Luxury hotel Fontainebleau Miami Beach sold a $975 million commercial mortgage-backed security to refinance debt.

The CMBS is part of a broader $1.2 billion debt package that includes a mezzanine loan of as much as $225 million. The almost 1,600-room hotel is also expected to get a $105 million equity infusion from Jeffrey Soffer, the indirect majority owner of the hotel, marking the total money raised to about $1.3 billion, according to deal documents.

The proceeds will mostly go toward refinancing around $1.18 billion of prior debt, comprised of a CMBS and a mezzanine loan. The rest of the funds are earmarked to repay a $75 million construction loan for

Fontainebleau Development, run by Soffer, "has long demonstrated a commitment to continuous reinvestment in our properties," the company's president, Brett Mufson, said in an emailed statement. "The financing deals that we have secured will ensure that our resorts maintain a competitive edge while also positioning us to grow our iconic Fontainebleau brand in new markets."

A representative for JPMorgan declined to comment. Goldman Sachs didn't respond to a request for comment.

The hotel, inspired by a French countryside palace, opened in the 1950s and has since been featured in famous films such as Scarface and Goldfinger. Soffer bought the property in 2005 and has overseen renovations in the years since.

Appraised at $1.72 billion, the hotel has a spa and saloon, pools, retail and a nightclub that often hosts artists such as Lil Wayne and Calvin Harris. It's also been home to one of the largest structured finance conferences, ABS East, for most years since the 2010s.

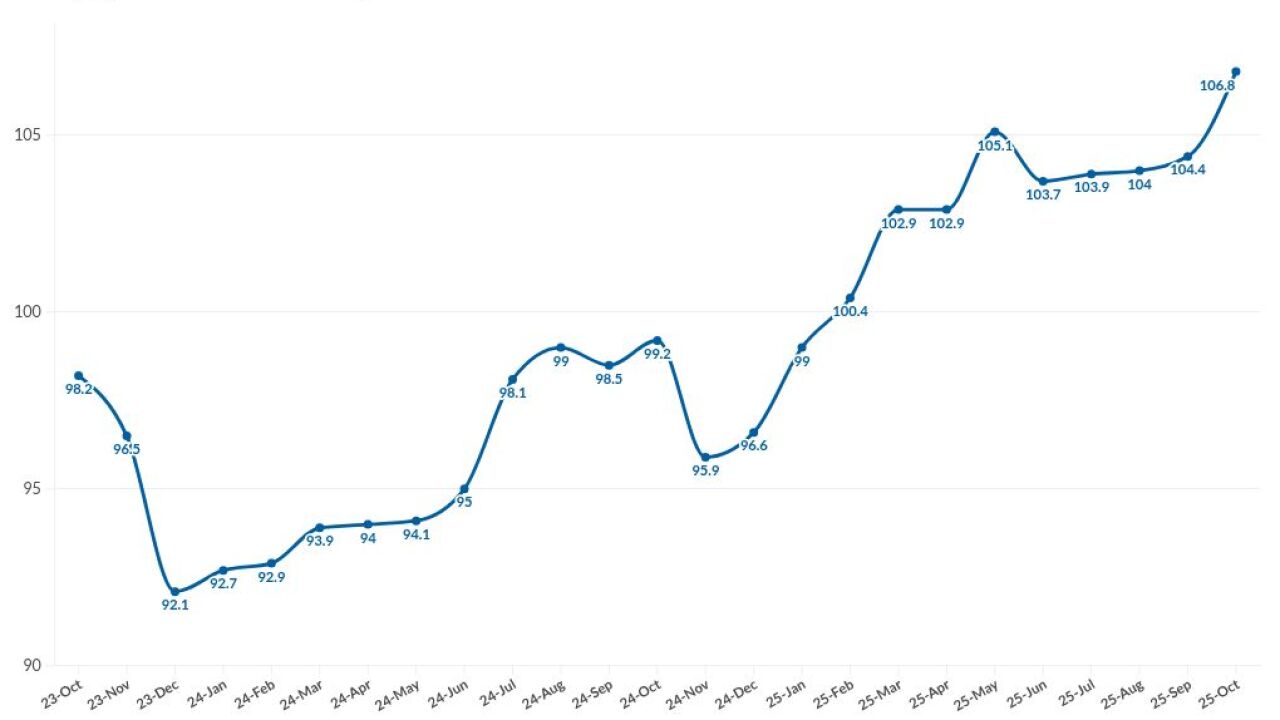

A number of blue-chip properties have tapped the private-label CMBS market to refinance debt this year, like the $3.4 billion bond for the Rockefeller Center, driving sales. Total volumes have skyrocketed to around $108 billion this year, more than double a year ago. Yet, investments in seemingly safe debt investments on office properties have faced losses for the first time since the Great Financial Crisis.

In 2023, Soffer opened the $3.7 billion Fontainebleau Las Vegas after more than two decades from when he and his development firm first bought the land.