Centerbridge Partners is tapping the commercial mortgage bond market to refinance a portfolio of Great Wolf Resorts waterparks.

In August, the private equity firm obtained a $1 billion mortgage from three banks, JPMorgan Chase (60%), Goldman Sachs (20%) and Citigroup (20%); this floating-rate loan has an initial term of two years and can be extended by one year up to three times, for a total term of five years.

Proceeds were used to repay debt taken out just two years ago, including a $715 million first mortgage that was securitized in single-borrower CMBS called Great Wolf Resorts 2015-WOLF, and to return $155.3 million of equity to the sponsors, according to Kroll Bond Rating Agency. However, Kroll noted in its presale report that Centerbridge contributed approximately $294.1 million in equity for the initial acquisition of the Great Wolf and has invested $24.8 million in the properties since the closing of the last securitization.

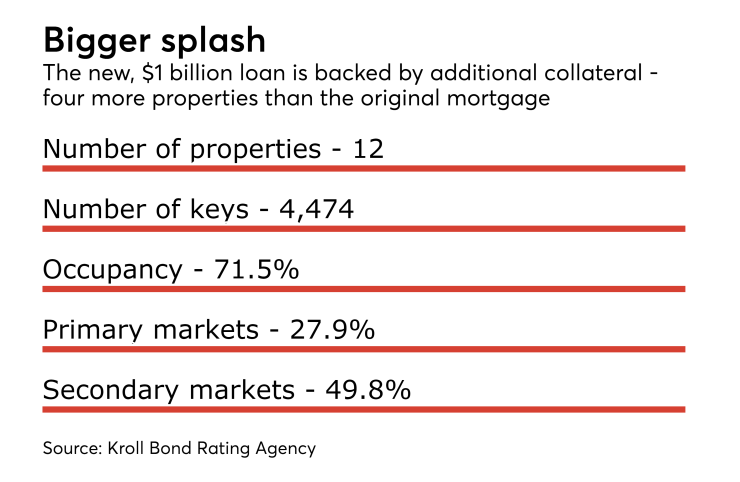

There are also additional assets collateralizing the new loan: an additional four properties. (The 2015 transaction was backed by just eight resorts.) The collateral also includes the minority equity interests in two joint ventures that each own a resort property and a pledge of the license agreement for a third-party-owned and -managed property.

Among the key rating considerations for Kroll is the deal’s leverage; it puts the loan-to-value ratio of the debt used as collateral at 84.9%, which it considers to be “relatively high for a single borrower transaction backed by lodging properties. (Kroll’s valuation of the property is 43% lower than that of the appraiser.) After taking into account $500 million of mezzanine debt held outside the securitization trust, the all-in KLTV is even higher, at 127.3%.

On the plus side, Great Wolf Resorts has experienced steady annual growth in revenue per available room since 2010, and it has strong brand recognition.

The 12 properties are also geographically diverse, as they are located in 11 states and 12 different metropolitan statistical areas. Moreover, 78% of the properties are in markets that Kroll considers to be primary or secondary, which have diverse economies and favorable demographics that can better withstand fluctuations and downturns in the national economy compared to tertiary markets.

Kroll expects to assign an AAA to the senior tranche of notes to be issued in the new transaction, Great Wolf Trust 2017-WOLF.

In order to satisfy risk retention the requirements, the underwriters of the mortgage bonds are expected to sell an “eligible horizontal residual interest” of at least 5.0% of the fair value of all nonresidual interests issued on the closing date to a third party.