-

Panels account for just 15% to 20% of the total cost of residential installations, so the impact on demand is going to be relatively muted; utility-scale installations will be hit harder.

February 27 -

Greenworks CEO Jessica Bailey said execution was good enough that it made economic sense; the company also wanted an early reading from rating agencies and investors.

February 26 -

It has obtained a $1.4 billion mortgage from four banks on a portfolio of 27 buildings that were previously securitized in a 2016 transaction, according to rating agency reports.

February 26 -

Timothy Bowler, president of the ICE Benchmark Administration, which has been responsible for calculating the index since mid-2013, argues that there is a strong case for keeping it going.

February 26 -

So far, consumers have not had much voice in the discussion of a suitable replacement for the benchmark rate; lenders and servicers want to limit any harm, and their liability.

February 26 -

Junson Capital obtained a $179 million first mortgage from Natixis; proceeds, along with $40 million of subordinate debt and $115 million of equity, were used to fund the $334.3 million acquisition.

February 23 -

Demand for hotel rooms is running high, and mortgage bond investors are lining up to finance acquisitions and upgrades of even the largest resorts.

February 22 -

The $144 million transaction consists of two classes of notes, compared with a single tranche for the initial deal, which was redeemed early in September 2017; the sponsor can also purchase additional liens on assets in the collateral pool.

February 22 -

Lender and servicers are increasingly using nontraditional methods such as "hybrid" appraisals and broker price opinions in an attempt to cut costs, but some are more reliable than others.

February 21 -

Grow was previously director of MBS and ABS securities; he replaces VIckie Tillman, who retired in December after overseeing the company's expansion into a diversified credit rating agency.

February 16 -

The $525.7 million transaction is backed by stronger collateral than its previous deal, completed in August. But the sponsor still had to increase the credit enhancement on the senior tranche.

February 16 -

The new transaction, the $608 million Business Jet Securities, Series 2018-1, is less than half the size of the $1.48 billion deal pulled in September; it also appears to be less risky, by several measures.

February 15 -

Ares, along with RDA and Park Hotels & Resorts, obtained a $475 million loan from JPMorgan Chase and Wells Fargo; proceeds will refinance a loan securitized in 2014 and return $90 million of equity.

February 14 -

Moody's Investors Service has revised its expectations for cumulative net losses, to 3.75% from 3.5%, because a 2016 transaction is not performing as well as expected.

February 13 -

The $510.2 million transaction, BDS 2018-FL1, is primarily backed by multifamily (47%) and office buildings (42.1%) originated by ROC Debt Strategies Fund II REIT.

February 12 -

There could be a pause in new issuance as CLO managers wait to see if the government will appeal; longer term, the pace will pick up as the playing field is leveled for smaller managers.

February 12 -

A three-judge panel for the D.C. Circuit Court of Appeals has sided with the LSTA in its lawsuit seeking to reverse rules requiring CLO managers to hold "skin in the game" under Dodd-Frank.

By Glen FestFebruary 9 -

The REIT has obtained a $395 million loan form JPMorgan Chase that is being used to repay existing debt of $378.9 million that was previously securitized in BAML 2014-ASHF.

February 9 -

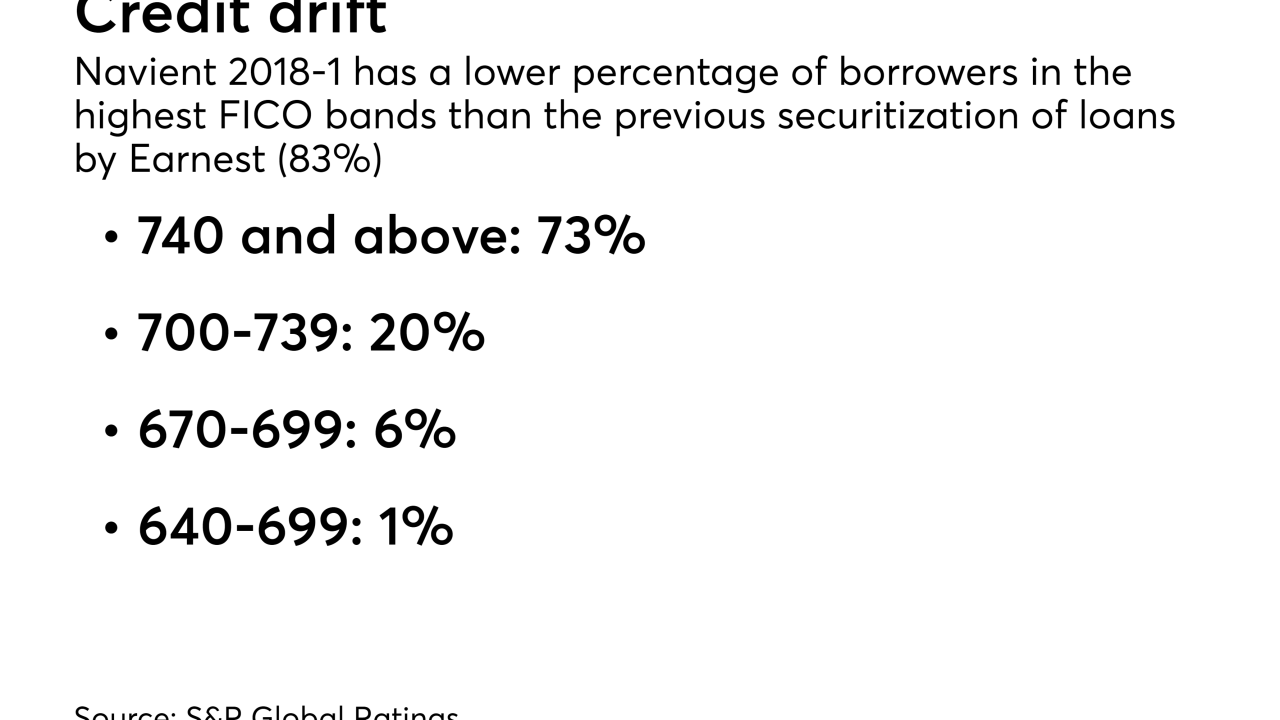

The collateral for Navient Private Education Refi 2018-1 is similar to that of Earnest's previous deal, completed in May, but it is rated two notches higher, at, AAA by S&P Global Ratings.

February 8 -

Most of the collateral was acquired over the past year; that’s in contrast with the sponsor’s previous two transactions, in which a portion of the collateral was seasoned and refinanced from earlier transactions.

February 8