-

Hertz Vehicle Financing II LP, Series 2018-1, is a master trust, and the notes share collateral on a pari passu, or equal basis, with Hertz’ other outstanding series of notes.

January 15 -

A fund controlled by the PE group obtained a $192 million loan from Wells Fargo; proceeds, along with $127 million in subordinate financing, funded the $300 million purchase.

January 12 -

The findings by consulting firm Oliver Wyman dispel a misconception that the increase in the use of its credit scores is being driven principally by its free availability to consumers, VantageScore says.

January 10 -

It’s the second such transaction; in 2016; New Residential completed a $126 million transaction that included some of the same collateral that it acquired from Ocwen. The original deal has since been repaid

January 9 -

Marketplace lenders bringing securitization in-house seized the top spot in 2017; readers also focused on Blackstone's big entry into an esoteric corner of the CRE market and the PACE industry's embrace of consumer protections.

January 9 -

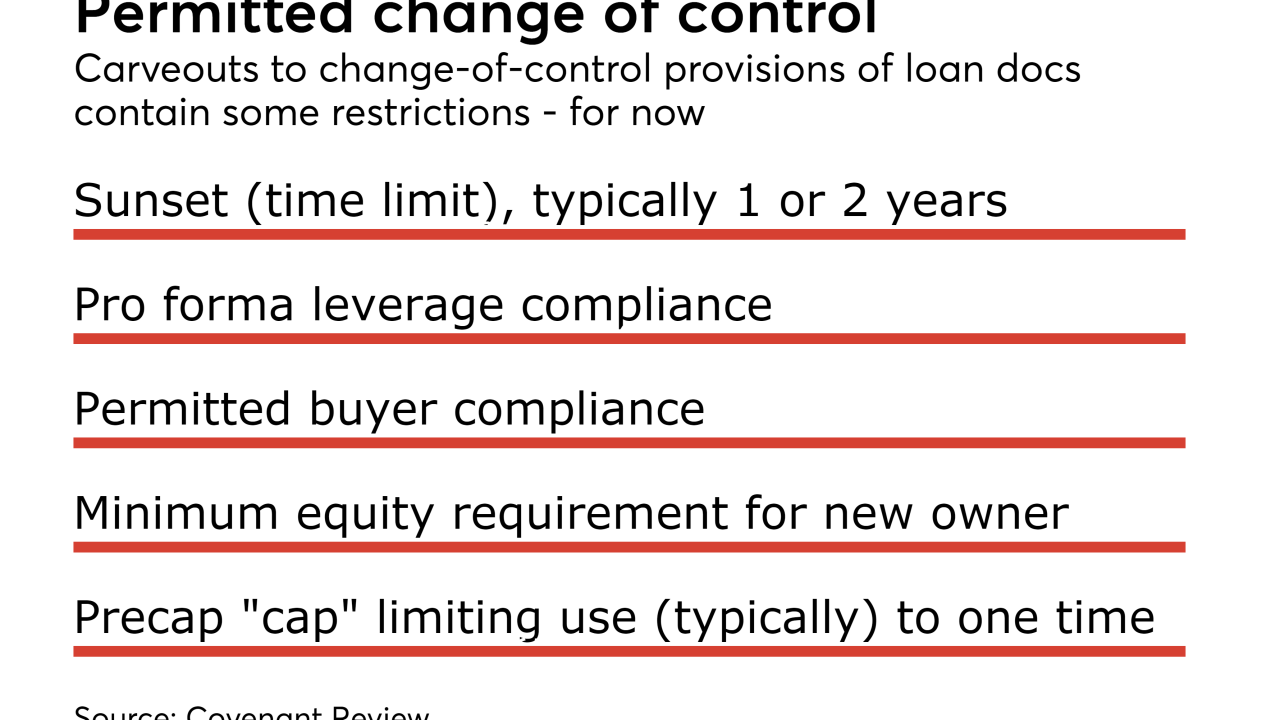

Corporate borrowers have started to ask lenders for leeway to be acquired by another company, under certain circumstances, without having to refinance their debt, according to Covenant Review.

January 8 -

In a rare example of a rating agency calling out a competitor, Fitch Ratings published an unsolicited report on the deal, which was rated by Kroll Bond Rating Agency; this caused some investors to take a closer look.

January 5 -

Limiting the deductibility of interest to a percentage of a taxpayer's income will make securitization uneconomical for auto and equipment rental companies, the Structured Finance Industry Group says.

January 4 -

A group of reinsurers has committed to provide up to $650 million of coverage for credit risk on some $21 billion of 30-year, fixed-rate loans that the government-sponsored agency will acquire over the next two years.

January 4 -

The $1.24 billion deal is the first GMCAR transaction to be rated by Fitch; it looks a lot like the three deals completed last year, with high FICOs, a high (but declining) concentration of long-term loans, and high concentration of trucks.

January 4 -

Navient and Nelnet avoided downgrades on $19.5 billion of bonds with the help of recent technological innovations; this helped restore investor confidence, allowing them to resume issuance.

January 3 -

The Trepp CMBS Delinquency Rate ended the year at 4.89%, a decrease of 29 basis points from the November level. That’s the largest monthly drop since January 2016.

January 3 -

With ideal macroeconomic fundamentals of economic growth and low interest rates still in place, S&P Global sees no reason for issuance to slow in 2018.

January 3 -

Some commercial buildings that are not required to obtain earthquake insurance may still be susceptible to significant structural damage that could put the borrowers at risk of default, according to Kroll Bond Rating Agency.

January 2 -

By sponsoring their own deals these matchmaking platforms are providing liquidity to multiple loan investors. They can also ensure that bond offerings are regular and uniform.

December 29 -

Speculators who bet on declines in commercial mortgage bond indexes as a way to profit from the expected demise of regional shopping malls may still be waiting for a big payout, according to Trepp.

By Glen FestDecember 28 -

Commercial real estate collateralized loan obligations appeal to investors now because they issue short-term, floating-rate notes; several nonbanks are using them to finance bridge lending.

December 27 -

The trend of putting ever-smaller pieces of the same commercial mortgages into multiple transactions means investors can end up with more exposure to a single property than they realize.

December 26 -

This feature, which has already been incorporated into some newer transactions, gives the sponsor more flexibility to manage its overall portfolio; Moody's investors Service thinks it is credit neutral.

December 26 -

Electric vehicles are starting to show up in pools of collateral for auto leases, but it's harder to predict what they will be worth when they are repossessed or come off lease, says Moody's Investors Service.

December 26