rights grows.

September 19 -

Investor demand for mortgage bonds is strong; the only limiting factors are consumer awareness of the product and loan officers' willingness to offer them.

September 19 -

The bankers and lawyers who put these deals together have been working hard to broaden their appeal beyond insurance companies, the traditional buyers.

September 18 -

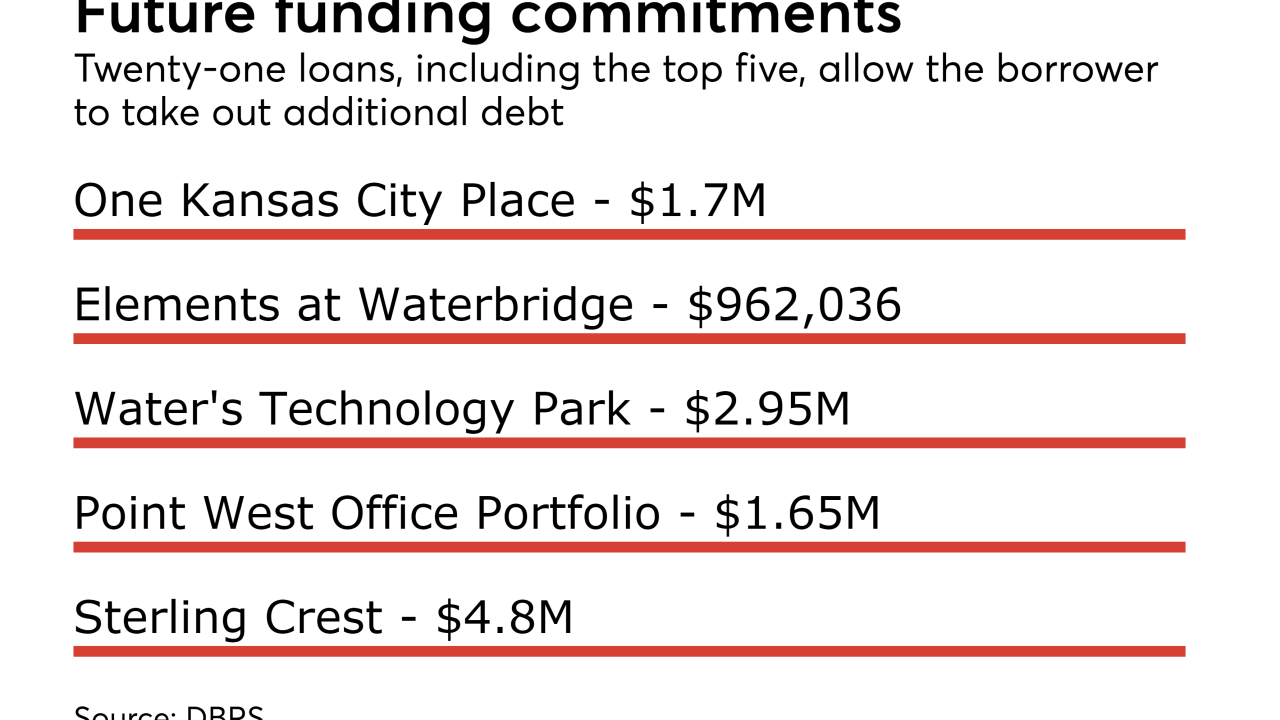

The largest loan, One Kansas City Place, representing 10.3% of the collateral pool, is primarily occupied by an investment-grade tenant, Kansas City Power and Light Co.

September 15 -

There are seven other CMBS issued this year with exposure to the skyscraper at 767 Fifth Avenue. In June, the owners took out a $1.47 billion whole loan that was used to refinance existing debt and pay a dividend; the largest portion was securitized in a single-asset transaction.

September 14 -

Like the sponsor's previous two offerings, completed in March and October, a large percentage of the collateral was sourced through a bulk acquisition from Bank of America. The total number of originators is 17.

September 14 -

The 19-story Class A office building boasts a LEED Gold certification and a concentrated tenant roster, led by Saatchi & Saatchi and Penguin Random House.

September 12 -

For the first time, the marketplace lender is using its own balance sheet: It's contributing 27.66% of the collateral. The rest comes from three third-party investors.

September 12 -

Morningstar thinks that $38.94 billion of CMBS loans that it rates in Florida could be impacted; it sees another $19.38 billion of exposure in Georgia, $5.16 billion in Alabama, and $5.03 billion in South Carolina.

September 11 -

Stonemont Financial Group, an Atlanta-based real-estate-management firm, is tapping the commercial mortgage bond market to help finance its acquisition of a portfolio of 100 office buildings, industrial and retail properties.

September 10 -

The $426.2 million COLT 2017-2 is backed entirely by loans originated by Caliber, an affiliate of private equity firm Lone Star Funds. There are no loans originated by Sterling Bank & Trust, which accounted for 22% of the collateral for the prior deal.

September 8 -

Redwood Trust, long known for targeting only the most pristine borrowers, is preparing its first securitization of residential mortgages with slightly wider credit parameters.

September 6 -

The family-owned real estate group affiliate has committed a significant amount of capital to growing the finance and investment side of the organization, which includes balance sheet lending.

August 27