After two regulatory agencies adopted final revisions to the rule, Dodd-Frank defenders expressed concern that the amendments to the proprietary trading ban undermined the post-crisis statute.

-

The original $436.5 million whole-business securitization deal that closed in May 2018 has already been downgraded twice, due in large part to dueling lawsuits between ousted founder Harvey Franco and Australia-based Macquarie over the past year.

September 19 -

There were signs Kathy Kraninger would continue a rollback of consent orders and investigations, but many observers see an aggressive approach reminiscent of the Obama era.

September 18 -

The $428 million Progress Residential 2019-SFR4 transaction will feature eight classes of notes secured by a single loan taken out by the Maryland-based REIT.

September 18 -

The mortgage industry has put more emphasis on organizing data in a digital manner and presenting it in an easily digestible format.

September 18 -

Ratings agencies have argued recently that the population of loans whose ratings fall below the lowest single-B rating – the lowest rung above the highly speculative triple-C ratings layers – will grow significantly in an economic downturn.

September 18

-

The agency's director told congressional leaders and staff that she backs a Supreme Court challenge to the bureau's leadership structure.

September 17 -

Senate Democrats are warning the Consumer Financial Protection Bureau to be careful as it considers changes to its mortgage underwriting rules.

September 17 -

Out of 83 commercial mortgages in the transaction, the collateral pool contains 75 loans secured by multifamily/manufactured housing properties, according to presale reports.

September 17 -

The transaction will raise proceeds from note sales to pay off existing debt, as well as potentially provide a dividend to majority-owner Blackstone, according to a presale report from S&P Global Ratings.

September 16 -

With the qualified mortgage patch expiring and a recession likely, wealth inequities that have hurt black and millennial homeownership could worsen, according to the National Association of Real Estate Brokers.

September 16 -

The third issuance from the master trust has a higher average interest rate and greater expected losses than previous pools due to the inclusion of more higher-risk marketplace loans.

September 16 -

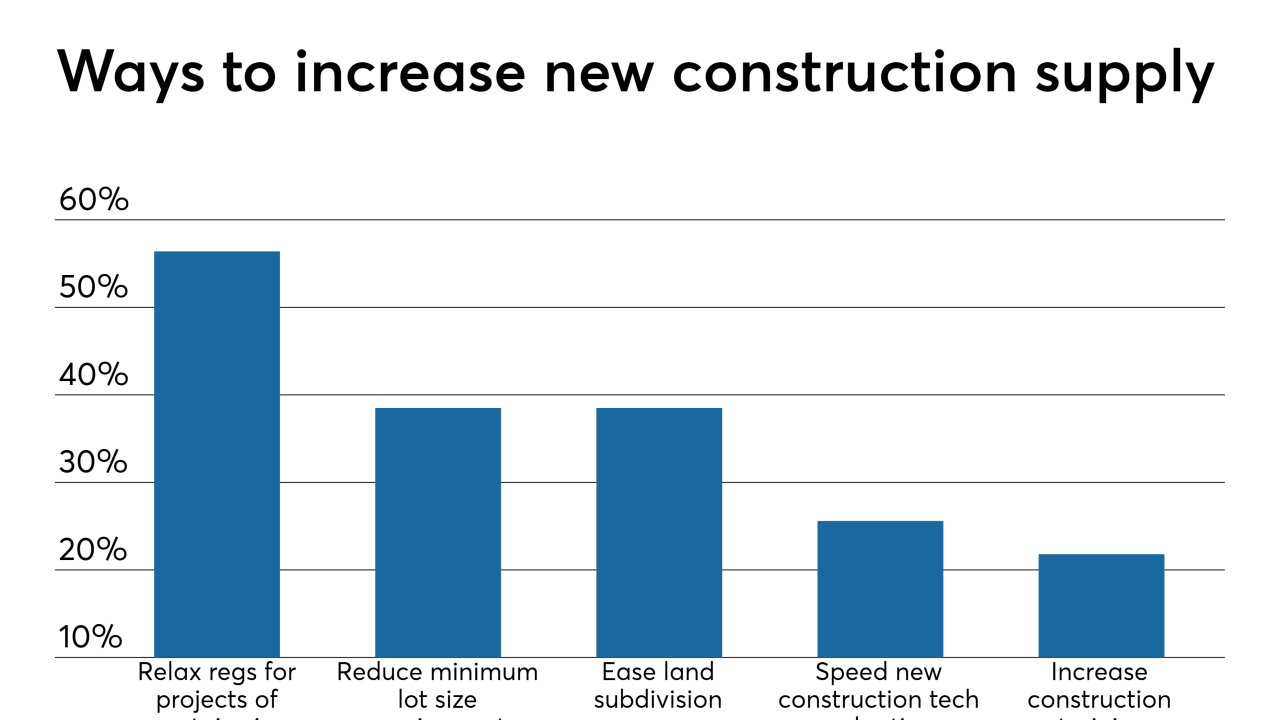

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16