-

The $525.7 million transaction is backed by stronger collateral than its previous deal, completed in August. But the sponsor still had to increase the credit enhancement on the senior tranche.

February 16 -

The new transaction, the $608 million Business Jet Securities, Series 2018-1, is less than half the size of the $1.48 billion deal pulled in September; it also appears to be less risky, by several measures.

February 15 -

Ares, along with RDA and Park Hotels & Resorts, obtained a $475 million loan from JPMorgan Chase and Wells Fargo; proceeds will refinance a loan securitized in 2014 and return $90 million of equity.

February 14 -

Moody's Investors Service has revised its expectations for cumulative net losses, to 3.75% from 3.5%, because a 2016 transaction is not performing as well as expected.

February 13 -

The $510.2 million transaction, BDS 2018-FL1, is primarily backed by multifamily (47%) and office buildings (42.1%) originated by ROC Debt Strategies Fund II REIT.

February 12 -

There could be a pause in new issuance as CLO managers wait to see if the government will appeal; longer term, the pace will pick up as the playing field is leveled for smaller managers.

February 12 -

A three-judge panel for the D.C. Circuit Court of Appeals has sided with the LSTA in its lawsuit seeking to reverse rules requiring CLO managers to hold "skin in the game" under Dodd-Frank.

By Glen FestFebruary 9 -

The REIT has obtained a $395 million loan form JPMorgan Chase that is being used to repay existing debt of $378.9 million that was previously securitized in BAML 2014-ASHF.

February 9 -

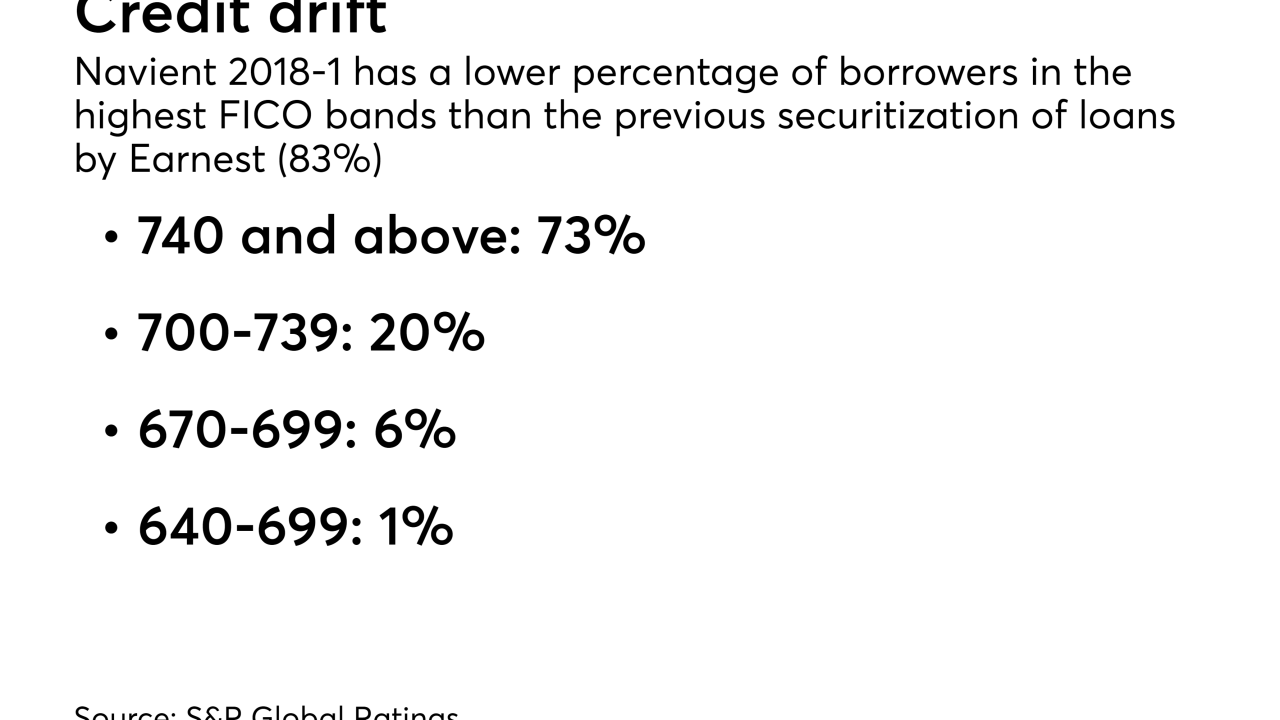

The collateral for Navient Private Education Refi 2018-1 is similar to that of Earnest's previous deal, completed in May, but it is rated two notches higher, at, AAA by S&P Global Ratings.

February 8 -

Most of the collateral was acquired over the past year; that’s in contrast with the sponsor’s previous two transactions, in which a portion of the collateral was seasoned and refinanced from earlier transactions.

February 8 -

It's the lender's first deal since being acquired by TIAA; DBRS points to the "stellar" performance of non-securitized prime jumbo loans between 2012 and 2016.

February 7 -

It's the first time the private tower operator has issued from its master trust in two years; the A rated notes will be backed by a pool of 2,551 towers representing 66% of its total tower cash flow.

February 6 -

Moody's considers the $932.4 million TPG Real Estate Finance Trust 2018-1 to be highly leveraged, though not as highly leveraged as Blackstone's inaugural transaction.

February 5 -

It's deep and liquid, and spreads are tight. To many, a deal with a few idiosyncratic risks — not to mention cool factor — just offers a chance to pick up a little extra yield.

February 2 -

The Trepp CMBS Delinquency Rate for U.S. commercial real estate loans in CMBS is now 4.83%, a decrease of six basis points from the December level.

February 2 -

All four senior tranches benefit from initial hard credit enhancement of12%, which is down from 12.25% on the senior tranches of the 2017-1 deal, 12.30% for 2016-1 and 12.90% in 2015-1.

January 31 -

The Renaissance Aruba Resort & Casino went through a foreclosure in 2012, giving its mezzanine lender an equity stake; the majority owners have obtained a new $195 million loan to buy out two partners.

January 31 -

The deal was launched shortly after SoFi announced that Anthony Noto, the chief operating officer of Twitter, will join as CEO. It also benefits from higher credit enhancement.

January 30 -

JPMorgan is bundling portions of the first mortgages on six towers in what was once the Jersey City Medical Center into collateral for $200 million of commercial mortgage bonds.

January 26 -

Varde VMC Lender, a Minneapolis firm specializing in distressed commercial real estate, has branched out to financing offices and apartment buildings being upgraded or repurposed.

January 25