-

From financing driverless cars to dealing with Libor's demise, here are the highlights from the Structured Finance Industry Group's annual conference.

-

This time, the real estate investment trust is putting down some fresh equity, rather than cashing money out, in the $550 million transaction.

February 28 -

Credit risk transfer does more than just reduce exposure to a downturn in the housing market. It also provides them with information about how others view mortgage credit risk.

February 27 -

Since most U.S. securities transactions are subject to New York law, it could be expedient to pass legislation defining Libor as SOFR plus a spread, says David Bowman, special adviser to the Fed.

February 26 -

Demeter Power Group co-founder Michael Wallander has joined Petros as senior vice president of solar financing for Petros Energy Solutions, a newly formed affiliate.

February 26 -

Without the ability to issue unsecured debt nearly as cheaply as U.S. Treasury bonds, Freddie Mac could not afford to repurchase defaulted loans from MBS, Freddie CEO Don Layton said.

February 26 -

Libor’s demise poses significant problems for outstanding floating-rate securities that are pegged to the benchmark; SFIG wants to make it easier to amend deals.

February 26 -

Expect even more actively managed CRE CLOs to be issued this year as investors get more comfortable with the idea of managers using proceeds from the repayment of collateral to acquire new bridge loan.

February 25 -

CleanFund CEO Greg Saunders sees financing of multimillion-dollar Property Assessed Clean Energy projects coming at the expense of smaller projects of around $500,000.

February 25 -

J.G. Wentworth first securitization of 2019 is backed by a similar mix of structured settlement and annuities receivables as its second deal of 2018, but the credit quality of the insurers making these payments is higher.

February 22 -

Industrial Logistics Properties Trust obtained a $650 million, 10-year fixed-rate mortgage on the portfolio from four banks; a $390 portion is being securitized in a single-borrower deal.

February 21 -

The $291 million Arroyo Mortgage Trust 2019-1 is significantly smaller then the sponsor's inaugural deal, which weighed in at $1.25 billion and was completed in April 2018.

February 20 -

SmartStop Asset Management is tapping the securitization market to help finance the $350 merger of two real estate investment trusts that it manages, cashing out $56 million of equity in the process.

February 20 -

The state's tougher oversight has stripped Property Assessed Clean Energy of its go-to project financing status among contractors. That shift may result in adverse selection.

February 15 -

The rating agency has developed rating criteria for bonds backed by oil and gas royalties, though such deals would be capped at the 'A' rating category.

February 14 -

The real estate investment trust obtained $230 million of loans from four banks: Citi, Barclays, BofA and Deutsche. A $200 million first mortgage is being securitized.

February 13 -

The $756 million GSMS 2019-GC38 is backed by with 36 loans secured by 53 properties; nine of the loans (29.2% of the total balance) are secured in whole or in part by 12 single-tenant properties.

February 11 -

Howard Goldwasser and Skanthan Vivekananda will be based in New York and Los Angeles, respectively.

February 11 -

Golub Capital BDC has also obtained shareholder approval to boost leverage, but David Golub said this was designed to give the middle-market lender more flexibility.

February 8 -

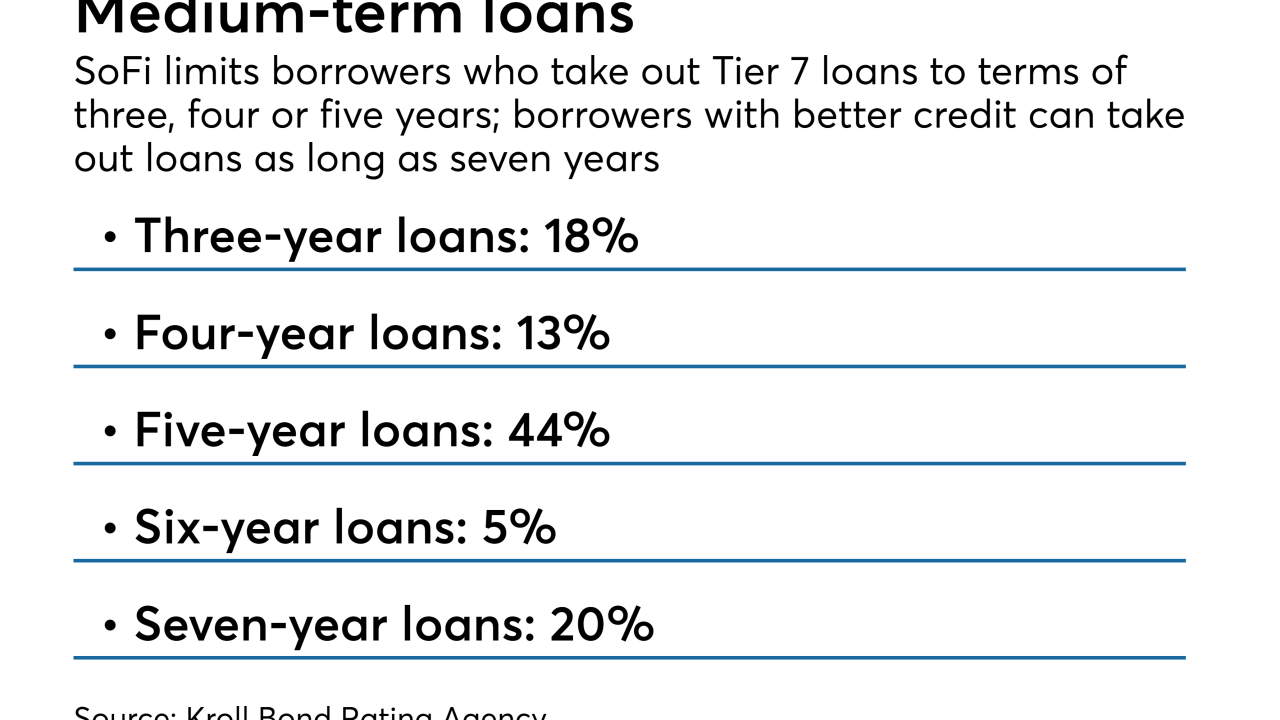

Tier 7 loans, which have lower limits on free cash flow and allow negative personal income, account for 7.26% of the collateral for the online lender's next transaction, according to Kroll.

February 8